Current Report Filing (8-k)

10 März 2020 - 11:08AM

Edgar (US Regulatory)

false0000075488000100498000010049802020-03-062020-03-060001004980pcg:PACIFICGASANDELECTRICCOMPANYMember2020-03-062020-03-060001004980pcg:FirstPreferredStockCumulativeParValue25PerShare6NonredeemableMemberpcg:NYSEAmericanLLCMember2020-03-062020-03-060001004980pcg:FirstPreferredStockCumulativeParValue25PerShare5NonredeemableMemberpcg:NYSEAmericanLLCMember2020-03-062020-03-060001004980pcg:FirstPreferredStockCumulativeParValue25PerShare480RedeemableMemberpcg:NYSEAmericanLLCMember2020-03-062020-03-060001004980pcg:FirstPreferredStockCumulativeParValue25PerShare5SeriesARedeemableMemberpcg:NYSEAmericanLLCMember2020-03-062020-03-060001004980pcg:FirstPreferredStockCumulativeParValue25PerShare550NonredeemableMemberpcg:NYSEAmericanLLCMember2020-03-062020-03-060001004980pcg:TheNewYorkStockExchangeMemberpcg:CommonStockNoParValueMember2020-03-062020-03-060001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare5RedeemableMember2020-03-062020-03-060001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare450RedeemableMember2020-03-062020-03-060001004980pcg:FirstPreferredStockCumulativeParValue25PerShare436SeriesARedeemableMemberpcg:NYSEAmericanLLCMember2020-03-062020-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: March 6, 2020

(Date of earliest event reported)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

Securities registered pursuant to Section 12(b) of the Act:

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2

of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed, on January 29, 2019, PG&E Corporation (the “Corporation”) and its subsidiary, Pacific

Gas and Electric Company (the “Utility,” and together with the Corporation, the “Debtors”), filed voluntary petitions for relief under chapter 11 of title 11 (“Chapter 11”) of the United States Code in the U.S. Bankruptcy Court for the Northern

District of California (the “Bankruptcy Court”). The Debtors’ Chapter 11 cases are being jointly administered under the caption In re: PG&E Corporation and Pacific Gas and Electric Company, Case No. 19-30088 (DM) (the “Chapter 11 Cases”). On

January 31, 2020, the Debtors, certain funds and accounts managed or advised by Abrams Capital Management, L.P. (“Abrams”), and certain funds and accounts managed or advised by Knighthead Capital Management, LLC (“Knighthead” and, together with

Abrams, the “Shareholder Proponents”) filed the Debtors’ and Shareholder Proponents’ Joint Chapter 11 Plan of Reorganization dated January 31, 2020 with the Bankruptcy Court (as may be amended, modified or supplemented from time to time, the

“Proposed Plan”).

Equity Backstop Commitment Letters

As previously disclosed, the Corporation entered into Chapter 11 Plan Backstop Commitment Letters (the “Backstop

Commitment Letters”) with certain investors (the “Backstop Parties”), under which such investors severally committed to fund up to $12.0 billion of proceeds to finance the Proposed Plan through the purchase of common stock of the Corporation.

Capitalized terms used but not defined herein have the meanings given in the Backstop Commitment Letters.

On March 6, 2020, the Corporation entered into agreements with Backstop Parties representing all $12.0 billion of

backstop commitments pursuant to which each Backstop Party consented to amend and modify certain terms of the Backstop Commitment Letter to which they are a party (as amended, the “Amended and Restated Backstop Commitment Letters”). These

modifications include, among others:

In addition, the Consents to the Amended and Restated Backstop Commitment Letters modify certain termination

rights and adjust the circumstances under which the Backstop Commitment Premium is subject to clawback.

The foregoing description of the Amended and Restated Backstop Commitment Letters does not purport to be complete

and is qualified in its entirety by reference to terms of the Form of Amended and Restated Backstop Commitment Letter, which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

As previously reported, on February 18, 2020, the Debtors filed certain projections with the Bankruptcy Court, as an exhibit to

their previously filed disclosure statement filed pursuant to section 1125 of the Bankruptcy Code. On March 9, 2020, the Debtors jointly filed a revised disclosure statement and revised financial projections (“Revised Financial Projections”)

exhibit to same with the Bankruptcy Court.

A copy of the Revised Financial Projections is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

herein by reference. The information in Exhibit 99.1 includes certain unaudited financial data and certain financial projections for the fiscal years ending December 31, 2020 through December 31, 2024 that are preliminary and may change including

as described in Exhibit 99.1. While presented with numerical specificity, the Revised Financial Projections are approximations based upon a variety of estimates and assumptions subject to significant business, economic, and competitive

uncertainties and contingencies, many of which are beyond the Debtors’ control. Actual results may vary materially from those presented. The Revised Financial Projections contain forward-looking statements that are not historical facts,

including statements about the beliefs, expectations, estimates, future plans and strategies of the Debtors, as well as forecasts based on the Debtors' plan of reorganization, which reflects settlements reached with various parties, regarding

settlement of liabilities in connection with the 2018 Camp fire, 2017 Northern California wildfires and the 2015 Butte fire, the confirmation of the plan of reorganization, the continuing availability of sufficient borrowing capacity or other

financing to fund operations, the Utility’s participation in the statewide wildfire fund created by California Assembly Bill 1054, the Debtors’ anticipated sources and uses upon emergence from Chapter 11, the outcome of regulatory cases and the

effect on earnings of such cases, projections of wildfire-related expenditures, anticipated regulatory and legislative policy, anticipated capital expenditures of the Debtors, anticipated costs of operations of the Debtors, efficiency

initiatives, dividend payments (both Utility preferred stock and Corporation common stock), credit ratings and the various assumptions described in detail therein. These statements are based on current expectations and assumptions, which

management believes are reasonable, and on information currently available to management, but are necessarily subject to various risks and uncertainties. However, because this information is highly subjective, it should not be relied on as

indicative of future results. The Debtors do not undertake any obligation to publicly update the projections to reflect circumstances existing after the date when the projections were made or to reflect the occurrence of future events, even in

the event that any or all of the assumptions underlying the projections are shown to be in error. As a result of the foregoing considerations and other limitations, including those described below under “Forward-Looking Statements,” you are

cautioned not to place undue reliance on the financial data included in this Item 7.01, including Exhibit 99.1.

The information set forth in this Item 7.01 of this Current Report on Form 8-K and in Exhibit 99.1 is being furnished hereby and

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of

the Debtors’ filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by

specific reference in such filings. The filing of this Current Report on Form 8-K (including the exhibit hereto or any information included herein or therein) shall not be deemed an admission as to the materiality of any information herein that is

required to be disclosed solely by reason of Regulation FD.

The Revised Financial Projections and other filings with the Bankruptcy Court related to the Chapter 11 Cases are available

electronically at http://restructuring.primeclerk.com/pge. This website address contains third-party content and is provided for convenience only. Third-party content is the responsibility of the third party, and the Debtors disclaim liability for

such content.

The information in Exhibit 99.1 includes certain financial measures that are not prepared in accordance with

GAAP, including “non-GAAP core earnings”, in order to provide measures that allow investors to compare the underlying financial performance of the business from one period to another, exclusive of non-core items. “Non-GAAP core earnings” is a

non-GAAP financial measure and is calculated as income available for common shareholders less non-core items. “Non-core items” include items that the management of the Debtors does not consider representative of ongoing earnings and affect

comparability of financial results between periods. The Debtors use non-GAAP core earnings to understand and compare operating results across reporting periods for various purposes including internal budgeting and forecasting, short- and

long-term operating planning, and employee incentive compensation. The Debtors believe that non-GAAP core earnings provide additional insight into the underlying trends of the business, allowing for a better comparison against historical results

and expectations for future performance.

Because Non-GAAP core earnings is not a measurement determined in accordance with GAAP and is susceptible to

varying calculations, such a measure may not be comparable to other similarly titled measures presented by other companies. Non-GAAP core earnings is not a substitute or alternative for GAAP measures such as consolidated income available for

common shareholders.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

(1) This Form of Amended and Restated Backstop Commitment

Letter is substantially identical in all material respects to each Amended and Restated Backstop Commitment Letter that is otherwise required to be filed as an

exhibit, except as to the Backstop Party and the amount of such Backstop Party’s Backstop Commitment Amount (as defined in the Amended and Restated Backstop

Commitment Letter). In accordance with instruction no. 2 to Item 601 of Regulation S-K, the registrant has filed the form of such Amended and Restated Backstop

Commitment Letter, with a schedule identifying the Backstop Commitment Letters omitted and setting forth the material details in which each Amended and Restated Backstop

Commitment Letter differs from the form that was filed. The registrant acknowledges that the Securities and Exchange Commission may at any time in its discretion require filing of copies of any agreement so omitted.

Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements that are not historical facts, including statements about the beliefs,

expectations, estimates, future plans and strategies of the Corporation and the Utility, including but not limited to the Proposed Plan, the Backstop Commitment Letters and forecasts and estimates regarding the Debtors’ five-year financial

forecast. These statements are based on current expectations and assumptions, which management believes are reasonable, and on information currently available to management, but are necessarily subject to various risks and uncertainties, including

the possibility that the conditions to emergence in the Proposed Plan or to funding under equity financing commitments will not be satisfied. In addition to the risk that these assumptions prove to be inaccurate, factors that could cause actual

results to differ materially from those contemplated by the forward-looking statements include factors disclosed in the Corporation and the Utility’s Annual

Report on Form 10-K for the year ended December 31, 2019 and their subsequent reports filed with the Securities and Exchange Commission. Additional factors include, but are not limited to, those associated with the Corporation’s and the Utility’s Chapter 11 Cases. The Corporation and the Utility undertake

no obligation to publicly update or revise any forward-looking statements, whether due to new information, future events or otherwise, except to the extent required by law.

No Securities Offering

This is not an offering of securities and securities may not be offered or sold absent registration or an applicable exemption from the registration

requirements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the

undersigned thereunto duly authorized.

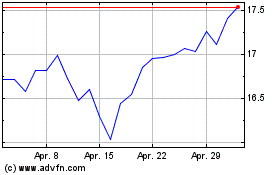

PG&E (NYSE:PCG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

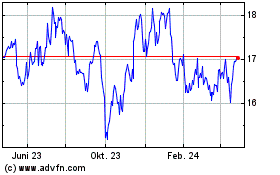

PG&E (NYSE:PCG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024