Yen Drops On Stimulus Bets

02 März 2020 - 5:23AM

RTTF2

The Japanese yen slipped against its major counterparts in early

European deals on Monday, as investors hope for policy responses

from the U.S Federal Reserve to the Bank of Japan and the Reserve

Bank of Australia to weather the damaging economic impact of the

coronavirus epidemic.

The U.S. Federal Reserve is expected to cut interest rates when

it meets on March 18.

The Reserve Bank of Australia holds its second meeting of the

year on Tuesday and the central bank is all-but certain to cut

interest rates. Economists expect New Zealand's Reserve Bank to

follow suit at its next meeting later this month.

Investors are expecting Beijing to loosen the purse strings

after both official and private surveys showed China's factory

activity collapsing to its worst levels on record.

In a rare emergency statement, Bank of Japan Governor Haruhiko

Kuroda said the central bank would take necessary steps to help

protect markets the impact of the coronavirus.

"The Bank of Japan will closely monitor future developments, and

will strive to provide ample liquidity and ensure stability in

financial markets through appropriate market operations and asset

purchases," Kuroda said in a statement.

The yen fell to 120.25 against the euro and 112.56 against the

franc, from its prior highs of 118.61 and 111.35, respectively. The

next possible support for the yen is seen around 122.00 against the

euro and 114.00 against the franc.

The yen reached as low as 108.58 against the greenback and

139.18 against the pound, off its early near a 5-month high of

107.36 and a 4-1/2-month high of 137.30, respectively. The yen may

locate support around 111.00 against the greenback and 142.5

against the pound.

The yen depreciated to 71.20 against the aussie, 81.39 against

the loonie and 67.79 against the kiwi, reversing from its early

high of 69.41, more than 5-month highs of 79.86 and 66.58,

respectively. If the yen slides further, 74.5, 83.5 and 70.00 are

likely seen as its next support levels against the aussie, the

loonie and the kiwi, respectively.

Looking ahead, U.K. mortgage approvals for January and final

factory PMI for February are due shortly.

U.S. ISM manufacturing index for February and construction

spending for January are set for release in the New York

session.

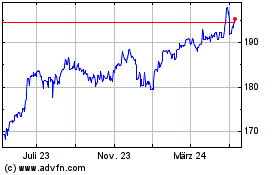

Sterling vs Yen (FX:GBPJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

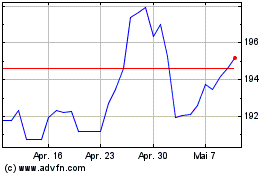

Sterling vs Yen (FX:GBPJPY)

Forex Chart

Von Apr 2023 bis Apr 2024