Wells Fargo Reaches Settlement With Government Over Fake-Account Scandal

21 Februar 2020 - 10:40PM

Dow Jones News

By Ben Eisen

Wells Fargo & Co. will pay $3 billion to settle

investigations by the Justice Department and the Securities and

Exchange Commission over its long-running fake-account problems,

the latest chapter in an extraordinary scandal for one of the

country's largest banks.

The deal resolves civil and criminal investigations. It includes

a so-called deferred prosecution agreement, where the Justice

Department files, but doesn't immediately pursue, criminal charges.

It will eventually dismiss them if the bank satisfies the

government's requirements, including its continued cooperation with

further government investigations, over the next three years.

The scandal has severely damaged the bank's reputation as well

as its regulatory relationships. Regulators fined the bank in 2016

for creating fake and unauthorized checking and savings accounts, a

revelation that outraged lawmakers and customers.

Friday's settlement shuts the door on a major portion of the

bank's legal problems related to the fake accounts, a scandal that

has claimed two CEOs. It is a victory for Charles Scharf, an

outsider who took over as chief executive in October and was tasked

with fixing the crisis.

The bank, though, still faces major regulatory problems. Most

notably, it is under sanction by the Federal Reserve, which has

taken the unusual step of capping the bank's growth. Settling with

the Justice Department and SEC could allow the bank to focus on

persuading the Fed to lift the cap.

Regulators and prosecutors could also still take action against

individual former executives, according to people familiar with the

situation. Last month, the Office of the Comptroller of the

Currency charged eight former Wells Fargo executives over the

fake-account scandal, including a former CEO.

As part of the settlement, Wells Fargo admitted that it

"unlawfully misused customers' sensitive personal information" and

harmed some customers' credit ratings, collecting millions of

dollars of fees and interest in the process.

Wells Fargo for years enjoyed a reputation as a folksy industry

darling that catered to Main Street customers. But that reputation

was left in tatters after the sales scandal became public.

Prosecutors said the practices date to 1998, when Wells Fargo

began to rely more heavily on sales growth. It pressured employees

to sell additional products to current customers, a practice known

as cross-selling.

The heightened pressure pushed many employees to undertake

illegal practices, such as opening checking and savings accounts

without customer knowledge and making up identification numbers to

activate unauthorized debit cards. Sometimes employees forged

customer signatures to open accounts or altered customers' contact

information to prevent them from learning about unauthorized

accounts, the government said.

Regulators and prosecutors said top managers knew of these

issues in 2002. In 2004, an internal investigator called it a

"growing plague."

After the scandal erupted in 2016, the bank's top executives

faced heavy criticism for blaming lower-level employees. An

investigation by the board of directors later found that the bank's

decentralized structure allowed top executives to avoid addressing

these issues as they got bigger.

The bank has struggled to recover since then. What was once a

fast-growing lender whose profits towered above those of rivals has

become a firm with declining revenue that is leaning heavily on

cost cuts.

--Rachel Louise Ensign, Aruna Viswanatha and Dave Michaels

contributed to this article.

Write to Ben Eisen at ben.eisen@wsj.com

(END) Dow Jones Newswires

February 21, 2020 16:25 ET (21:25 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

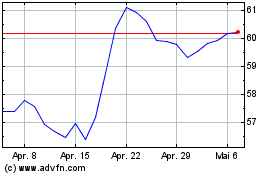

Wells Fargo (NYSE:WFC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

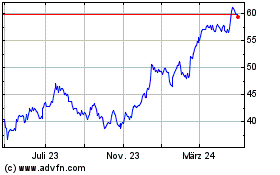

Wells Fargo (NYSE:WFC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024