Wells Fargo Nears Settlement With Government Over Fake-Account Scandal -- Update

21 Februar 2020 - 6:57PM

Dow Jones News

By Ben Eisen and Rachel Louise Ensign

Wells Fargo & Co. is nearing settlements with the Justice

Department and the Securities and Exchange Commission over its

long-running fake-account scandal, according to people familiar

with the matter.

The bank could pay roughly $3 billion combined, some of the

people said. The settlements could come as soon as Friday, the

people said. The DOJ portion of the settlement could include

criminal charges, some of the people said.

People familiar with the matter said the settlements are

expected to be only with the bank, not with former executives.

Regulators and prosecutors could still take action against

individuals, these people said. Last month, the Office of the

Comptroller of the Currency charged eight former Wells Fargo

executives over the fake-account scandal, including the former

CEO.

Charles Scharf, Wells Fargo's new CEO, has said his priority is

resolving the bank's regulatory issues. The bank had previously

disclosed the probe by the Justice Department and SEC, which is one

of its biggest outstanding regulatory problems.

Investigators interviewed former executives including former

Chief Executive Officer Timothy Sloan in connection with the probe,

the Journal has reported.

Wells Fargo for years enjoyed a reputation as a folksy industry

darling that catered to Main Street customers. But that reputation

was left in tatters after it became public that an aggressive sales

culture led employees to open millions of possibly fake accounts,

spurring outrage among regulators, lawmakers and customers.

The bank settled with the OCC, the Consumer Financial Protection

Bureau and the Los Angeles City Attorney's office in 2016. Days

later, the Journal reported that federal prosecutors were in the

early stages of an investigation into those same sales

practices.

Since then, the bank has struggled to recover. The scandal has

claimed two CEOs, and what was once a fast-growing bank whose

profits towered above those of rivals has become a company with

declining revenue that is leaning heavily on cost cuts.

The potential settlement with the DOJ and SEC was earlier

reported by the New York Times.

The lender has no shortage of other regulatory problems: It

recently had hundreds of private regulatory warnings known as

"Matters Requiring Attention," the Journal has previously reported.

Hiring staffers to help fix these issues has been costly and forced

the bank to dial back expense-cutting targets.

It also is under sanction by the Federal Reserve, which has

taken the unusual step of capping the bank's growth. Settling with

the DOJ and SEC should allow the bank to focus on persuading the

Fed to lift the cap.

--Aruna Viswanatha and Dave Michaels contributed to this

article.

Write to Ben Eisen at ben.eisen@wsj.com and Rachel Louise Ensign

at rachel.ensign@wsj.com

(END) Dow Jones Newswires

February 21, 2020 12:42 ET (17:42 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

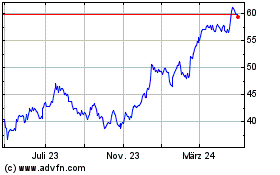

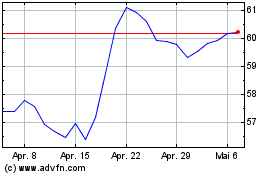

Wells Fargo (NYSE:WFC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Wells Fargo (NYSE:WFC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024