Goldman, JPMorgan Back New Exchange Taking On NYSE and Nasdaq

20 Februar 2020 - 2:29PM

Dow Jones News

By Alexander Osipovich

Goldman Sachs Group Inc. and JPMorgan Chase & Co. agreed to

back a new low-cost stock exchange that plans to launch this summer

to challenge the New York Stock Exchange and Nasdaq Inc.

The two banks, along with high-speed trading firm Jane Street

Capital LLC, led a new round of funding for Members Exchange, or

MEMX, the startup exchange said in a news release Thursday.

Goldman's and JPMorgan's investment provides an additional boost

to MEMX from two of Wall Street's most prominent institutions.

MEMX, which unveiled its plans in January 2019, already had the

backing of nine financial heavyweights, including banks, retail

brokers and electronic trading firms.

MEMX was created after years of frustration among brokers and

traders with the fees charged by the big U.S. exchange groups,

particularly for market-data feeds that many financial firms regard

as essential for their business. MEMX's backers have expressed hope

that by charging rock-bottom fees, the new exchange will pressure

the incumbents to keep their own fees low.

"We've been quite vocal about the rising cost of data," Jason

Sippel, global head of equities and prime services at JPMorgan,

said in an interview. "Lowering data costs will benefit all of our

clients."

About 60% of U.S. stock-trading volume takes place on exchanges

run by three companies: NYSE, owned by Intercontinental Exchange

Inc.; Nasdaq; and Cboe Global Markets Inc., the country's No. 3

stock-exchange group by market share.

Brokers and trading firms say the big three exchange groups

behave in an oligopolistic fashion and charge too much for services

such as market-data feeds. NYSE, Nasdaq and Cboe reject such

criticisms and say their fees are reasonable.

Electronic-trading giants Virtu Financial Inc. and Citadel

Securities, which together trade about 40% of the shares that

change hands in the U.S. stock market, are both in MEMX's founding

consortium. They are expected to support MEMX by quoting prices and

executing trades at the new exchange.

MEMX's other investors are Bank of America Corp., Charles Schwab

Corp., E*Trade Financial Corp., Fidelity Investments, Morgan

Stanley, TD Ameritrade Holding Corp. and UBS Group AG.

In an interview, MEMX Chief Executive Jonathan Kellner declined

to say how much money the startup exchange had raised in the new

funding round. MEMX, which is based in Jersey City, N.J., raised

$70 million in its initial funding round last year.

MEMX said in Thursday's news release that its marketplace would

go live on July 24, pending regulatory approval from the Securities

and Exchange Commission.

NYSE has criticized MEMX's application to register as an

exchange. In a Jan. 15 letter to the SEC, the Big Board warned that

MEMX's owners could glean unfair advantages over rival market

participants through access to the new exchange's trading data.

"NYSE Group believes that this apparent unfettered access to the

records and facilities of MEMX by [members of the

consortium]...could pose significant conflicts of interest," the

Big Board said in its letter.

Last week, MEMX responded in a letter to the SEC that NYSE's

conclusions were wrong. It said that confidentiality provisions in

MEMX's governance documents would ensure that only authorized

people, such as MEMX's in-house market regulators, would have

access to sensitive trading data.

MEMX's name harks back to the era when stock exchanges were

nonprofit cooperatives owned by their "members," which were

generally brokerage firms that traded at the exchanges.

U.S. exchanges converted into investor-owned, for-profit

companies starting in the 2000s. Since that shift, tensions have

grown between brokers and exchanges, largely because of the cost of

data feeds and related services that the exchanges sell to their

customers.

Write to Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

February 20, 2020 08:14 ET (13:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

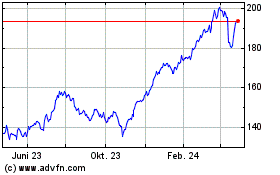

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

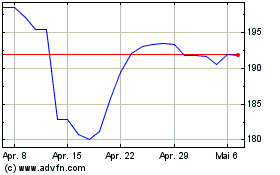

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024