GE Boss Warns of Quarterly Cash Drain From Boeing MAX

19 Februar 2020 - 4:39PM

Dow Jones News

By Thomas Gryta

Larry Culp, chief executive of General Electric Co., cautioned

investors that the manufacturing giant would burn about $2 billion

in cash flow in the first quarter.

Mr. Culp cited pressure from the extended grounding and

production halt of Boeing Co.'s 737 MAX aircraft. A GE joint

venture with France's Safran SA makes the engines used on the

jet.

Mr. Culp, speaking at an investor conference Wednesday, said

there will be pressure on GE's ability to generate cash in the

first half of the year but he expects GE to generate cash from

operations later this year.

He hadn't previously provided a first quarter target, though he

has forecast $2 billion to $4 billion in positive cash flow for the

full year. A year ago, GE burned through $1.2 billion in cash

during the first quarter of 2019 before ending the year with $2.3

billion of total cash flow from its industrial operations.

The cash flow pressure will likely result in first quarter

earnings lower than last year, Mr. Culp said.

Mr. Culp also said a long awaited review of its legacy insurance

holdings came in better than expected in the first quarter, with an

expected $100 million charge to earnings.

(Updates to come)

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

February 19, 2020 10:24 ET (15:24 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

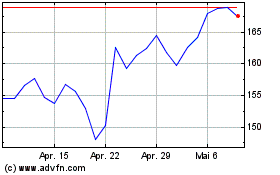

GE Aerospace (NYSE:GE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

GE Aerospace (NYSE:GE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024