Current Report Filing (8-k)

07 Februar 2020 - 11:30PM

Edgar (US Regulatory)

false0001004980000007548800010049802020-02-052020-02-050001004980pcg:PACIFICGASANDELECTRICCOMPANYMember2020-02-052020-02-050001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare480RedeemableMember2020-02-052020-02-050001004980pcg:FirstPreferredStockCumulativeParValue25PerShare550NonredeemableMemberpcg:NYSEAmericanLLCMember2020-02-052020-02-050001004980pcg:FirstPreferredStockCumulativeParValue25PerShare436SeriesARedeemableMemberpcg:NYSEAmericanLLCMember2020-02-052020-02-050001004980pcg:FirstPreferredStockCumulativeParValue25PerShare6NonredeemableMemberpcg:NYSEAmericanLLCMember2020-02-052020-02-050001004980pcg:FirstPreferredStockCumulativeParValue25PerShare450RedeemableMemberpcg:NYSEAmericanLLCMember2020-02-052020-02-050001004980pcg:FirstPreferredStockCumulativeParValue25PerShare5NonredeemableMemberpcg:NYSEAmericanLLCMember2020-02-052020-02-050001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare5RedeemableMember2020-02-052020-02-050001004980pcg:FirstPreferredStockCumulativeParValue25PerShare5SeriesARedeemableMemberpcg:NYSEAmericanLLCMember2020-02-052020-02-050001004980pcg:CommonStockNoParValueMemberpcg:NewYorkStockExchangeLLCMember2020-02-052020-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: February 5, 2020

(Date of earliest event reported)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

Securities registered pursuant to Section 12(b) of the Act:

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed, on January 29, 2019 (the “Petition Date”), PG&E Corporation and its subsidiary, Pacific Gas and Electric

Company (the “Utility,” and together with PG&E Corporation, the “Debtors”), filed voluntary petitions for relief under chapter 11 of title 11 (“Chapter 11”) of the United States Code in the U.S. Bankruptcy Court for the Northern District of

California (the “Bankruptcy Court”). The Debtors’ Chapter 11 cases are being jointly administered under the caption In re: PG&E Corporation and Pacific Gas and Electric Company, Case No. 19-30088 (DM) (the “Chapter 11 Cases”). On January 31,

2020, the Debtors filed an amendment to the Joint Chapter 11 Plan of Reorganization dated December 12, 2019 (as amended, the “Proposed Plan”).

Also as previously disclosed, on January 22, 2020, the Debtors entered into a Restructuring Support Agreement (the “RSA”) with certain

holders of senior unsecured debt of the Utility (the “Initial Consenting Noteholders”) and the Shareholder Proponents (as defined therein). Thereafter, as previously disclosed, the Debtors entered into Joinder Agreements with additional holders of

senior unsecured debt of the Utility (the “Additional Consenting Noteholders,” and, together with the Initial Consenting Noteholders, the “Consenting Noteholders”) under which each Additional Consenting Noteholder agreed to join and be bound by the

terms of the RSA.

On February 5, 2020, the Bankruptcy Court entered an order approving the RSA (the “RSA Approval Order”).

Under the terms of the RSA, the Debtors have agreed to pay to each Consenting Noteholder that holds Utility Impaired Senior Note Claims

(as defined in the RSA) and has become a Consenting Noteholder prior to entry of the RSA Approval Order and remains a Consenting Noteholder as of the effective date, a pro-rated share of an underwriting fee equal to $63 million in the aggregate. The

pro-rated share of such underwriting fee will be based on the amount of Utility Impaired Senior Note Claims held by Consenting Noteholders as of the close of business on February 5, 2020, the date of the entry of the RSA Approval Order (the “RSA

Approval Order Date”).

Consenting Noteholders informed PG&E Corporation that, as of the RSA Approval Order Date, they held, in the aggregate, (i) $5.89

billion (approximately 95%) of the aggregate principal amount of Utility Impaired Senior Note Claims and (ii) $1.43 billion (approximately 82%) of the aggregate principal amount of Utility Short-Term Senior Note Claims (as defined in the RSA).

Any description of the RSA or the Joinder Agreements thereto is qualified in its entirety by reference to the information provided in the

Debtors’ Current Report on Form 8-K filed on January 22, 2019 and the complete copies of the RSA and Form of Joinder Agreement filed as Exhibit 10.1 thereto, which are incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned thereunto

duly authorized.

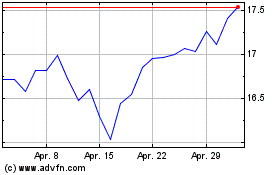

PG&E (NYSE:PCG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

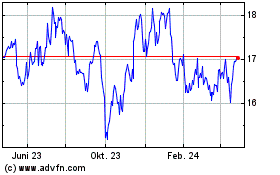

PG&E (NYSE:PCG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024