UK Service Sector Rebounds On Client Demand

05 Februar 2020 - 5:57AM

RTTF2

The UK service sector rebounded at a faster-than-estimated pace

in January driven by rising client demand after general election,

survey results from IHS Markit and Chartered Institute of

Procurement & Supply showed Wednesday.

The services Purchasing Managers' Index rose to 53.9 in January

from 50.0 in December. The reading exceeded the flash estimate of

52.9. A score above 50 indicates expansion.

The sector expanded for the first time since last August and

also at the fastest rate in 16 months as the headwind from delayed

decision-making had lifted since the general election and helped to

deliver a return to business activity growth in January.

New business intake was the strongest since June 2018. Export

sales also returned to growth in January.

A number of respondents commented on the need to hire additional

staff due to an expected rise in workloads. Job creation reached

its highest level since July 2019.

Operating expenses grew in January reflecting robust demand for

staff and increased fuel and transportation costs. The rate of

input price inflation was the strongest for four months.

Consequently, average prices charged by service providers

increased the most since June 2018.

Firms reported an upturn in their projections for activity

growth during the next 12 months. Latest data signaled that the

degree of positive sentiment reached its highest level since May

2015. Further, the composite output index, which reflects the

manufacturing and services activities, climbed to 53.3 in January

from 49.3 in December. The score was above the neutral 50.0 mark

for the first time since last August and above the flash estimate

of 52.4.

The solid increase in private sector output was driven by a

return to growth in the service economy and supported by a broad

stabilization in manufacturing production.

January's PMI surveys give a clear signal that the UK economy

has picked up since the general election, as a diminishing headwind

from political uncertainty translated into rising business and

consumer spending, Tim Moore, economics associate director at IHS

Markit, said.

"With the vast majority of PMI survey data collected prior to

23rd January, we've yet to see any overall impact on business

conditions from the Wuhan coronavirus outbreak, but disruptions to

global supply chains and international travel could present risks

to the UK economy and key trading partners in the coming months,"

Moore added.

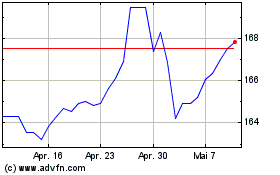

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024