Wells Fargo Utilities and High Income Fund Announces Sources of Distribution

04 Februar 2020 - 10:46PM

Business Wire

The Wells Fargo Utilities and High Income Fund (NYSE American:

ERH) released information about the sources of the February 3,

2020, distribution in a Notice provided to shareholders. The full

text of the Notice is available below and on the Wells Fargo Asset

Management website.

IMPORTANT NOTICE TO SHAREHOLDERS

This Notice provides information about the sources of the Fund’s

monthly distributions. You should not draw any conclusions about

the Fund’s investment performance from the amount of this

distribution or from the terms of the Fund’s Managed Distribution

Plan.

The Fund estimates that it has distributed more than its income

and net realized capital gains; therefore, a portion of your

distribution may be a return of capital. A return of capital may

occur, for example, when some or all of the money that you invested

in the Fund is paid back to you. A return of capital distribution

does not necessarily reflect the Fund’s investment performance and

should not be confused with ‘yield’ or ‘income’.

The amounts and sources of distributions reported in this Notice

are only estimates and are not being provided for tax reporting

purposes. Sources include net investment income (NII), short-term

capital gains (ST), long-term capital gains (LT) and paid in

capital. The actual amounts and sources of the amounts for tax

reporting purposes will depend upon the Fund’s investment

experience during the remainder of its fiscal year and may be

subject to changes based on tax regulations. The Fund will send you

a Form 1099-DIV for the calendar year that will tell you how to

report these distributions for federal income tax purposes.

The following table provides an estimate of the Fund’s

distribution sources, reflecting year-to-date cumulative experience

through the month-end prior to the latest distribution. The Fund

attributes these estimates equally to each regular distribution

throughout the year. Consequently, the estimated information as of

the specified month-end shown below is for the current

distribution, and also represents an updated estimate for all prior

months in the year.

Data as of 12/31/2019

Current Month

Fiscal Year to Date Current

Month Estimated Sources of Distribution

Estimated Sources of Distribution

Estimated Percentages of Distribution Per

Share LT ST Paid

in Per Share LT

ST Paid in LT

ST Paid in Distribution

NII Gains Gains

Capital Distribution NII

Gains Gains Capital

NII Gains Gains

Capital ERH

0.07949

0.00000

0.07949

0.00000

0.00000

0.39075

0.13370

0.07949

0.00000

0.17789

0.0%

100.0%

0.0%

0.0%

The following table provides information regarding distributions

and total return performance over various time periods. This

information is intended to help you better understand whether

returns for the specified time periods were sufficient to meet

distributions.

Data as of 12/31/2019

Annualized Cumulative

Quarterly Dist

Fiscal YTD

Dist

NAV

5-Year Return

on

NAV

Fiscal

YTD Dist Rate

on NAV1

Fiscal YTD Return

on

NAV

Fiscal

YTD Dist Rate

on NAV1

ERH

0.07949

0.39075

13.01

6.56%

7.17%

17.26%

2.60%

1 As a percentage of 12/31/2019 NAV

Additional Disclosures about the Wells Fargo Closed-End

Funds

The fund makes distribution in accordance with a managed

distribution plan that provides for the declaration of monthly

distributions to common shareholders of the fund at an annual

minimum fixed rate of 7.5%, based on the fund’s average monthly net

asset value (NAV) per share over the prior 12 months. Under the

managed distribution plan, distributions are sourced from income

and also may be sourced from paid-in capital and/or capital gains.

The fund’s distributions in any period may be more or less than the

net return earned by the fund on its investments and therefore

should not be used as a measure of performance or confused with

yield or income. Distributions in excess of fund returns will cause

the fund’s NAV to decline. Investors should not draw any

conclusions about the fund’s investment performance from the amount

of its distribution or from the terms of its managed distribution

plan.

The Wells Fargo Utilities and High Income Fund is a closed-end

equity and high-yield bond fund. The fund’s investment objective is

to seek a high level of current income and moderate capital growth

with an emphasis on providing tax-advantaged dividend income.

The final determination of the source of all distributions is

subject to change and is made after year-end. The fund will send

shareholders a Form 1099-DIV for the calendar year that will tell

shareholders how to report these distributions for federal income

tax purposes.

For more information on Wells Fargo’s closed-end funds, please

visit our website.

The fund is a closed-end fund that is no longer engaged in

initial public offerings, and shares are available only through

broker-dealers on the secondary market. Unlike an open-end

mutual fund, a closed-end fund offers a fixed number of shares for

sale. After the initial public offering, shares are bought and sold

through broker-dealers in the secondary marketplace, and the market

price of the shares is determined by supply and demand, not by NAV,

and is often lower than the NAV. A closed-end fund is not required

to buy its shares back from investors upon request.

High-yield, lower-rated bonds may contain more risk due to the

increased possibility of default. Foreign investments may contain

more risk due to the inherent risks associated with changing

political climates, foreign market instability, and foreign

currency fluctuations. Risks of international investing are

magnified in emerging or developing markets. Funds that concentrate

their investments in a single industry or sector may face increased

risk of price fluctuation over more diversified funds due to

adverse developments within that industry or sector. Small- and

mid-cap securities may be subject to special risks associated with

narrower product lines and limited financial resources compared

with their large-cap counterparts. When interest rates rise, the

value of debt securities tends to fall. When interest rates

decline, interest that a fund is able to earn on its investments in

debt securities also may decline, but the value of those securities

may increase. Changes in market conditions and government policies

may lead to periods of heightened volatility in the debt securities

market and reduced liquidity for certain fund investments. Interest

rate changes and their impact on the funds and their NAVs can be

sudden and unpredictable.

The use of leverage results in certain risks, including, among

others, the likelihood of greater volatility of the NAV and the

market price of common shares. Derivatives involve additional

risks, including interest rate risk, credit risk, the risk of

improper valuation, and the risk of noncorrelation to the relevant

instruments they are designed to hedge or to closely track. There

are numerous risks associated with transactions in options on

securities. Illiquid securities may be subject to wide fluctuations

in market value and may be difficult to sell.

Wells Fargo Asset Management (WFAM) is the trade name for

certain investment advisory/management firms owned by Wells Fargo

& Company. These firms include but are not limited to Wells

Capital Management Incorporated and Wells Fargo Funds Management,

LLC. Certain products managed by WFAM entities are distributed by

Wells Fargo Funds Distributor, LLC (a broker-dealer and Member

FINRA).

This material is for general informational and educational

purposes only and is NOT intended to provide investment advice or a

recommendation of any kind—including a recommendation for any

specific investment, strategy, or plan.

Some of the information contained herein may include

forward-looking statements about the expected investment activities

of the funds. These statements provide no assurance as to the

funds’ actual investment activities or results. Readers must make

their own assessment of the information contained herein and

consider such other factors as they may deem relevant to their

individual circumstances.

PAR-0220-03108

INVESTMENT PRODUCTS: NOT FDIC INSURED ● NO

BANK GUARANTEE ● MAY LOSE VALUE

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200204006034/en/

Media Jeanette Foster, 415-264-1323

jeanette.d.foster@wellsfargo.com

Shareholder inquiries 1-800-730-6001

Financial advisor inquiries 1-888-877-9275

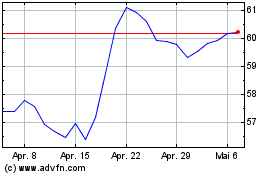

Wells Fargo (NYSE:WFC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

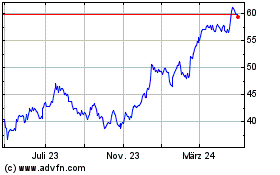

Wells Fargo (NYSE:WFC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024