By Gunjan Banerji and Will Horner

Stocks around the world continued a sharp slump Friday as fresh

economic data and the viral outbreak in China fanned worries about

global growth.

Anxiety swept through stocks, bonds and metals markets as

investors dumped equities and reached for traditionally safer

assets like Treasurys and gold.

The Dow Jones Industrial Average dropped 508 points, or 1.8%, as

losses accelerated midday. The S&P 500 lost 1.5%, and the

tech-heavy Nasdaq Composite fell 1.2%.

Market volatility flared up throughout the week, with major U.S.

indexes logging big swings both up and down. The S&P 500 had

been on one of its longest stretches without a move of more than 1%

since 1969, before the calm shattered to start the week. In a

dramatic reversal, the broad stock market gauge is on track to

record three such moves over the past five days.

The record run for major indexes, earlier propelled by easing

trade tensions between the U.S. and China and a strengthening

domestic economy, came to a halt. Stock markets in Europe and Asia

finished their worst months since August.

"We alleviate one area of uncertainty and we get two more in its

place," said Adam Phillips, director of portfolio strategy at

wealth management firm E.P. Wealth Advisors.

Mr. Phillips said he has been advising clients to brace for

choppy waters ahead in the stock market. "It could get worse before

it gets better," he said.

The potential effects of the coronavirus darkened the outlook at

a time when many investors had been encouraged by progress on trade

between two of the biggest world economies, along with three

interest rate cuts by the Federal Reserve.

In the bond market, the yield on the benchmark 10-year U.S.

Treasury note edged back below the yield of the three-month bill.

The phenomenon, known as a yield-curve inversion, is often

interpreted as a warning sign about a recession ahead.

The World Health Organization on Thursday declared the

coronavirus -- which has now sickened more than 9,500 people and

killed over 200 -- a public-health emergency of international

concern. Although the move highlighted the risk the outbreak posed

globally, the WHO stopped short of recommending restrictions on

travel or trade. Meanwhile, the U.S. saw its first person-to-person

transmission of the virus, escalating concerns about its

spread.

The growing contagion has roiled markets in recent days as

investors attempt to assess whether the virus could weigh on

China's economy as businesses are shut, borders closed and flights

suspended, while also gauging the outbreak's wider impact.

The outbreak comes as some big manufacturers have exhibited

signs of strain, raising other concerns about the economy.

Caterpillar, often considered a bellwether for the economy, said

Friday it expects demand for its machinery to fall this year,

citing global economic uncertainty that crimped sales in the latest

quarter. Its shares dropped 2.5% Friday.

Boeing earlier this week reported its first annual loss in more

than two decades, as one of its aircraft has been grounded

world-wide. And 3M is planning layoffs during a global

restructuring.

Meanwhile, new data Friday showed that business activity

faltered. One measure, the Chicago Business Barometer, fell to its

lowest point in about four years, hitting 42.9 and falling well

below expectations. Readings under 50 indicate activity is

contracting.

"It's a disappointing number," said Chris Zaccarelli, chief

investment officer for Independent Advisor Alliance. "It's been a

tale of two economies."

Although manufacturing data has disappointed recently, the U.S.

consumer continues to spend, giving comfort that the decadelong

economic expansion could continue.

The University of Michigan's headline index of consumer

sentiment hit an eight-month high.

Fresh data released Friday showed household spending rose a

seasonally adjusted 0.3% in December from November. Personal income

advanced 0.2% last month. The spending figures were in line with

economists' expectations, while the personal income number fell

short of expectations.

The rocky week for major indexes has been marked by even more

explosive moves in individual stocks. The sharply divergent

fortunes of some corners of the stock market was on stark display.

As manufacturing heavyweights delivered lackluster news, some tech

highflyers outperformed the market, soaring to unprecedented

heights.

Amazon.com jumped 8.6% after the e-commerce giant's

fourth-quarter sales set a record for the holiday period. It is

poised to become the fourth U.S. company to close with a $1

trillion market value and close at a record.

Tesla's stock continued to soar after the electric-car maker

reported its third consecutive quarter of record vehicle

deliveries. Its shares jumped 10% Thursday though they edged lower

Friday.

International Business Machines rose about 4.5% after the

technology company said Chief Executive Ginni Rometty is stepping

down following a challenging eight-year run.

"There was a belief going into earnings season that expectations

of tech companies were so high that whatever happened, investors

would be disappointed," said Mr. Kreckel. "That hasn't

happened."

Elsewhere, new data on major European economies proved to be a

disappointment on Friday. France's output shrank in the fourth

quarter as strikes and protests against the government's pension

plan curtailed business activity. Italy's economy also contracted

in the latest quarter, when economists had been expecting output to

remain flat. The euro area also grew more slowly than economists

had forecast.

The pan-continental Stoxx Europe 600 gauge fell about 1.2% this

month, its biggest one-month decline since August 2019. The U.K.'s

FTSE 100 index just finished its worst week since October 2018

after the country reported its first two cases of the virus.

The weaker-than-expected European data suggests that any boost

to gross-domestic-product growth will take longer to materialize,

said Brian O'Reilly, head of investment strategy at the

Dublin-based Mediolanum International Funds.

"There was definitely a sense of euphoria that was priced into

the market," Mr. O'Reilly said. "But we are not expecting a rebound

in global GDP at least until the middle of this year. We think it

will just take time for confidence to build."

Stocks in Asia were mixed. The Hang Seng Index had its worst

month since August 2019 and exchanges in China remained shut.

The number of people sickened by the new coronavirus in China

now exceeds the global total infected with severe acute respiratory

syndrome, or SARS, which killed nearly 800 people after emerging

from southern China in late 2002 and spreading into 2003.

Write to Gunjan Banerji at Gunjan.Banerji@wsj.com and Will

Horner at William.Horner@wsj.com

(END) Dow Jones Newswires

January 31, 2020 13:43 ET (18:43 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

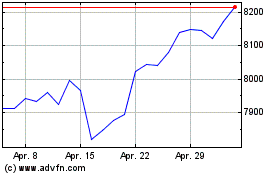

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024