By Rachel Louise Ensign

At 5 a.m. one day last February, construction work tripped a

sophisticated fire-extinguisher system in a Minnesota data center

used by Wells Fargo & Co., knocking out power to servers housed

in the building.

Customers soon noticed: the bank's online and mobile banking

systems were out for hours.

The outage brought into public view the technology failures that

have been occurring behind the scenes at Wells Fargo for years.

Antiquated systems have made it difficult for the bank to meet the

demands of regulators, who are closely scrutinizing the firm after

its 2016 fake-account scandal, according to more than a dozen

current and former employees.

The firm has struggled with tasks like monitoring employee pay

and building a new platform for financial advisers, hampering key

businesses.

"We need to be a technology company," Chief Executive Charles

Scharf said in his first meeting with employees after taking the

job in October. Saul Van Beurden, his head of technology and

another relatively new arrival, said in an interview that his top

priorities include fixing issues raised by regulators, attracting

talent and making sure key systems don't go offline again.

Banking was once a business of ornate branches and large vaults,

but the sector now runs on digital systems designed to move money

around, keep cybercriminals out and knit the disparate parts of

sprawling institutions together. Big banks spend billions on these

tools, employ tens of thousands of people to keep them running

smoothly and use flashy mobile apps to compete for customers.

Wells Fargo says it was the first U.S. lender to provide online

banking in the 1990s, a point of corporate pride. But it fell

behind in recent years, current and former employees say.

A spokesman said the bank has made a number of improvements to

its technology offerings, including card-free ATMs, contactless

debit cards and online mortgage applications.

In late 2015, the year before the fake-account scandal erupted,

the bank announced the departure of its chief information officer,

who reported to the CEO. The bank didn't replace the tech chief and

distributed his direct reports to other executives, including an

administrative head later placed on leave after regulators

reprimanded her for oversight failures.

The reporting structure at times could be disorganized.

Regulators, for instance, expect banks to keep meticulous records

of each stage of internal technology projects. In the unit

overseeing initiatives like Apple Pay, required documents were

often missing and the processes for creating them and checking they

were in place were largely manual, said Mark McAllister, a project

manager in the unit from 2014 to 2019.

Mr. McAllister said he was fired after raising concerns about

the lapses. The bank spokesman said Mr. McAllister wasn't

retaliated against, but declined to elaborate further.

By June 2018, regulators had identified problems across Wells

Fargo's tech operations, including software vulnerabilities,

cybersecurity concerns and risk-management inconsistencies, The

Wall Street Journal previously reported.

Last year, the Office of the Comptroller of the Currency told

Wells Fargo to improve its human-resources functions, including

technology systems. The agency in particular criticized the

division's manual processes for overseeing pay and performance for

its 260,000 employees, according to a person familiar with the

matter.

Legions of tech workers at the bank are toiling to satisfy

problems regulators have cited. Some relate to mundane topics like

improving systems that control employee building access, according

to another person familiar with the matter.

Other problems have affected customers, like the

online-and-mobile banking outage in early 2019. Wells Fargo said

construction work in a room of important servers tripped the fire

system, releasing extinguishing chemicals into the air, according

to public records from the local fire department. That triggered a

shutdown of power to servers, the bank said.

Issues at a single data center aren't supposed to knock out key

bank systems, which are meant to be routed to backups if they fail.

Bank employees believe backup systems weren't adequately tested to

make sure they would come online quickly if the suburban

Minneapolis data center had a problem, according to people familiar

with the matter.

Mr. Van Beurden joined Wells Fargo in April from JPMorgan Chase

& Co. and reports to Mr. Scharf. He said fixing the laundry

list of items cited by regulators is his "first priority." He's

also working to attract top software developers and cut down on the

time it takes to develop new technology.

Some of his projects were inspired by his former employers, like

an automated tool that predicts customer activity each day. That

helps the bank ensure that digital systems have the bandwidth to

handle busy days.

He said he has also made changes to prevent another outage, like

removing that particular type of fire-extinguisher system from data

centers. When "the app is down, the bank is down for our

customers," he said.

None of this is cheap. Executives have said that spending on

technology workers has been one reason expenses have remained

higher than the bank would like. Mr. Van Beurden last summer asked

outside consultants to refund some of the money the bank has

spent.

He has also shelved some long-running projects. In 2015, the

bank agreed to buy outside software that would replace old

technology used by its financial advisers. The new platform would

store wealth-management clients' data, making it easier for

employees to analyze.

The cost of the initiative ballooned, according to one person

who worked on it. Last year, the bank suspended the project,

according to the software provider, which cited the bank's "need to

change priorities."

Write to Rachel Louise Ensign at rachel.ensign@wsj.com

(END) Dow Jones Newswires

January 11, 2020 05:44 ET (10:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

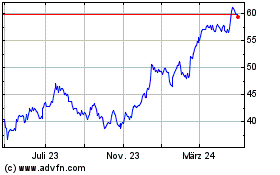

Wells Fargo (NYSE:WFC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

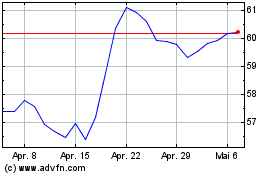

Wells Fargo (NYSE:WFC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024