Rite Aid Corporation (NYSE: RAD) (“Rite Aid” or the “Company”)

today announced that it has commenced an offer to exchange (the

“Exchange Offer”) up to $600 million aggregate principal amount

(the “Maximum Amount”) of its outstanding 6.125% Senior Notes due

2023 (the “Old Notes”) for newly issued 7.500% Senior Secured Notes

due 2025 (the “New Notes”), upon the terms and subject to the

conditions set forth in the offering memorandum dated January 6,

2020 (the “Offering Memorandum”). The purpose of the Exchange Offer

is to improve the Company’s maturity profile by extending the

maturity date of a portion of the Old Notes from April 2023 to July

2025.

The table below summarizes the principal economic terms of the

Exchange Offer.

Old Notes

tobeExchanged

CUSIP Number /ISIN

AggregatePrincipalAmountOutstanding

ExchangeConsideration(1)

Early

TenderPayment(1)

Total

ExchangeConsideration(1)(2)

6.125%Senior Notesdue 2023

767754CH5 /US767754CH50 /U76659AW8

/USU76659AW82

$1,753,490,000

$950 principalamount of NewNotes

$50 principalamount ofNew Notes

$1,000 principalamount of NewNotes

____________________

(1) For each $1,000 principal amount of Old Notes. (2) Includes the

Early Tender Payment.

The New Notes will mature on July 1, 2025, will be fully and

unconditionally guaranteed on a senior secured basis by the same

subsidiary guarantors as the Company’s existing credit facilities

and the Old Notes and will be effectively senior to the Old Notes.

The New Notes and the related guarantees will be secured by

substantially all of the Company’s subsidiaries assets, including

(i) a first-priority lien on the Notes priority collateral, and

(ii) a second-priority lien on the ABL priority collateral, which,

in each case include assets of PBM entities (other than insurance

entities) and also secure the Company’s existing credit

facilities.

The ABL priority collateral generally consists of cash and cash

equivalents, accounts, receivables, payment intangibles, inventory,

prescription files (including eligible script lists) and, prior to

the repayment of the Company’s first-in, last-out senior secured

term loan facility, intellectual property. The Notes priority

collateral generally consists of equipment, fixtures, investment

property (other than equity interests in subsidiaries),

intellectual property (following the repayment of the Company’s

first-in, last-out senior secured term loan facility) and other

collateral to the extent it does not constitute ABL priority

collateral.

In order to be eligible to receive the Total Exchange

Consideration of $1,000 in principal amount of New Notes per $1,000

principal amount of Old Notes, holders are required to validly

tender their Old Notes in the Exchange Offer prior to 5:00 p.m.,

New York City time, on January 17, 2020 (such date and time, as it

may be extended by the Company, the “Early Deadline”). Holders will

be eligible to receive only the Exchange Consideration of $950 in

principal amount of New Notes per $1,000 principal amount of Old

Notes for any Old Notes tendered in the Exchange Offer after the

Early Deadline. The Exchange Offer will expire at 11:59 p.m., New

York City time, on February 3, 2020 (such date and time, as it may

be extended by the Company, the “Expiration Time”).

In addition to the Total Exchange Consideration or Exchange

Consideration, as applicable, all Old Notes accepted for exchange

will also receive payment of accrued and unpaid interest in cash

to, but not including, the settlement date for the Exchange Offer,

which will occur promptly after the Expiration Time and is expected

to be within two business days following the Expiration Time (the

“Settlement Date”).

If the Exchange Offer is oversubscribed, Old Notes will be

accepted for exchange on a pro rata basis up to the Maximum Amount,

and the balance of Old Notes not accepted for exchange will be

returned to Holders; provided that Old Notes tendered for exchange

before the Early Deadline will be accepted in priority to Old Notes

tendered for exchange after the Early Deadline.

Old Notes that are tendered may be validly withdrawn, in whole

or in part, at any time prior to 5:00 p.m., New York City time, on

January 17, 2020 (the “Withdrawal Deadline”). The Company reserves

the right to amend, extend or terminate the Exchange Offer at any

time, subject to applicable law.

The Exchange Offer is subject to certain customary conditions

described in the Offering Memorandum, including the receipt by the

Company of Old Notes that have been validly tendered and not

validly withdrawn which will result in the issuance of at least

$250 million aggregate principal amount of New Notes. The Maximum

Amount is $600 million and the Company does not intend to increase

such amount. As of November 30, 2019, $600 million is the maximum

amount of incremental secured debt that can be issued under Rite

Aid's Old Notes indenture without reducing the Company's borrowing

capacity under its revolving credit facilities (and assuming the

outstanding letters of credit).

The Exchange Offer and the issuance of the New Notes have not

been and will not be registered with the Securities and Exchange

Commission under the Securities Act of 1933, as amended (the

“Securities Act”), or any other applicable securities laws, and,

unless so registered, the New Notes may not be offered, sold,

pledged or otherwise transferred within the United States or to or

for the account of any U.S. person, except pursuant to an exemption

from the registration requirements thereof. Accordingly, the New

Notes are being offered and will be issued only to (i) “qualified

institutional buyers” (as defined in Rule 144A under the Securities

Act (“Rule 144A”)) and (ii) non-“U.S. persons” who are outside the

United States in compliance with Regulation S under the Securities

Act (“Regulation S”). Non U.S.-persons may also be subject to

additional eligibility criteria.

Available Documents and Other Details

Documents relating to the Exchange Offer will only be

distributed to holders of the Old Notes who complete and return an

eligibility form confirming that they are either a “qualified

institutional buyer” under Rule 144A or not a “U.S. person” under

Regulation S for purposes of applicable securities laws. Holders of

Old Notes who desire to complete an eligibility form should either

visit https://gbsc-usa.com/eligibility/riteaid or request

instructions by sending an e-mail to contact@gbsc-usa.com or by

calling Global Bondholder Services Corporation, the information and

exchange agent for the Exchange Offer, at (toll-free) (866)

470-3900 or (banks and brokers) (212) 430-3774. The eligibility

form is also available electronically at:

http://gbsc-usa.com/eligibility/riteaid.

The complete terms and conditions of the Exchange Offer are set

forth in the Offering Memorandum. This press release is for

informational purposes only and is neither an offer to purchase nor

a solicitation of an offer to sell the New Notes or any other

securities. The Exchange Offer is only being made pursuant to the

Offering Memorandum. The Exchange Offer is not being made to

holders of Old Notes in any jurisdiction in which the making or

acceptance thereof would not be in compliance with the securities,

blue sky or other laws of such jurisdiction. The New Notes have not

been approved or disapproved by any regulatory authority, nor has

any such authority passed upon the accuracy or adequacy of the

Offering Memorandum.

About Rite Aid Corporation

Rite Aid Corporation is on the front lines of delivering health

care services and retail products to over 1.6 million Americans

daily. Our pharmacists are uniquely positioned to engage with

customers and improve their health outcomes. We provide an array of

whole being health products and services for the entire family

through over 2,400 retail pharmacy locations across 18 states.

Through EnvisionRxOptions, we also deliver pharmacy benefit

management to approximately 1,900 clients and 3.4 million

members.

Statements in this release that are not historical, are

forward-looking statements made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Such statements include, but are not limited to, statements

regarding Rite Aid’s competitive position and ability to realize

its growth initiatives and operating efficiencies; and any

assumptions underlying any of the foregoing. Words such as

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “predict,” “project,” “should,” and “will”

and variations of such words and similar expressions are intended

to identify such forward-looking statements.

These forward-looking statements are not guarantees of future

performance and involve risks, assumptions and uncertainties,

including, but not limited to, our ability to complete the

transaction described herein, and any resulting charges or impact

on our financial results; our high level of indebtedness and our

ability to make interest and principal payments on our debt and

satisfy the other covenants contained in our debt agreements;

general economic, industry, market, competitive, regulatory and

political conditions; our ability to improve the operating

performance of our stores in accordance with our long term

strategy; the impact of private and public third-party payers

continued reduction in prescription drug reimbursements rates and

their efforts to limit access to payor networks, including through

mail order; our ability to manage expenses and our investments in

working capital; outcomes of legal and regulatory matters; changes

in legislation or regulations, including healthcare reform; our

ability to achieve the benefits of our efforts to reduce the costs

of our generic and other drugs; the inability to complete the sale

of the remaining Rite Aid distribution centers and related assets

to Walgreens Boots Alliance, Inc. due to failure to satisfy the

minimal remaining conditions applicable only to the distribution

centers being transferred at such distribution center closing; our

ability to successfully execute and achieve benefits from our

recent change in senior leadership; the potential for operational

disruptions due to, among other things, concerns of management,

employees, current and potential customers, other third parties

with whom we do business and shareholders; the success of any

changes to our business strategy that may be implemented under our

new chief executive officer and other management; our ability to

achieve cost savings through the organizational restructurings

within the anticipated timeframe, if at all; possible changes in

the size and components of the expected costs and charges

associated with the organizational restructuring plan; and the

outlook for and future growth of the Company.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200106006027/en/

INVESTORS:Byron Purcell(717) 975-5809

MEDIA:Christopher Savarese(717) 975-5718

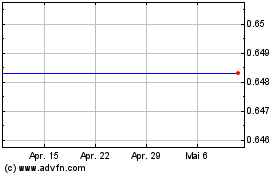

Rite Aid (NYSE:RAD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Rite Aid (NYSE:RAD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024