Ahold Delhaize to invest $480 million in U.S. supply chain to create a fully integrated, self-distribution model

10 Dezember 2019 - 10:00PM

Ahold Delhaize to invest $480 million in U.S. supply chain to

create a fully integrated, self-distribution model

Expect to see over $100 million in annual savings following the

transition period; audio cast to be held on December 11 at 16:00

Central European Time, details below.

Zaandam, the Netherlands, December 10, 2019 – Ahold Delhaize USA

today announced that it is investing $480 million to transform and

expand its supply chain operations on the U.S. East Coast. This

investment supports the new three-year strategy to move the U.S.

supply chain into a fully integrated, self-distribution model. The

Ahold Delhaize USA announcement is attached to this release.

The $480 million capital outlay will cover a three-year

transition period, which will support the acquisition of three

distribution facilities by Ahold Delhaize USA from C&S

Wholesale Grocers and leases on two additional facilities. In

addition, it includes investment in two new fully automated Ahold

Delhaize USA frozen facilities to be constructed in the Northeast

and Mid-Atlantic of the U.S.

The new self-distribution U.S. supply chain will enable the U.S.

businesses to reduce costs, improve speed to shelf, enhance

relationships with vendors, and improve product availability and

freshness for customers.

“Today’s announcement is another example of how Ahold Delhaize

USA is transforming our infrastructure to support the next

generation of grocery retail,” said Kevin Holt, Chief Executive

Officer, Ahold Delhaize USA and Ahold Delhaize Management Board

Member. “Through this initiative, we will modernize our supply

chain distribution, transportation and procurement through a

fully-integrated, self-distribution model, that will be managed by

our companies directly and locally. This will result in

efficiencies and most importantly product availability and

freshness for customers of our local brands, now and in the future,

whenever, wherever however they choose to shop.”

Excluding the transition expenses, the impact on Ahold Delhaize

USA underlying operating income will be neutral in 2020 and 2021

and favorable in 2022 by $60 million. The ongoing annual benefit on

underlying operating income will be more than $100 million. During

the first three years, there will be transition expenses of $160

million, impacting underlying operating income ($50 million in

2020; $50 million in 2021; $60 million in 2022).

Our previous group level annual free cash flow target of €1.8

billion through 2021 expressly excluded M&A and other such

transactions. Therefore, free cash flow will be impacted by an

incremental $410 million (€369 million) in capital expenditures

from 2020-2022. The total investment also includes an additional

$70 million (€63 million) in lease commitments.

This investment will not materially impact 2019 results and

there is no change to the outlook that was provided on November 6,

2019. We reiterate plans to spend approximately 3% of sales on

capital expenditures on top of the amount to be spent on this

transaction over the next few years. Below are our expectations on

the financial impact to results at the US segment and group level

through 2023.

We note that beginning in the Q4 2019 earnings release, reported

results will include the full impacts from the supply chain

transformation. Our underlying operating profit, which is an

alternative performance measure, will include the ongoing effects

of the supply chain transformation. We will also provide a

supplementary disclosure of transition expenses related to the

supply chain transformation for informational purposes. Transition

expenses include legal/consulting, IT transition, procurement and

replenishment transition costs as well as facility start-up

costs.

Please join us for an audiocast at 16:00 CET on Wednesday,

December 11, 2019, where Frans Muller, Jeff Carr, and Kevin Holt

will review the transaction. The audiocast will be available live

on our website: www.aholddelhaize.com.

- 20191012 Supply chain press Release - Ahold Delhaize Version

final

- Ahold Delhaize USA Supply chain press release final

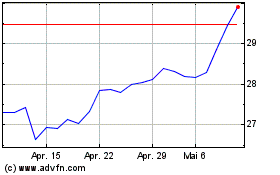

Koninklijke Ahold Delhai... (TG:AHOG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

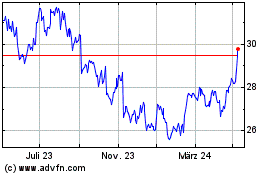

Koninklijke Ahold Delhai... (TG:AHOG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024