Coloplast delivers a strong full-year result and the company concludes that the Interventional Urology business remains core ...

05 November 2019 - 12:06PM

Coloplast delivers a strong full-year result and the company

concludes that the Interventional Urology business remains core to

its future value creation

Coloplast delivered 8% organic revenue growth in the

2018/19 financial year and a 9% increase in EBIT corresponding to

an EBIT margin of 31% before special items. The unconditional

strategic review of Interventional Urology has concluded that the

business remains core to the Coloplast mission and future value

creation. In the fourth quarter of the 2018/19 financial

year, Coloplast delivered 8% organic revenue growth with reported

revenue in DKK up by 9% to DKK 4,618m. This marks the company’s

tenth consecutive quarter delivering 8% organic growth. Full-year

organic revenue growth was also 8% with reported revenue in DKK up

by 9% to DKK 17,939m. Full-year ROIC after tax and before special

items was 48% against 44% last year.

- “We are delivering a strong set of results with 8% organic

growth and a 31% EBIT margin before special items. Expressed

differently, we have helped make life easier for millions of people

with intimate healthcare needs. We continue to take market share

across all regions and across all business areas, and we continue

to invest to drive both short-term growth as well as to build an

even stronger and more competitive company for the medium and long

term,” says Coloplast CEO Kristian Villumsen.

The business areas reported the following full-year organic

growth rates: Ostomy Care 7%, Continence Care 8%, Interventional

Urology 10% and Wound & Skin Care 8%.

Looking at sales by geographies, the European markets

contributed 6% growth to full-year sales, Other developed markets,

driven mainly by the USA, delivered 11% revenue growth, while

Emerging Markets provided a 12% increase.

Full-year EBIT before special items amounted to DKK 5,556m, a 9%

increase in DKK, corresponding to an EBIT-margin of 31%, which is

in line with the company guidance and on par with 2017/18.

EBIT was impacted by a further provision of DKK 400m to cover

potential settlements and costs in connection with the existing

lawsuits in the United States alleging injury resulting from the

use of transvaginal surgical mesh products. The additional

provision is made because the remaining lawsuits are taking longer

to resolve than initially expected, hence incurring higher costs.

The company has not seen an increase in the inflow of new

lawsuits.

Interventional Urology remains core to the Coloplast

mission and future value creationAn unconditional

strategic review has concluded that Interventional Urology remains

core to the Coloplast mission and future value creation. Coloplast

is fully committed to further developing the business and providing

the investment and focus required.

- “After completing a thorough review, we have firmly concluded

that the Interventional Urology business is core to our mission,

and that retaining the business is the right decision to deliver

continued shareholder value creation. Fundamentally, we observe

large, fast-growing markets and real unmet clinical needs

representing long-term growth opportunities,” says Kristian

Villumsen and continues:

- Today, the business delivers strong growth and profitability,

which is a good outset from which to invest and develop the

business further, to derive even greater long-term value.”

Financial guidance 2019/20 In line with its

long-term guidance Coloplast is guiding for 7-8% organic revenue

growth and a reported growth in DKK of 7-8% in 2019/20. The

guidance includes the effects of a comprehensive healthcare reform

in France, representing an average reduction in prices for Ostomy

Care and Continence Care of ~9% as of 1 July 2019, and Wound Care

of ~2% as of 1 June 2019. Coloplast has successfully mitigated half

of the impact. Coloplast expects an EBIT margin of ~31% at constant

exchange rates with a reported EBIT margin of ~31% in DKK. The EBIT

margin forecast reflects additional incremental investments of up

to 2% of revenue for innovation, sales, and marketing purposes.

|

CONTACTS Lina DanstrupSenior Media Relations

Manager, Corporate Communications+45 49 11 26

07dklina@coloplast.com |

| Ellen BjurgertVice

President, Investor Relations+45 49 11 33

76dkebj@coloplast.com |

Financial highlights and key ratios

|

DKKm |

2018/19 |

2017/18 |

Change |

|

2018/19Q4 |

2017/18Q4 |

Change |

|

Revenue |

17,939 |

16,449 |

9% |

|

4,618 |

4,234 |

9% |

|

EBIT before special items |

5,556 |

5,091 |

9% |

|

1,479 |

1,415 |

5% |

|

EBIT margin before special items |

31% |

31% |

|

|

32% |

33% |

|

|

Special items* |

-400 |

0 |

nm |

|

-400 |

0 |

nm |

|

EBIT after special items |

29% |

31% |

|

|

23% |

33% |

|

|

Profit for the period |

3,873 |

3,845 |

1% |

|

793 |

1,039 |

-24% |

*DKK 400m as further provision to cover potential

settlements and costs in connection with the existing lawsuits in

the US alleging injury resulting from the use of transvaginal

surgical mesh products.

Sales performance by business area

|

DKKm |

2018/19 |

2017/18 |

Organic growth |

Reported growth |

|

Ostomy Care |

7,166 |

6,643 |

7% |

8% |

|

Continence Care |

6,459 |

5,926 |

8% |

9% |

|

Interventional Urology |

1,970 |

1,740 |

10% |

13% |

|

Wound & Skin Care |

2,344 |

2,140 |

8% |

10% |

|

Revenue |

17,939 |

16,449 |

8% |

9% |

|

(DKKm) |

2018/19Q4 |

2017/18Q4 |

Organic growth |

Reported growth |

|

Ostomy Care |

1,849 |

1,700 |

7% |

9% |

|

Continence Care |

1,649 |

1,520 |

7% |

9% |

|

Interventional Urology |

493 |

432 |

11% |

14% |

|

Wound & Skin Care |

627 |

582 |

6% |

8% |

|

Revenue |

4,618 |

4,234 |

8% |

9% |

Financial guidance for 2019/20

|

|

Guidance for 2019/20 |

Guidance for 2019/20 (DKK) |

|

Sales growth |

7-8% (organic) |

7-8% |

|

EBIT margin |

~31% (at constant exchange rates) |

~31% |

|

Capital expenditure |

- |

~850m |

|

Tax rate |

- |

~23% |

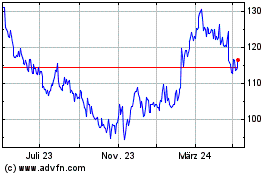

Coloplast AS (TG:CBHD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

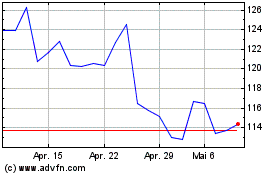

Coloplast AS (TG:CBHD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024