Fiat Chrysler Leaps on Merger News, Peugeot Shareholders, Suppliers Fret

31 Oktober 2019 - 1:11PM

Dow Jones News

By Max Bernhard

Fiat Chrysler Automobiles NV (FCA.MI) appeared to get the better

deal in its merger agreement with Peugeot SA (UG.FR), analysts said

Thursday, with the Italian-American car maker's shares soaring

while the French company's plunged.

"It's not hard to understand this reaction when you consider the

job done by Peugeot management over the last five years, while Fiat

Chrysler management have overseen a tired product line and little

in the way of innovation, in response to the challenges that are

facing the sector as a whole, which include, but aren't confined

to, electric and driverless cars," CMC's Michael Hewson said in a

note.

Fiat Chrysler and Peugeot shareholders will each initially own

50% of the new company, with John Elkann, Fiat Chrysler's chairman,

as chairman and Peugeot's Chief Executive Carlos Tavares as CEO.

Fiat Chrysler will pay a special dividend of 5.5 billion euros

($6.1 billion) and distribute its unit Comau to shareholders, while

Peugeot will distribute its 46%-stake in auto parts maker Faurecia

SE (EO.FR) to its own shareholders.

Citi analyst Raghav Gupta-Chaudhary said the deal appears to

favor existing Fiat Chrysler shareholders who benefit from the cash

distribution, while Peugeot's shareholders "are being asked to

remain patient."

At 1126 GMT Fiat Chrysler shares were up 8.6%, while Peugeot was

down 14%.

The impact of the deal extends beyond the car makers, with

several suppliers trading lower following the news, which would

create one of the world's largest auto makers by volume with a

market value of $48.4 billion. Faurecia was down 2.9% and Valeo SA

(FR.FR) traded 2.4% lower. German suppliers Schaeffler AG (SHA.XE),

Leoni AG (LEO.XE) and Continental AG (CON.XE) were down 5.1%, 3.2%

and 2.1%, respectively.

"Part of the motivation for a PSA-FCA deal are procurement

savings," said Kai Mueller at Bank of America Merrill Lynch.

The deal is bad news for suppliers who have already been

struggling with pressure for discounts from car makers amid a

global slowdown in demand. Consolidation in the sector means car

manufacturers could ask for higher discounts based on higher

volumes.

Write to Max Bernhard at max.bernhard@dowjones.com;

@mxbernhard

(END) Dow Jones Newswires

October 31, 2019 07:56 ET (11:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

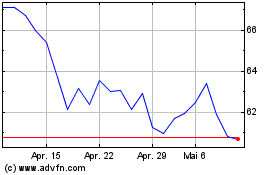

Continental (TG:CON)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Continental (TG:CON)

Historical Stock Chart

Von Apr 2023 bis Apr 2024