Snuggle, Right Guard Maker's Promotion of CFO Draws Criticism

26 Oktober 2019 - 1:17AM

Dow Jones News

By Nina Trentmann

Companies that promote a finance chief to chief executive often

do so in the name of caution, putting the reins in what can be seen

as familiar and safe hands.

While such announcements rarely raise eyebrows, reaction this

week to that very situation at consumer goods giant Henkel AG shows

that investors and analysts don't always crave continuity.

The maker of Dial soap, Snuggle fabric softener and Right Guard

deodorant said Thursday that CFO Carsten Knobel would be an

"excellent successor" to Hans van Bylen, who will step down Jan. 1.

"He knows Henkel very well and has many years of international

management and leadership experience," the company said.

On Friday, analysts roasted the Düsseldorf, Germany-based

company for the move -- the third consecutive time Henkel has

elevated an internal executive to CEO.

Sanford C. Bernstein & Co. analysts said Mr. Knobel lacked

commercial operating experience and pointed to the executive's

involvement in a 2016 deal to acquire Sun Products Corp. for about

$3.6 billion -- a transaction they described as disastrous.

"He is not an external, experienced hire that Henkel now

requires to solve its fundamental strategic, operating and cultural

problems," they wrote.

JPMorgan Chase & Co. analysts added that Mr. Knobel "is part

of the same management board that failed to deliver on operational

execution."

Henkel, whose stock price declined 1.8% Thursday and another

1.4% Friday, didn't immediately respond to a request for

comment.

While many companies start looking internally for a new leader,

most times they opt for an external candidate as CEO, said Mickey

Matthews, international chairman at executive search firm Stanton

Chase.

And often, the new CEO comes from an operations role. Promotions

from CFO to CEO at Fortune 500 and S&P 500 companies are

expected to be about 6.9% this year, the same as last year,

according to Crist|Kolder Associates, a recruitment firm.

And while a CFO-to-CEO elevation might be intended to convey an

aura of stability and confidence, such promotions run the risk of

underwhelming the market. "The perception is that this a missed

opportunity," Mr. Matthews said.

Outside observers could interpret such a move as a sign that the

company is anticipating an economic slowdown and wants a person

familiar with the financials at the helm during that time, he

said.

Henkel's adhesives business has been struggling in recent

months, and sales in its beauty care also have been lagging. Net

income declined 7.3% to EUR558 million ($618.2 million) in the

second quarter, down from EUR602 million in the prior-year

quarter.

The choice of Mr. Knobel, who joined Henkel in 1995 and has been

leading the company's finance department since 2012, could cast

doubt among observers over Henkel's willingness to alter the

structure of the company, either through mergers and acquisitions

or through a breakup, JPMorgan analysts wrote.

Write to Nina Trentmann at nina.trentmann@wsj.com

(END) Dow Jones Newswires

October 25, 2019 19:02 ET (23:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

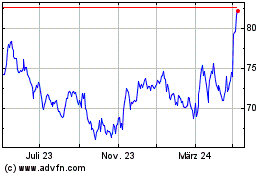

Henkel AG & Co KGAA (TG:HEN3)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

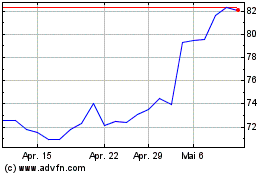

Henkel AG & Co KGAA (TG:HEN3)

Historical Stock Chart

Von Apr 2023 bis Apr 2024