Auto Supplier Continental to Overhaul Business -- Update

22 Oktober 2019 - 10:28PM

Dow Jones News

By William Boston

BERLIN -- Continental AG, one of the world's biggest auto

suppliers, said it would reorganize its business and book a EUR2.5

billion ($2.8 billion) write-down, in the latest evidence of how

softening global car demand and the mass shift to electric vehicles

are reshaping the car-manufacturing economy.

In a sign that it expects the industry's current travails to

continue, Continental said it had shelved plans for a partial

initial public offering of stock in its powertrain division -- home

to most of its legacy, pre-electric technology -- choosing instead

to spin off the unit to existing shareholders.

The business, Vitesco Technologies, which makes parts for

fuel-powered vehicles, will become a potential vehicle for

acquisitions or a merger in anticipation of a coming shakeout among

global automotive-parts suppliers.

The decision indicates that a pure play centered on conventional

car technology is no longer enticing enough to outside investors in

a world where demand for traditional cars is cratering while

governments and manufacturers -- if not buyers -- are pivoting to

electric mobility.

So does the multibillion-euro write-down, which affects mainly

assets acquired in the past decade and will hit the company's

third-quarter results, reflecting the company's gloomy assessment

of the car market's medium-term prospects.

After a meeting of the executive board and the decision to scrap

Vitesco's IPO, Continental said sales for the three months to the

end of September totaled EUR11 billion, down 3% from a year

earlier. The company added that it expects to post a loss before

adjustments for the full year.

Despite the grim news, Continental shares rose 4.1%, as

investors cheered the decision to separate the powertrain business,

a move that could accelerate consolidation in the supply industry,

which is struggling in the current slump.

Demand for cars has dropped simultaneously in China, the U.S.

and Europe. Analysts predict that global auto sales could decline

4% to 6% this year, the second year of falling sales in a row. Last

year, global new-car sales were down about 0.5%, the first decline

since 2009.

"We do not anticipate that global production of passenger cars

and light commercial vehicles will experience any material

improvement in the next five years," Continental Chief Finance

Officer Wolfgang Schäfer told reporters on Tuesday, explaining why

the company adjusted its outlook and valuations of businesses.

Most of the charges against third-quarter earnings are the

result of goodwill that the company has carried from acquisitions

dating to 2008, Mr. Schäfer said. Goodwill is accrued through the

cost of the acquisition minus the fair market value of the assets

acquired.

The biggest share, about EUR1.54 billion, affects the company's

business with auto interiors, which includes electronics and

onboard navigation and entertainment systems. It totaled EUR724

million in the chassis and safety-components business, and EUR244

million in powertrain.

While the change won't occur immediately, analysts expect auto

suppliers to be hit particularly hard as the industry shifts to

producing electric cars and vehicles that are powered more by

software than mechanical engineering.

In August, Continental said it would start phasing out

production of components for internal-combustion engines because of

a faster-than-expected fall in demand.

The news about the third-quarter write-downs also highlights the

dilemma that suppliers find themselves in: As the business

providing parts, services and technology for internal-combustion

engines fades, electric-car sales are still too small to compensate

for lost revenue.

"The business with electric vehicles is difficult, and it's

going to remain so until we have more volume," Mr. Schäfer

said.

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

October 22, 2019 16:13 ET (20:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

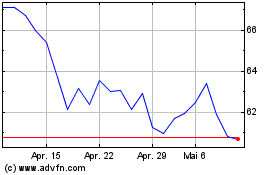

Continental (TG:CON)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Continental (TG:CON)

Historical Stock Chart

Von Apr 2023 bis Apr 2024