San Jose to Propose Turning PG&E Into Giant Customer-Owned Utility--Update

21 Oktober 2019 - 10:17PM

Dow Jones News

By Rebecca Smith

San Jose, California's third-biggest city, is proposing to

convert PG&E Corp. into the country's largest customer-owned

utility, its mayor told The Wall Street Journal on Monday.

The most populous city served by PG&E hopes to persuade

other cities and counties in coming weeks to line up behind the

plan, which would strip PG&E of its status as an investor-owned

company and turn it into a nonprofit, electric-and-gas

cooperative.

The buyout proposal amounts to a revolt by some of PG&E's

roughly 16 million customers as the company struggles to keep the

lights on and provide basic services while preventing its aging

electric equipment from sparking wildfires.

San Jose Mayor Sam Liccardo said in an interview that the time

has come for the people dependent on PG&E for essential

services to propose a new direction. A cooperative, he said, would

create a utility better able to meet customers' needs because it

would be owned by customers -- and answerable to them.

"This is a crisis begging for a better solution than what

PG&E customers see being considered today," said Mr. Liccardo.

He said recent power shut-offs initiated by the company were poorly

handled, adding, "I've seen better organized riots."

PG&E in the past has said its energy systems are not for

sale -- a position it reiterated Monday -- and has repeatedly

beaten back efforts on the part of dissatisfied cities to form

municipal electric utilities.

"We have not seen the proposal. However, PG&E's facilities

are not for sale, and to do so would not be consistent with our

charter to operate or our mission to serve Northern and Central

California communities," the company said. "We remain focused on

the safety of our customers and communities and will continue

working together with our state and local government partners and

across all sectors and disciplines to develop comprehensive,

long-term safety and energy solutions for the future."

The buyout idea represents a dramatic twist in the debate over

how PG&E could emerge from bankruptcy, compensate fire victims

and address its many safety problems. It likely will face stiff

opposition from PG&E, which sought chapter 11 protection in

January from what it estimated at more than $30 billion in

wildfire-related liabilities. The company's bondholders also will

likely contest the idea after putting forward a rival

reorganization plan in bankruptcy court.

California officials are running out of patience with PG&E

after the company shut off power to roughly two million

Californians in 34 counties earlier this month to ensure that its

power lines, transformers and fuses didn't ignite fires that could

spread quickly amid warnings of high winds. PG&E warned Monday

that winds could trigger another round of shut-offs for parts of 17

counties later this week.

PG&E may have accidentally galvanized support for the public

buyout proposal last week when Chief Executive Bill Johnson told

state regulators that the utility may need to rely on power

shut-offs for up to 10 years. That is a horrifying prospect for

public officials, who note that the blackouts affect public safety

and the delivery of other basic services such as clean water.

"We need to align the financial interest with the public

interest," Mr. Liccardo said. "We hope there will be recognition

that this structure better addresses the public need and we're

looking to start the drumbeat to enable all of us to march

together."

Peg Brickley contributed to this article.

Write to Rebecca Smith at rebecca.smith@wsj.com

(END) Dow Jones Newswires

October 21, 2019 16:02 ET (20:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

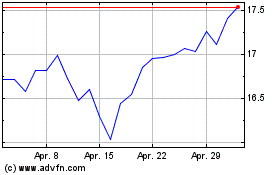

PG&E (NYSE:PCG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

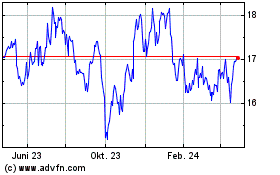

PG&E (NYSE:PCG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024