By Agam Shah

NEW YORK -- When passengers step into one of the 36 elevators

running at 10 Hudson Yards, the heavy lifting is done by a network

of software and sensors.

The 53-floor structure, part of the Hudson Yards development on

the west side of Manhattan, opened in 2016. But the elevators, from

Switzerland-based Schindler Group, are designed to run as if it's

day one.

A combination of analytics and sensor technologies identify any

deviations from what would be considered a normal ride, from a

slight temperature change in the shafts to a slow-closing door.

When such anomalies are detected, the system sends alerts to

hand-held devices carried by maintenance personnel.

The setup helps Schindler analyze problem faster, said Chief

Technology Officer Karl-Heinz Bauer.

"We can do the jobs in a shorter period of time and with higher

quality, " he said.

The transformation of elevators from just a mechanically

efficient way to go up and down into data-spewing devices is

helping Schindler, as well as rivals Otis Elevator Co. and

Thyssenkrupp AG, predict and diagnose elevator problems and better

attune rides with expected foot traffic.

As a result, technology executives are helping identify and

develop new revenue opportunities, built around a tech-driven

service model.

Connecticut-based Otis is using digitization to sell a

subscription-based elevator-management platform called Otis One,

launched last month in China and in the pilot stage in Europe and

the U.S. Similar to Schindler's system, the Otis platform includes

analytics tools that identify irregular sensor readings, like

unusual door closing and opening times, and send alerts to property

owners and maintenance professionals. Otis maintains elevators in a

different building in Hudson Yards, although Otis One hasn't been

deployed there.

Chief Digital Officer Neil Green hopes the platform will help

Otis expand the maintenance part of the business beyond the two

million elevators the company currently services.

"When I think about the role that my team and I can play -- if

we can capture another two million out of the 14 million that we're

not managing today, that's a huge opportunity for Otis to drive

revenue and profitability growth," said Mr. Green, who joined the

company a year ago.

Otis generates about 55% of its revenue from services and 45%

through new equipment sales, a company spokeswoman said. The

company, which is in the process of being spun out from parent

United Technologies Corp., had 2018 revenue of $12.9 billion. Otis

declined to comment on its revenue breakdown for previous

years.

Schindler doesn't publish similar figures.

Global elevator revenue totaled $104 billion in 2018, up from

$100 billion in 2017, according to research firm Freedonia Group.

Services drew almost half of total revenue: $51 billion in 2018 and

$49 billion the previous year, Freedonia said.

Otis, the world's biggest elevator company by revenue, had a 12%

market share last year, followed by Schindler at 11%, Finland-based

Kone Oyj at 10%, Germany-based Thyssenkrupp AG at 9% and Japanese

company Hitachi Ltd. at 7%, according to Freedonia.

Servicing and maintenance are attractive to elevator makers

because of profit margins of up to 25%, while new equipment sales

yield margins of around 5% to 10%, said Andre Kukhnin, research

analyst at Credit Suisse. He estimates that servicing -- which

includes elevator retrofits and upgrades and maintenance --

accounts for 60% percent of the elevator market.

"You sell the hardware, and then you just make money off the

service on top of that," Mr. Kukhnin said.

Software is being used for more elevator control and

functionality at Thyssenkrupp.

"The hardware can be built by everybody; the differentiation is

in the software," said Reinhold Achatz, Thyssenkrupp's chief

technology officer.

Thyssenkrupp has about 100,000 elevators in the U.S. connected

to the cloud, where sensors transmit maintenance data like

acceleration, vibration, acoustics and frequency, Mr. Achatz said.

Software in the elevators uses sensor data to flag immediate

breakdowns, while the company's cloud uses artificial intelligence

to predict problems like broken doors.

As its elevator business becomes more digital, the company is

recruiting and training workers in technologies including AI, big

data and predictive maintenance, Mr. Achatz said.

"It definitely needs a cultural change because a company like

Thyssenkrupp is more a classic engineering company." Mr. Achatz

said.

Write to Agam Shah at agam.shah@wsj.com

(END) Dow Jones Newswires

October 07, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

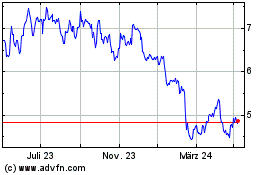

Thyssenkrupp (TG:TKA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Thyssenkrupp (TG:TKA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024