EUROPE MARKETS: Defensive Plays Lead European Stocks As German Confidence Still Bleak

24 September 2019 - 1:56PM

Dow Jones News

By Steve Goldstein, MarketWatch

VW lower as CEO charged with market manipulation in Germany

Led by defensive plays, Europe stocks advanced Tuesday as a key

economic report showed German business confidence still bleak.

Rising for the fourth day in five, the Stoxx Europe 600 rose

0.19% to 390.53, as pharmaceuticals, household products firms and

food producers led the way, all sectors that are relatively less

exposed to the swings of the economy.

The German DAX rose 0.07% to 12350.76 as the Ifo business

climate index in Germany rose marginally in September, but the

expectations component fell to a decade low.

"A much welcome rebound, but the details weren't uplifting,"

said Claus Vistesen, chief eurozone economist at Pantheon

Macroeconomics. "We always have to be careful fitting stories to

these data, but it looks to us as if the ECB's recently announced

measured have succeeded in providing a modest lift to the current

assessment, while expectations are still hampered by unchanged, and

elevated, global uncertainty."

The French CAC 40 rose 0.22% to 5643.37 and the U.K. FTSE 100

declined 0.14% to 7315.47 after the U.K. Supreme Court ruled that

suspending Parliament was unlawful. See London Markets

(http://www.marketwatch.com/story/british-pound-jumps-as-uk-supreme-court-rules-suspension-of-parliament-was-unlawful-2019-09-24)

After a slight advance for the Dow industrials on Monday, U.S. stock futures were higher.

Stocks in the spotlight included EQT Partners , as the Swedish

private equity firm surged to 84.50 crowns after pricing its

initial public offering at 67 crowns.

Volkswagen (VOW3.XE) shares fell over 2% as German prosecutors

charged executives including CEO Herbert Diess with market

manipulation in connection with the diesel emissions scandal that

erupted in 2015. Read more on VW

(http://www.marketwatch.com/story/germany-volkswagen-bosses-charged-with-market-manipulation-2019-09-24).

VW's majority owner Porsche Automobil Holding (PAH3.XE) fell

over 2% as well.

K+S (SDF.XE) shares fell 4% as the German chemicals producer

said it was cutting its fertilizer production due to weak demand,

which will hurt operating profit by up to 80 million euros.

Evotec (EVT.XE) climbed 5% as the company announced a drug

discovery collaboration with Takeda Pharmaceuticals, where the

Japanese firm will pay an undisclosed upfront fee as well as

milestones that can reach around $170 million per program.

TUI rose 4.3%, extending Monday's rally, as the travel company

reiterated its fiscal year underlying profit guidance that may fall

as much as 26%. The company said it's assessing the short-term

impact of Thomas Cook's insolvency.

(END) Dow Jones Newswires

September 24, 2019 07:41 ET (11:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

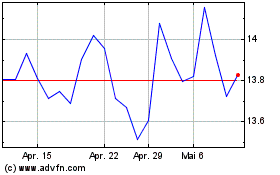

K and S (TG:SDF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

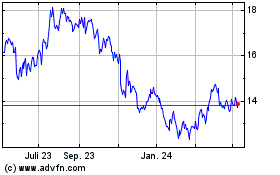

K and S (TG:SDF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024