BOUYGUES: Bouygues successfully completes sale of Alstom shares

Press release – Paris 12/09/2019 Bouygues successfully

completes sale of Alstom shares

Not for distribution, directly or indirectly, in

the United States, Canada, Australia or Japan

Bouygues S.A. (“Bouygues”)

announces the successful sale of 29,150,000 shares in Alstom S.A.

(“Alstom”), representing 13.0% of its share

capital, at a price of 37 euros per share (i.e., a total amount of

1,079 million euros) by way of an accelerated book building

involving institutional investors.

Following this transaction, Bouygues will remain

Alstom’s main shareholder with 14.7% of the share capital. Olivier

Bouygues and Bouygues S.A will remain Board members of Alstom.

Bouygues undertakes with the banks in charge of the placement to a

180-day lock up for its remaining Alstom shares, subject to

customary exceptions.

Commenting on this sale of shares, Martin

Bouygues, Chairman and CEO, said: “I am delighted with the outcome

of this transaction. It further demonstrates investors’ confidence

in Alstom’s management team and its ability to successfully

implement its new strategy « Alstom in Motion » presented

on June 24th 2019 to be the leading global innovative player for a

sustainable and smart mobility”.

DISCLAIMER

- The sale of Alstom shares was considered by Bouygues SA, before

its disclosure, as non-public information within the meaning of the

applicable regulations (Article 7.1 of EU Regulation 596/2014,

April 16, 2014).Responsible for notification: Arnauld van Eeckhout,

General Counsel.

- This press release does not constitute an offer to sell, and

the offer of Alstom shares by Bouygues does not constitute a public

offering.

No communication and no information in respect

of the sale by Bouygues of Alstom shares may be distributed to the

public in any jurisdiction where a registration or approval is

required. No steps have been or will be taken in any

jurisdiction where such steps would be required. The offer or

sale of the Alstom shares by Bouygues may be subject to specific

legal or regulatory restrictions in certain jurisdictions.

Bouygues, its shareholders and its affiliates take no

responsibility for any violation of any such restrictions by any

person.

This press release does not constitute an offer

or a solicitation to sell or subscribe requiring a prospectus

within the meaning of Regulation (EU) 2017/1129 of the European

Parliament and of the Council of June 14, 2017 (the “Prospectus

Regulation”).

This announcement does not, and shall not, in

any circumstances constitute a public offering, nor an offer to

sell or to subscribe, nor a solicitation to offer to purchase or to

subscribe securities in any jurisdiction.

In France, the offer and sale of the Alstom

shares by Bouygues will be carried out through an offering to

qualified investors, in accordance with article L.411-2, II of the

French Monetary and Financial Code and other applicable laws and

regulations. There will be no public offering in France.

With respect to the member states of the

European Economic Area, other than France, no action has been or

will be taken in order to permit a public offer of the securities

which would require the publication of a prospectus in one of such

Member States. In Member States, this press release and any offer

if made subsequently are directed exclusively at persons who are

“qualified investors” and acting for their own account within the

meaning of the Prospectus Regulation.

In the United Kingdom, this press release is not

an invitation nor an inducement to engage in investment activity

for the purpose of Section 21 of the Financial Services and Markets

Act 2000, as amended (FSMA). This press release is directed only at

(i) persons outside the United Kingdom, (ii) investment

professionals falling within Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (the

Order), (iii) persons referred to in Article 49(2) (a) to (d) of

the Order (high net worth entities, non-registered associations,

etc.) and (iv) other persons to whom this document may be lawfully

communicated (all persons listed in (i), (ii), (iii) and (iv) above

being referred to as Relevant Persons). The securities of Alstom

described herein are available only to, and any invitation, offer

or agreement to subscribe, purchase or otherwise acquire such

securities will be engaged in only with Relevant Persons. Any

person who is not a Relevant Person must not act or rely on this

document or any of its contents.

This press release does not constitute or form a

part of any offer or solicitation to purchase or subscribe for

securities in the United States. Securities may not be

offered or sold in the United States unless they are registered

under the U.S. Securities Act of 1933, as amended (the “Securities

Act”), or exempt from registration. The shares of Alstom have

not been and are not being registered under the Securities Act and

neither Bouygues, nor any of its shareholders or its affiliates

intend to register any portion of the proposed offering in the

United States or to conduct a public offering of securities in the

United States.

Any investment decision to buy shares in Alstom

must be made solely on the basis of publicly available information

regarding Alstom. Such information is not the responsibility

of Bouygues, BNP PARIBAS, J.P. Morgan Securities plc, Merrill Lynch

International or Société Générale and has not been independently

verified by Bouygues, BNP PARIBAS, J.P. Morgan Securities plc,

Merrill Lynch International or Société Générale

BNP PARIBAS, J.P. Morgan Securities plc, Merrill

Lynch International and Société Générale are acting for Bouygues

and no one else in connection with the placing and will not be

responsible to anyone other than Bouygues for providing the

protections afforded to clients of BNP PARIBAS, J.P. Morgan

Securities plc, Merrill Lynch International and Société Générale

nor for providing advice in connection with the placing.

This press release may not be published,

forwarded or distributed in the United States, Canada, Australia or

Japan.

ABOUT BOUYGUES

Bouygues is a diversified services group with a

strong corporate culture whose businesses are organized around

three sectors of activity: Construction, with Bouygues Construction

(building & civil works and energies & services),

Bouygues Immobilier (property development) and Colas (roads);

Telecoms, with Bouygues Telecom, and Media, with TF1.

PRESS CONTACT:presse@bouygues.com • Tel: +33 (0)1 44 20 12

01

INVESTORS CONTACT:investors@bouygues.com • Tel: +33 (0)1 44 20

10 79

BOUYGUES SA • 32 avenue Hoche • 75378 Paris CEDEX 08 •

bouygues.com

- Bouygues successfully completes sale of Alstom shares

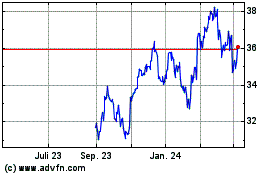

Bouygues (TG:BYG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

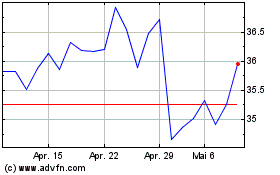

Bouygues (TG:BYG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024