EUROPE MARKETS: European Stock Rally Continues On Trade War Optimism And German Real Estate Boost

30 August 2019 - 12:38PM

Dow Jones News

By Callum Keown

European stocks climbed higher on Friday as U.S.-China trade war

optimism continued and German real-estate companies soared.

The Stoxx 600 enjoyed a second day of strong gains, climbing

0.8%, while the German DAX rose 1.1% and the French CAC lifted

0.9%.

What's moving the markets?

China's positive comments on Thursday continued to lift European

stocks as investors became more confident of a resolution to the

trade war.

Beijing said discussions with U.S. negotiators were continuing

and that it would not retaliate

(http://www.marketwatch.com/story/asian-markets-gain-as-latest-trade-war-fears-subside-2019-08-29)

to the latest tariff increase.

On Friday, China's foreign ministry confirmed that talks were

continuing between trade teams on both sides.

Eurozone inflation remained steady at 1%, well below the

European Central Bank's target

(http://www.marketwatch.com/story/weak-european-inflation-bolsters-case-for-stimulus-2019-08-30)

of just under 2%, fueling expectations of further stimulus next

month.

Bert Colijn, ING senior economist, said: "Headline inflation is

at 1%, with core inflation at 0.9% in August and unemployment

falling by just 16,000 in July.

"These are the final readings the ECB will get before the

important stimulus decision. Don't expect the ECB to hold

back."

However, hawkish comments from German ECB member Sabine

Lautenschläger and Dutch central bank president Klaas Knot damped

hopes of a big stimulus package.

German real-estate stocks soared after daily newspaper Bild

reported that plans for a rent freeze in Berlin could be watered

down.

Europe's largest economy showed further signs of slowing as

German retail sales suffered a sharp 2.2% fall in July.

Which stocks are active?

German property company Deutsche Wohnen (DWNI.XE) soared 11.3%

following reports that a planned rent freeze in Berlin may not be

as severe as first feared. Its larger peer Vonovia (VNA.XE) climbed

5.7%.

U.K. and Ireland-based building materials firm Grafton Group

(GFTU.LN) rose 6.4% after a rise in first-half profit. The FTSE 250

company said strong performance in its merchant and retail

businesses in Ireland, and good growth in the Netherlands, led the

rise.

(END) Dow Jones Newswires

August 30, 2019 06:23 ET (10:23 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

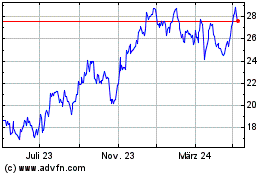

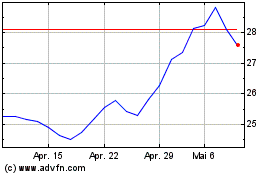

Vonovia (TG:VNA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Vonovia (TG:VNA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024