Celgene, Bristol Clear Way For Merger -- WSJ

27 August 2019 - 9:02AM

Dow Jones News

By Jared S. Hopkins and Colin Kellaher

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 27, 2019).

Bristol-Myers Squibb Co. took a major step toward completing its

$74 billion acquisition of Celgene Corp., as the two pharmaceutical

companies found a buyer for a skin treatment whose sale they hope

will address antitrust concerns.

Amgen Inc. agreed on Monday to buy Celgene's psoriasis medicine

Otezla for $13.4 billion in cash. The decision comes after the U.S.

Federal Trade Commission raised anticompetitive concerns related to

anti-inflammatory drugs, of which Otezla is an example.

Bristol-Myers in January said it would acquire rival Celgene in

a deal knitting together two leading sellers in the $123 billion

world-wide market for cancer drugs. Shareholders signed off on the

deal in April after an unsuccessful activist campaign to derail the

merger.

New York-based Bristol pioneered the development of cancer drugs

known as immunotherapies, which unleash the body's immune system on

tumors. Summit, N.J.-based Celgene leads in the sale of treatments

for multiple myeloma. The two companies were estimated at the time

to have nearly $38 billion in combined annual sales.

Otezla sales totaled $1.6 billion last year. The drug is used to

treat forms of psoriasis, a skin disease in which an overreaction

by the immune system causes itchy rashes to form on the body.

Analysts were surprised by the FTC's concerns about competition

because Bristol doesn't currently sell psoriasis medicines, though

it does have an experimental drug for the disease in late-stage

trials.

Shareholders were cool on the Bristol-Celgene deal when it was

struck in January, and Bristol's stock is trading lower than

year-ago levels. Through Friday's close, shares were down about 10%

this year compared with a gain of about 14% for the S&P 500.

Shares of both Bristol and Celgene were up about 3% on Monday in

midmorning trading. Amgen's stock was up 2.5%.

There has been a flurry of mergers and acquisitions in health

care this year. In January, Eli Lilly & Co. said it would buy

Loxo Oncology Inc. for about $8 billion. In June, AbbVie Inc.

agreed to acquire Allergan PLC for about $63 billion. And in July,

Pfizer Inc. announced it would merge its division of off-patent

drugs with Mylan NV.

Bristol-Myers on Monday said the sale of Otezla to Amgen is

contingent on a consent decree with the FTC and completion of the

Celgene acquisition, which the company now expects to occur by the

end of the year.

Bristol-Myers initially said the Celgene acquisition would close

in the third quarter, but then U.S. regulators raised

anticompetitive concerns. In June, the companies said they would

shed Otezla to satisfy the concerns.

Analysts said at the time that the FTC action could indicate the

government was taking a stronger look at pharmaceutical-industry

mergers. Earlier this year, Roche Holding AG has said the FTC

requested additional information regarding its planned takeover of

Spark Therapeutics Inc.

Analysts at JP Morgan Chase said in a note to clients the Otezla

deal was "a clear positive" for Bristol-Myers and that there aren't

any additional FTC concerns on the horizon related to the merger

with Celgene. They wrote the price tag exceeded their own estimate

of $10 billion.

Still, challenges lie ahead for the combined company. Bristol

faces heavy competition from Merck & Co. for immunotherapy

sales, while Celgene's top-selling product, multiple myeloma

treatment Revlimid, is expected to lose U.S. patent protection in

the next several years.

Amgen, based in Thousand Oaks, Calif., said Otezla is a strong

strategic fit with its psoriasis and inflammation portfolio and it

expects at least low-double-digit sales growth for the drug, on

average, over the next five years. Amgen said the deal is worth

about $11.2 billion, net of anticipated future cash tax

benefits.

Amgen, which has been pressured recently by the introduction of

copycats to its white-blood-cell booster Neulasta and calcium

reducer Sensipar, said Otezla has exclusivity through at least 2028

in the U.S.

Bristol-Myers said it would use proceeds from the Otezla sale to

pare its debt, adding that it plans to focus near term on

maintaining strong investment-grade credit ratings and a ratio of

debt to earnings before interest, taxes, depreciation and

amortization of less than 1.5 by 2023.

The New York drugmaker also boosted an accelerated

share-repurchase program, planned for after the Celgene deal

closes, to $7 billion from $5 billion.

Write to Jared Hopkins at jared.hopkins@wsj.com and Colin

Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

August 27, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

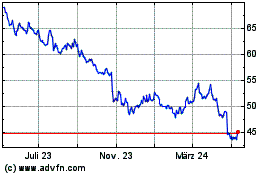

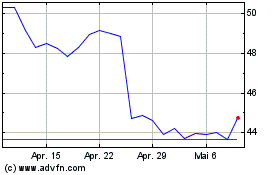

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024