Caleres (NYSE: CAL) (caleres.com), a diverse portfolio of global

footwear brands, today reported second quarter 2019 financial

results.

- Delivered earnings per diluted share of $0.61, up 10.9%.

- Record second quarter sales of $752.5 million, up 6.5%

year-over-year

- Positive same-store-sales of 1.5% at Famous Footwear

- On-track to deliver eighth consecutive year of positive

back-to-school same-store-sales

- Continued to evolve portfolio, announcing partnership with

Veronica Beard and relaunch of Zodiac

“During the quarter we successfully executed on our strategies

to strengthen the emotional connections we have with our consumers.

Our deep insights, combined with our industry-leading footwear

capabilities, allowed us to deliver relevant product, supporting

growth in the Brand Portfolio and positive same-store-sales growth

at Famous Footwear,” said Diane Sullivan, CEO, president and

chairman of Caleres. “A continued focus on expense discipline

improved profitability for the quarter. As a company, we remain

focused on creating consistent, profitable and sustainable growth

over the long term.”

Second Quarter 2019 Results Versus Second Quarter

2018

- Consolidated sales of $752.5 million, up 6.5%.

- Brand Portfolio sales of $359.6 million, up 17.9%.

- Famous Footwear total sales of $419.8 million, with

same-store-sales up 1.5%.

- Gross profit of $305.9 million, up 4.4%, representing gross

margin of 40.7%.

- SG&A expense of $267.5 million, up 3.4%, representing 35.6%

of sales.

- Operating earnings of $37.8 million, up 17.6%, representing

operating margin of 5.0%.

- Adjusted operating earnings of $38.4 million, up 10.4%,

representing adjusted operating margin of 5.1%.

- Net earnings of $25.3 million, resulting in earnings per

diluted share of $0.61, up 10.9%.

- Adjusted net earnings of $25.8 million, resulting in adjusted

earnings per diluted share of $0.62, up 5.1%.

First Half 2019 Results Versus First Half 2018

- Consolidated sales of $1,430.2 million, up 6.8%.

- Brand Portfolio sales of $700.6 million, up 19.0%.

- Famous Footwear total sales of $772.0 million, with

same-store-sales up 0.4%.

- Gross profit of $585.8 million, up 3.1%, representing gross

margin of 41.0%.

- Adjusted gross margin of 41.5%, excluding $7.2 million related

to Vionic inventory adjustment amortization and Brand Portfolio

business exit expense.

- SG&A expense of $529.6 million, up 4.0%, representing 37.0%

of sales.

- Operating earnings of $54.7 million, down 0.8%, representing

operating margin of 3.8%.

- Adjusted operating earnings of $63.3 million, up 6.3%,

representing adjusted operating margin of 4.4%.

- Net earnings of $34.4 million, resulting in earnings per

diluted share of $0.82, down 12.8%.

- Adjusted net earnings of $40.8 million, resulting in adjusted

earnings per diluted share of $0.98, down 3.9%.

Balance Sheet and Cash Flow

- Cash and equivalents of $42.6 million and cash from operations

of $116.6 million, year-to-date.

- There were $300.0 million of outstanding borrowings under the

revolving credit facility, following the October 18, 2018

acquisition of Vionic.

- Inventory of $792.1 million, up 10.7% year-over-year, including

$50.7 million of Vionic inventory.

- Year-to-date capital expenditures of $30.2 million, up 40.3%

year-over-year due to the investment in automation at the new Brand

Portfolio fulfillment center.

- Returned $35.8 million to shareholders in the first half of

2019, via share repurchases and dividends.

Investor Conference Call

Caleres will host an investor conference call at 4:30 p.m. ET

today, Monday, August 26. The webcast and slides will be available

at investor.caleres.com/news/events. The live conference call will

be available at (877) 217-9089 for analysts in North America or

(706) 679-1723 for international analysts by using the conference

ID 3196093. A replay will be available at

investor.caleres.com/news/events/archive for a limited period.

Investors may also access a replay of the call through September 2

by dialing (855) 859-2056 in North America or (404) 537-3406

internationally and using the conference ID

3196093.

Investor Day

Caleres also invites financial analysts and institutional

investors to save the date for an Investor Day, to be held in New

York on October 2, 2019. The event will be hosted by CEO, President

and Chairman of the Board Diane Sullivan, Senior Vice President and

Chief Financial Officer Ken Hannah, and other members of the

executive leadership team. A formal invitation will be provided at

a later date.

Definitions

All references in this press release, outside of the condensed

consolidated financial statements that follow, unless otherwise

noted, related to net earnings attributable to Caleres, Inc. and

diluted earnings per common share attributable to Caleres, Inc.

shareholders, are presented as net earnings and earnings per

diluted share, respectively.

Non-GAAP Financial Measures

In this press release, the company’s financial results are

provided both in accordance with generally accepted accounting

principles (GAAP) and using certain non-GAAP financial measures. In

particular, the company provides historic and estimated future

gross profit, operating earnings, net earnings and earnings per

diluted share adjusted to exclude certain gains, charges and

recoveries, which are non-GAAP financial measures. These results

are included as a complement to results provided in accordance with

GAAP because management believes these non-GAAP financial measures

help identify underlying trends in the company’s business and

provide useful information to both management and investors by

excluding certain items that may not be indicative of the company’s

core operating results. These measures should not be considered a

substitute for or superior to GAAP results.

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995

This press release contains certain forward-looking statements

and expectations regarding the company’s future performance and the

performance of its brands. Such statements are subject to various

risks and uncertainties that could cause actual results to differ

materially. These risks include (i) changing consumer demands,

which may be influenced by consumers' disposable income, which in

turn can be influenced by general economic conditions and other

factors; (ii) rapidly changing fashion trends and consumer

preferences and purchasing patterns; (iii) intense competition

within the footwear industry; (iv) political and economic

conditions or other threats to the continued and uninterrupted flow

of inventory from China and other countries, where the Company

relies heavily on third-party manufacturing facilities for a

significant amount of its inventory; (v) imposition of tariffs;

(vi) the ability to accurately forecast sales and manage inventory

levels; (vii) cybersecurity threats or other major disruption to

the Company’s information technology systems; (viii) customer

concentration and increased consolidation in the retail industry;

(ix) transitional challenges with acquisitions; (x) a disruption in

the Company’s distribution centers; (xi) foreign currency

fluctuations; (xii) changes to tax laws, policies and treaties;

(xiii) the ability to recruit and retain senior management and

other key associates; (xiv) compliance with applicable laws and

standards with respect to labor, trade and product safety issues;

(xv) the ability to secure/exit leases on favorable terms; (xvi)

the ability to maintain relationships with current suppliers; and

(xvii) the ability to attract, retain, and maintain good

relationships with licensors and protect our intellectual property

rights. The company's reports to the Securities and Exchange

Commission contain detailed information relating to such factors,

including, without limitation, the information under the caption

Risk Factors in Item 1A of the company’s Annual Report on Form 10-K

for the year ended February 2, 2019, which information is

incorporated by reference herein and updated by the company’s

Quarterly Reports on Form 10-Q. The company does not undertake any

obligation or plan to update these forward-looking statements, even

though its situation may change.

About Caleres

Caleres is the home of today’s most coveted footwear brands and

represents a diverse portfolio spanning all of life’s styles and

experiences. Every shoe tells a story and Caleres has the perfect

fit for every one of them. Our collections have been developed and

acquired to meet the evolving needs of today’s assorted and growing

global audiences, with consumer insights driving every aspect of

the innovation, design, and craft that go into our distinctly

positioned brands, including Famous Footwear, Sam Edelman,

Naturalizer, Allen Edmonds, Vionic, Dr. Scholl’s Shoes, Franco

Sarto, and more. The Caleres story is most simply defined by the

company’s mission: Inspire people to feel great…feet first.

SCHEDULE 1

CALERES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

EARNINGS

(Unaudited)

Thirteen Weeks Ended

Twenty-Six Weeks Ended

(Thousands, except per share data)

August 3,

2019

August 4,

2018

August 3,

2019

August 4,

2018

Net sales

$

752,485

$

706,612

$

1,430,239

$

1,338,754

Cost of goods sold

446,541

413,511

844,459

770,731

Gross profit

305,944

293,101

585,780

568,023

Selling and administrative expenses

267,531

258,835

529,642

509,033

Restructuring and other special charges,

net

609

2,123

1,465

3,900

Operating earnings

37,804

32,143

54,673

55,090

Interest expense, net

(7,389

)

(3,602

)

(14,729

)

(7,285

)

Other income, net

2,650

3,078

5,269

6,169

Earnings before income taxes

33,065

31,619

45,213

53,974

Income tax provision

(7,838

)

(8,008

)

(10,901

)

(13,183

)

Net earnings

25,227

23,611

34,312

40,791

Net loss attributable to noncontrolling

interests

(114

)

(35

)

(112

)

(67

)

Net earnings attributable to Caleres,

Inc.

$

25,341

$

23,646

$

34,424

$

40,858

Basic earnings per common share

attributable to Caleres, Inc. shareholders

$

0.61

$

0.55

$

0.83

$

0.95

Diluted earnings per common share

attributable to Caleres, Inc. shareholders

$

0.61

$

0.55

$

0.82

$

0.94

SCHEDULE 2

CALERES, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

August 3, 2019

August 4, 2018

February 2, 2019

(Thousands)

ASSETS

Cash and cash equivalents

$

42,601

$

102,884

$

30,200

Receivables, net

167,727

153,421

191,722

Inventories, net

792,064

715,705

683,171

Prepaid expenses and other current

assets

51,394

62,159

71,354

Total current assets

1,053,786

1,034,169

976,447

Lease right-of-use assets

723,415

—

—

Property and equipment, net

232,045

207,726

230,784

Goodwill and intangible assets, net

546,110

362,049

549,897

Other assets

89,037

89,701

81,440

Total assets

$

2,644,393

$

1,693,645

$

1,838,568

LIABILITIES AND EQUITY

Borrowings under revolving credit

agreement

$

300,000

$

—

$

335,000

Trade accounts payable

448,596

400,391

316,298

Lease obligations

143,202

—

—

Other accrued expenses

190,331

195,987

202,038

Total current liabilities

1,082,129

596,378

853,336

Noncurrent lease obligations

649,100

—

—

Long-term debt

198,161

197,702

197,932

Deferred rent

—

52,396

54,850

Other liabilities

90,325

109,975

97,015

Total other liabilities

937,586

360,073

349,797

Total Caleres, Inc. shareholders’

equity

623,429

735,853

634,053

Noncontrolling interests

1,249

1,341

1,382

Total equity

624,678

737,194

635,435

Total liabilities and equity

$

2,644,393

$

1,693,645

$

1,838,568

SCHEDULE 3

CALERES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

Twenty-Six Weeks Ended

(Thousands)

August 3, 2019

August 4, 2018

OPERATING ACTIVITIES:

Net cash provided by operating

activities

$

116,578

$

91,007

INVESTING ACTIVITIES:

Purchases of property and equipment

(26,741

)

(18,559

)

Disposals of property and equipment

636

—

Capitalized software

(4,084

)

(2,951

)

Acquisition cost, net of cash received

—

(16,793

)

Net cash used for investing activities

(30,189

)

(38,303

)

FINANCING ACTIVITIES:

Borrowings under revolving credit

agreement

149,000

—

Repayments under revolving credit

agreement

(184,000

)

—

Repayments of capital lease obligation

(609

)

—

Dividends paid

(5,808

)

(6,053

)

Acquisition of treasury stock

(29,995

)

(3,288

)

Issuance of common stock under share-based

plans, net

(2,547

)

(4,365

)

Other

(85

)

—

Net cash used for financing activities

(74,044

)

(13,706

)

Effect of exchange rate changes on cash

and cash equivalents

56

(161

)

Increase in cash and cash equivalents

12,401

38,837

Cash and cash equivalents at beginning of

period

30,200

64,047

Cash and cash equivalents at end of

period

$

42,601

$

102,884

SCHEDULE 4

CALERES, INC.

RECONCILIATION OF NET EARNINGS AND

DILUTED EARNINGS PER SHARE (GAAP BASIS) TO ADJUSTED NET EARNINGS

AND ADJUSTED DILUTED EARNINGS PER SHARE (NON-GAAP BASIS)

(Unaudited)

Thirteen Weeks Ended

August 3, 2019

August 4, 2018

(Thousands, except per share data)

Pre-Tax

Impact of

Charges/Other

Items

Net

Earnings

Attributable

to Caleres, Inc.

Diluted

Earnings

Per Share

Pre-Tax

Impact of

Charges/Other

Items

Net

Earnings

Attributable

to Caleres, Inc.

Diluted

Earnings

Per Share

GAAP earnings

$

25,341

$

0.61

$

23,646

$

0.55

Charges/other

items:

Vionic integration-related costs

$

609

452

0.01

$

—

—

—

Blowfish Malibu acquisition-related

costs

—

—

—

778

576

0.01

Acquisition, integration and

reorganization of men's brands

—

—

—

1,885

1,394

0.03

Total charges/other items

$

609

$

452

$

0.01

$

2,663

$

1,970

$

0.04

Adjusted earnings

$

25,793

$

0.62

$

25,616

$

0.59

(Unaudited)

Twenty-Six Weeks Ended

August 3, 2019

August 4, 2018

(Thousands, except per share data)

Pre-Tax

Impact of

Charges/Other

Items

Net

Earnings

Attributable to

Caleres, Inc.

Diluted

Earnings

Per Share

Pre-Tax

Impact of

Charges/Other

Items

Net

Earnings

Attributable

to Caleres, Inc.

Diluted

Earnings

Per Share

GAAP earnings

$

34,424

$

0.82

$

40,858

$

0.94

Charges/other

items:

Vionic acquisition and integration-related

costs

$

6,727

4,996

0.13

$

—

—

—

Brand Portfolio - business exits

1,905

1,415

0.03

—

—

—

Blowfish Malibu acquisition-related

costs

—

—

—

778

576

0.01

Acquisition, integration and

reorganization of men's brands

—

—

—

3,662

2,709

0.07

Total charges/other items

$

8,632

$

6,411

$

0.16

$

4,440

$

3,285

$

0.08

Adjusted earnings

$

40,835

$

0.98

$

44,143

$

1.02

SCHEDULE 5

CALERES, INC.

SUMMARY FINANCIAL RESULTS BY

SEGMENT

SUMMARY FINANCIAL RESULTS

(Unaudited)

Thirteen Weeks Ended

Famous Footwear

Brand Portfolio

Eliminations and Other

Consolidated

(Thousands)

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

Net sales

$

419,841

$

429,472

$

359,575

$

305,021

$

(26,931

)

$

(27,881

)

$

752,485

$

706,612

Gross profit

182,301

187,114

124,840

108,288

(1,197

)

(2,301

)

305,944

293,101

Adjusted gross profit

182,301

187,114

124,840

108,828

(1,197

)

(2,301

)

305,944

293,641

Gross profit rate

43.4

%

43.6

%

34.7

%

35.5

%

4.4

%

8.3

%

40.7

%

41.5

%

Adjusted gross profit rate

43.4

%

43.6

%

34.7

%

35.7

%

4.4

%

8.3

%

40.7

%

41.6

%

Operating earnings (loss)

31,542

33,240

13,898

15,909

(7,636

)

(17,006

)

37,804

32,143

Adjusted operating earnings (loss)

31,542

33,240

13,916

18,248

(7,045

)

(16,682

)

38,413

34,806

Operating earnings %

7.5

%

7.7

%

3.9

%

5.2

%

28.4

%

61.0

%

5.0

%

4.5

%

Adjusted operating earnings %

7.5

%

7.7

%

3.9

%

6.0

%

26.2

%

59.8

%

5.1

%

4.9

%

Same-store sales % (on a 13-week

basis)

1.5

%

2.6

%

(9.3

)%

(1.3

)%

—

%

—

%

—

%

—

%

Number of stores

973

1,008

231

233

—

—

1,204

1,241

RECONCILIATION OF ADJUSTED RESULTS

(NON-GAAP)

(Unaudited)

Thirteen Weeks Ended

Famous Footwear

Brand Portfolio

Eliminations and Other

Consolidated

(Thousands)

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

Gross profit

$

182,301

$

187,114

$

124,840

$

108,288

$

(1,197

)

$

(2,301

)

$

305,944

$

293,101

Charges/Other

Items:

Blowfish Malibu acquisition-related

costs

—

—

—

540

—

—

—

540

Total charges/other items

—

—

—

540

—

—

—

540

Adjusted gross profit

$

182,301

$

187,114

$

124,840

$

108,828

$

(1,197

)

$

(2,301

)

$

305,944

$

293,641

Operating earnings (loss)

$

31,542

$

33,240

$

13,898

$

15,909

$

(7,636

)

$

(17,006

)

$

37,804

$

32,143

Charges/Other

Items:

Vionic integration-related costs

—

—

18

—

591

—

609

—

Blowfish Malibu acquisition-related

costs

—

—

—

540

—

238

—

778

Acquisition, integration and

reorganization of men's brands

—

—

—

1,799

—

86

—

1,885

Total charges/other items

—

—

18

2,339

591

324

609

2,663

Adjusted operating earnings (loss)

$

31,542

$

33,240

$

13,916

$

18,248

$

(7,045

)

$

(16,682

)

$

38,413

$

34,806

SCHEDULE 5

CALERES, INC.

SUMMARY FINANCIAL RESULTS BY

SEGMENT

SUMMARY FINANCIAL RESULTS

(Unaudited)

Twenty-Six Weeks Ended

Famous Footwear

Brand Portfolio

Eliminations and Other

Consolidated

(Thousands)

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

Net sales

$

772,006

$

792,883

$

700,625

$

588,518

$

(42,392

)

$

(42,647

)

$

1,430,239

$

1,338,754

Gross profit

334,994

352,316

251,700

217,149

(914

)

(1,442

)

585,780

568,023

Adjusted gross profit

334,994

352,316

258,867

217,689

(914

)

(1,442

)

592,947

568,563

Gross profit rate

43.4

%

44.4

%

35.9

%

36.9

%

2.2

%

(3.4

)%

41.0

%

42.4

%

Adjusted gross profit

rate

43.4

%

44.4

%

36.9

%

37.0

%

2.2

%

(3.4

)%

41.5

%

42.5

%

Operating earnings (loss)

42,355

55,097

26,827

27,536

(14,509

)

(27,543

)

54,673

55,090

Adjusted operating earnings (loss)

42,355

55,097

34,621

31,458

(13,671

)

(27,025

)

63,305

59,530

Operating earnings %

5.5

%

6.9

%

3.8

%

4.7

%

34.2

%

64.6

%

3.8

%

4.1

%

Adjusted operating earnings %

5.5

%

6.9

%

4.9

%

5.3

%

32.2

%

63.4

%

4.4

%

4.4

%

Same-store sales % (on a 26-week

basis)

0.4

%

1.0

%

(8.9

)%

(1.2

)%

—

%

—

%

—

%

—

%

Number of stores

973

1,008

231

233

—

—

1,204

1,241

RECONCILIATION OF ADJUSTED RESULTS

(NON-GAAP)

(Unaudited)

Twenty-Six Weeks Ended

Famous Footwear

Brand Portfolio

Eliminations and Other

Consolidated

(Thousands)

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

Gross profit

$

334,994

$

352,316

$

251,700

$

217,149

$

(914

)

$

(1,442

)

$

585,780

$

568,023

Charges/Other

Items:

Vionic acquisition and integration-related

costs

—

—

5,812

—

—

—

5,812

—

Brand Portfolio - business exits

—

—

1,355

—

—

—

1,355

—

Blowfish Malibu acquisition-related

costs

—

—

—

540

—

—

—

540

Total charges/other items

—

—

7,167

540

—

—

7,167

540

Adjusted gross profit

$

334,994

$

352,316

$

258,867

$

217,689

$

(914

)

$

(1,442

)

$

592,947

$

568,563

Operating earnings (loss)

$

42,355

$

55,097

$

26,827

$

27,536

$

(14,509

)

$

(27,543

)

$

54,673

$

55,090

Charges/Other

Items:

Vionic acquisition and integration-related

costs

—

—

5,889

—

838

—

6,727

—

Brand Portfolio - business exits

—

—

1,905

—

—

—

1,905

—

Blowfish Malibu acquisition-related

costs

—

—

—

540

—

238

—

778

Acquisition, integration and

reorganization of men's brands

—

—

—

3,382

—

280

—

3,662

Total charges/other items

—

—

7,794

3,922

838

518

8,632

4,440

Adjusted operating earnings (loss)

$

42,355

$

55,097

$

34,621

$

31,458

$

(13,671

)

$

(27,025

)

$

63,305

$

59,530

SCHEDULE 6

CALERES, INC.

BASIC AND DILUTED EARNINGS PER SHARE

RECONCILIATION

(Unaudited)

Thirteen Weeks Ended

Twenty-Six Weeks Ended

(Thousands, except per share data)

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

Net earnings attributable to Caleres,

Inc.:

Net earnings

$

25,227

$

23,611

$

34,312

$

40,791

Net loss attributable to noncontrolling

interests

114

35

112

67

Net earnings attributable to Caleres,

Inc.

25,341

23,646

34,424

40,858

Net earnings allocated to participating

securities

(857

)

(673

)

(1,125

)

(1,148

)

Net earnings attributable to Caleres, Inc.

after allocation of earnings to participating securities

24,484

22,973

$

33,299

$

39,710

Basic and diluted common shares

attributable to Caleres, Inc.:

Basic common shares

39,951

41,964

40,346

41,937

Dilutive effect of share-based awards

55

117

58

120

Diluted common shares attributable to

Caleres, Inc.

40,006

42,081

40,404

42,057

Basic earnings per common share

attributable to Caleres, Inc. shareholders

$

0.61

$

0.55

$

0.83

$

0.95

Diluted earnings per common share

attributable to Caleres, Inc. shareholders

$

0.61

$

0.55

$

0.82

$

0.94

SCHEDULE 7

CALERES, INC.

BASIC AND DILUTED ADJUSTED EARNINGS PER

SHARE RECONCILIATION

(Unaudited)

Thirteen Weeks Ended

Twenty-Six Weeks Ended

(Thousands, except per share data)

August 3, 2019

August 4, 2018

August 3, 2019

August 4, 2018

Adjusted net earnings attributable to

Caleres, Inc.:

Adjusted net earnings

$

25,679

$

25,581

$

40,723

$

44,076

Net loss attributable to noncontrolling

interests

114

35

112

67

Adjusted net earnings attributable to

Caleres, Inc.

25,793

25,616

40,835

44,143

Net earnings allocated to participating

securities

(873

)

(729

)

(1,336

)

(1,241

)

Adjusted net earnings attributable to

Caleres, Inc. after allocation of earnings to participating

securities

24,920

24,887

$

39,499

$

42,902

Basic and diluted common shares

attributable to Caleres, Inc.:

Basic common shares

39,951

41,964

40,346

41,937

Dilutive effect of share-based awards

55

117

58

120

Diluted common shares attributable to

Caleres, Inc.

40,006

42,081

40,404

42,057

Basic adjusted earnings per common share

attributable to Caleres, Inc. shareholders

$

0.62

$

0.59

$

0.98

$

1.02

Diluted adjusted earnings per common share

attributable to Caleres, Inc. shareholders

$

0.62

$

0.59

$

0.98

$

1.02

SCHEDULE 8

CALERES, INC.

CALCULATION OF EBITDA AND ADJUSTED

EBITDA (NON-GAAP METRICS)

(Unaudited)

Twenty-Six Weeks Ended

August 3, 2019

August 4, 2018

(in 000's)

EBITDA

Net earnings attributable to Caleres,

Inc.

$34,424

$40,858

Income tax provision

10,901

13,183

Interest expense, net

14,729

7,285

Depreciation and amortization (1)

32,774

29,520

EBITDA

$92,828

$90,846

Adjusted EBITDA

Adjusted net earnings attributable to

Caleres, Inc.

$40,835

$44,143

Income tax provision

13,123

14,338

Interest expense, net

14,729

7,285

Depreciation and amortization (1)

32,774

29,520

Adjusted EBITDA

$101,461

$95,286

(1) Includes depreciation and amortization

of capitalized software and intangible assets

Earnings before interest expense, income

taxes and depreciation and amortization (EBITDA) and adjusted

earnings before interest expense, income taxes and depreciation and

amortization (Adjusted EBITDA) are non-GAAP financial measures that

we believe provide useful information to both management and

investors by excluding certain items that may not be indicative of

the Company’s core operating results, including the amortization of

intangible assets. These measures should not be considered a

substitute for or superior to GAAP results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190826005626/en/

Ken Hannah khannah@caleres.com Jo Ann Stoda

jstoda@caleres.com

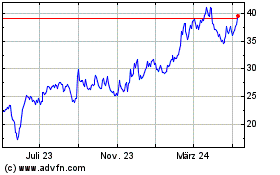

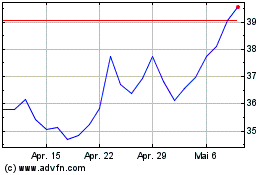

Caleres (NYSE:CAL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Caleres (NYSE:CAL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024