Judge Prods SEC to Settle Fraud Lawsuit With Volkswagen -- WSJ

17 August 2019 - 9:02AM

Dow Jones News

By Dave Michaels

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 17, 2019).

A federal judge on Friday ordered Volkswagen AG and the

Securities and Exchange Commission to seek a settlement over

allegations the auto maker defrauded U.S. investors, rather than

continue an expensive legal fight.

U.S. District Judge Charles Breyer told the SEC and Volkswagen

to return as soon as Oct. 4 with an idea of how to resolve the

dispute, which could engender a battle over evidence on two

continents and whether the company should face liability for

securities fraud after settling similar claims with the U.S.

Justice Department.

"Whatever you work out today will be less expensive to everybody

than what you would work out in the future," Judge Breyer said at a

hearing Friday in San Francisco. The judge said the settlement

would be better for the SEC, which has "scarce resources."

Judge Breyer previously questioned why the SEC sued Volkswagen

years after other government agencies resolved their litigation

over the auto maker's diesel-cheating scandal. The judge in May

suggested the agency looked like a "carrion hawk" picking over the

remains of a crime.

The SEC's lawsuit, filed in March, centers on claims that

Volkswagen defrauded investors by selling billions of dollars of

bonds while making misleading statements about the environmental

impact of the company's "clean diesel" fleet. The SEC also sued

Martin Winterkorn, Volkswagen's former chief executive. Mr.

Winterkorn, who lives in Germany, has been indicted in his home

country and in the U.S. in connection with the emissions

scandal.

Volkswagen paid a hefty price for rigging diesel engines to pass

U.S. emissions tests. The German auto maker pleaded guilty to the

charges in 2016 and has paid more than $25 billion in fines,

penalties and compensation to settle criminal and civil

litigation.

The SEC opened its investigation in 2015 and said Volkswagen

stalled the probe with long delays in producing documents and other

information, according to a court filing submitted last month. The

regulator tried to settle with Volkswagen years ago but was

excluded from the company's settlement talks with the U.S.

Department of Justice and other agencies, according to SEC court

filings.

Judge Breyer's latest instructions put pressure on the SEC to

resolve the lawsuit, perhaps by accepting a reduced penalty. The

judge said Friday that he didn't have an opinion on the case's

legal merits, but said "many aspects of the case have already been

settled years ago."

He said his goal is "to get this thing resolved," especially

given the limited resources at the SEC.

An SEC spokesman didn't respond to a request for comment Friday.

A spokesman for Volkswagen declined to comment. An attorney for Mr.

Winterkorn declined to comment.

Judge Breyer, who handled the earlier litigation against the

auto maker, said any penalties that result from litigation would

likely be lowered to account for fines that Volkswagen already

paid. He didn't allow the SEC's lawyers or the company's attorneys

to make arguments in court Friday.

"On the one side of the ledger will be the fact that they have

paid...$25 billion," he said. "That is where I see the case

evolving if the SEC is correct in their allegations that there is

liability."

Write to Dave Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

August 17, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

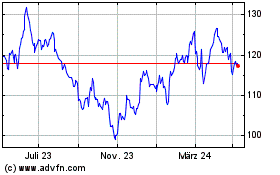

Volkswagen (TG:VOW3)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

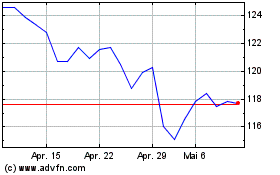

Volkswagen (TG:VOW3)

Historical Stock Chart

Von Apr 2023 bis Apr 2024