EUROPE MARKETS: Europe Stocks Trade Lower As German Economy Heads Toward Recession

14 August 2019 - 4:20PM

Dow Jones News

By Steve Goldstein, MarketWatch

Europe stocks traded lower on Wednesday after data showing the

Continent's largest economy contracted and eurozone industrial

production declined.

After halting a two-day losing run on Tuesday, the Stoxx Europe

600 dumbled 1.66% to 366.21, with banks including UniCredit

(UCG.MI) and Danske Bank (DANSKE.KO) lower.

The U.K. FTSE 100 slumped 1.41% to 7148.3, the German DAX

skidded 2.1% to 11503.37 and the French CAC 40 tumbled 1.97% to

5257.64.

U.S. stocks were hammered at the open, as the 2- and 10-year

Treasurys briefly inverted, which historically has been a predictor

of U.S. recessions.

What's moving markets

The state of the global economy returned to focus a day after

relief from the U.S. government delaying tariffs on Chinese

consumer products.

Germany's economy shrank by 0.1% in the second quarter

(http://www.marketwatch.com/story/german-economy-shrinks-amid-trade-concerns-auto-woes-2019-08-14),

according to data released by Destatis, the statistics agency.

"The external backdrop is set to remain challenging due to

persistent weakness in global demand amid re-escalated U.S.-China

trade tensions and the increased likelihood of a no-deal Brexit,"

said Iaroslav Shelepko, an economist at Barclays. "Given varied

risks, a gloomy global trade outlook and elevated uncertainty, we

expect the economy to post another mild decline in the third

quarter and therefore enter a technical recession even before

Brexit and U.S.-E.U. trade risks are due to crystallize."

The economy in the eurozone as a whole rose 0.2%, Eurostat

reported, with Spain's economy rising 0.5%, France's economy

improving by 0.2% and Italy's economy staying flat.

Perhaps more concerning to markets was the 1.6% downturn in

eurozone industrial production in June, as well as the softest

Chinese industrial production growth in 17 years.

Focus stocks

Schindler Holding fell 6.8% as the elevator maker said markets

may "slightly weaken over the remainder of the year" alongside a

2.8% decline in first-half operating profit. Its guidance for an

annual net profit between 900 million and 940 million francs

compares to consensus around 970 million francs. Rival ThyssenKrupp

(TKA.XE) fell 5%.

Admiral Group (ADM.LN) shares advanced 4.6% as the British

insurer reported a 4% rise in first-half pretax profit and an

increase in its dividend.

Sports Direct (SPD.LN) tumbled 10% after announcing that its

auditor, Grant Thornton, will step down on Sept. 11, when the

troubled sporting-goods retailer holds its annual shareholder

meeting. The Financial Times reported the retailer is in

discussions with the U.K. government over its auditor difficulties,

since no other accountant has so far been willing to step in.

(END) Dow Jones Newswires

August 14, 2019 10:05 ET (14:05 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

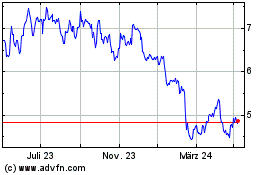

Thyssenkrupp (TG:TKA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Thyssenkrupp (TG:TKA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024