EUROPE MARKETS: Europe Stocks Trade Lower As German Economy Heads Toward Recession

14 August 2019 - 11:57AM

Dow Jones News

By Steve Goldstein, MarketWatch

Europe stocks traded lower on Wednesday after data showing the

Continent's largest economy contracted and eurozone industrial

production declined.

After halting a two-day losing run on Tuesday, the Stoxx Europe

600 declined 0.12% to 371.96, with banks including UniCredit

(UCG.MI) and Danske Bank (DANSKE.KO) lower.

The U.K. FTSE 100 gained 0.1% to 7258.5, the German DAX fell

0.3% to 11714.89 and the French CAC 40 weakened 0.3% to

5346.88.

U.S. stock futures pointed to a decline for the Dow Jones Industrial Average at the open.

What's moving markets

The state of the global economy returned to focus a day after

relief from the U.S. government delaying tariffs on Chinese

consumer products.

Germany's economy shrank by 0.1% in the second quarter

(http://www.marketwatch.com/story/german-economy-shrinks-amid-trade-concerns-auto-woes-2019-08-14),

according to data released by Destatis, the statistics agency.

"The external backdrop is set to remain challenging due to

persistent weakness in global demand amid re-escalated U.S.-China

trade tensions and the increased likelihood of a no-deal Brexit,"

said Iaroslav Shelepko, an economist at Barclays. " Given varied

risks, a gloomy global trade outlook and elevated uncertainty, we

expect the economy to post another mild decline in the third

quarter and therefore enter a technical recession even before

Brexit and U.S.-E.U. trade risks are due to crystallize."

The economy in the eurozone as a whole rose 0.2%, Eurostat

reported, with Spain's economy rising 0.5%, France's economy

improving by 0.2% and Italy's economy staying flat.

Perhaps more concerning to markets was the 1.6% downturn in

eurozone industrial production in June, as well as the softest

Chinese industrial production growth in 17 years.

Focus stocks

Schindler Holding fell 4% as the elevator maker said markets may

"slightly weaken over the remainder of the year" alongside a 2.8%

decline in first-half operating profit. Its guidance for an annual

net profit between 900 million and 940 million francs compares to

consensus around 970 million francs. Rival ThyssenKrupp (TKA.XE)

fell 3.4%.

Straumann Holding (STMN.EB) shares rose 3.3% as first-half

earnings for the dental implant maker came in ahead of forecast and

its sales guidance was upgraded.

Admiral Group (ADM.LN) shares advanced 4% as the British insurer

reported a 4% rise in first-half pretax profit and an increase in

its dividend.

Drugmaker Sanofi (SAN.FR) saw its shares rise 2% as UBS upgraded

the company to buy from neutral, saying the pipeline of drugs

"looks lackluster" but isn't empty, and that it's underperformed

rivals like Novartis (NOVN.EB) , Roche (ROG.EB) and Johnson &

Johnson (JNJ) .

(END) Dow Jones Newswires

August 14, 2019 05:42 ET (09:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

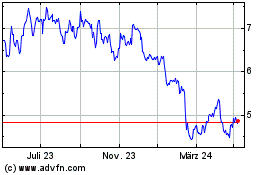

Thyssenkrupp (TG:TKA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Thyssenkrupp (TG:TKA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024