As filed with the Securities and Exchange Commission on August 12, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WORKIVA INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware

(State or other jurisdiction of incorporation or organization)

|

47-2509828

(I.R.S. Employer Identification Number)

|

|

2900 University Blvd

Ames, IA 50010

(888) 275-3125

|

|

(

Address, including zip code and telephone number, including area code, of Registrant’s principal executive offices

)

|

Martin J. Vanderploeg, Ph.D.

Chief Executive Officer

2900 University Boulevard

Ames, Iowa 50010

(888) 275-3125

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

|

|

|

|

|

Copies to:

|

|

|

|

|

Troy M. Calkins

Chief Legal and Administrative Officer

and Corporate Secretary

2900 University Boulevard

Ames, Iowa 50010

(888) 275-3125

|

Kimberly K. Rubel

Adam S. Weinstock

Drinker Biddle & Reath LLP

191 N. Wacker Drive, Suite 3700

Chicago, Illinois 60606

(312) 569-1000

|

Approximate date of commencement of proposed sale of the securities to the public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box:

☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box:

☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

Large accelerated filer

☒

|

Accelerated filer

☐

|

|

Non-accelerated filer

☐

|

Smaller reporting company

☐

|

|

Emerging growth company

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered

|

Amount to be registered

|

Proposed maximum offering price per share

|

Proposed maximum aggregate offering price

|

Amount of registration fee

|

|

Class A common stock, $0.001 par value per share

|

1,500,000

(1)

|

(2)

|

(2)

|

(3)

|

|

|

|

|

(1)

|

These shares are being registered for possible offering from time to time at indeterminate prices.

|

|

|

|

|

(2)

|

Omitted pursuant to Form S-3 General Instruction II.E.

|

|

|

|

|

(3)

|

In accordance with Rule 456(b) and 457(r) under the Securities Act of 1933, as amended, the registrant is deferring payment of the registration fee.

|

PROSPECTUS

Class A Common Stock

This prospectus relates solely to sales of Class A common stock of Workiva Inc. (the “Company”) by selling stockholders. This prospectus describes the general terms of our Class A common stock and the general manner in which our Class A common stock will be offered by certain selling stockholders. We will describe the specific manner in which these shares will be offered in supplements to this prospectus, which may also supplement, update or amend information contained in this prospectus. We may also authorize one or more free writing prospectuses to be provided to you in connection with these offerings. You should carefully read this prospectus and any applicable prospectus supplement or free writing prospectuses before you invest.

The names of any underwriters or agents, if applicable, and the terms of the arrangements with such entities will be stated in an accompanying prospectus supplement. For additional information on the method of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus and in the applicable prospectus supplement.

We will not receive any proceeds from the sale of shares of our Class A common stock by the selling stockholders. We may bear a portion of the expenses related to the registration and offering of shares of our Class A common stock, provided that the selling stockholders will pay any applicable underwriting fees, discounts or commissions.

Our Class A common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “WK.” On August 9, 2019, the last reported sale price on the New York Stock Exchange was $63.04 per share.

Investing in these securities involves certain risks. See “Risk Factors” included in any accompanying prospectus supplement and in the documents incorporated by reference in this prospectus for a discussion of the factors you should carefully consider before deciding to purchase these securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus or any applicable prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 12, 2019

TABLE OF CONTENTS

We urge you to read this entire prospectus and the information incorporated by reference herein carefully, including the “Risk Factors” section. We carry on our business directly and through our subsidiaries. In this prospectus, unless the context indicates or implies otherwise, the terms “company,” “we,” “us,” and “our” refer to Workiva Inc. and its subsidiaries.

We have not authorized anyone else to provide you with any information other than the information contained or incorporated by reference in this prospectus and any applicable prospectus supplement. The securities are not being offered in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus and any accompanying prospectus supplement is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus and any accompanying prospectus supplement is delivered or securities are sold on a later date.

ABOUT THIS PROSPECTUS

This prospectus is part of an automatic shelf registration statement that we filed with the Securities and Exchange Commission, or the SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended, or the Securities Act. Under this shelf registration process, any selling stockholder may sell Class A common stock described in this prospectus in one or more offerings. Each time any selling stockholders sell securities pursuant to this prospectus, we will describe in a prospectus supplement, which will be delivered with this prospectus, specific information about the offering. In the prospectus supplement relating to any sales by selling stockholders, we will, among other things, identify the number of shares of our Class A common stock that each of the selling stockholders will be selling. The applicable prospectus supplement may also add, update or change the information contained in this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference in this prospectus or any prospectus supplement — the statement in the later-dated document modifies or supersedes the earlier statement.

Before making an investment in our securities, you should read both this prospectus and any applicable prospectus supplement and any applicable free writing prospectus, together with the information incorporated and deemed to be incorporated by reference herein as described under “Information Incorporated by Reference” and the additional information described under the heading “Where You Can Find More Information.” This prospectus may not be used to sell our Class A common stock unless accompanied by a prospectus supplement.

The registration statement of which this prospectus is a part, including the exhibits to the registration statement, provides additional information about us and the securities. Wherever references are made in this prospectus to information that will be included in a prospectus supplement, to the extent permitted by applicable law, rules or regulations, we or the selling stockholders may instead include such information or add, update or change the information contained in this prospectus by means of a post-effective amendment to the registration statement of which this prospectus is a part, through filings we make with the SEC that are incorporated by reference into this prospectus or by any other method as may then be permitted under applicable law, rules or regulations. The registration statement, including the exhibits to the registration statement and any post-effective amendment thereto, can be obtained from the SEC, as described under the heading “Where You Can Find More Information.”

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and any prospectus supplement or free writing prospectus, including the documents incorporated or deemed to be incorporated by reference herein contain statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with respect to our current or future financial condition, results of operations, future operations, business strategies, operating efficiencies, competitive positions, growth opportunities, plans and objectives of our management, as well as the market for our Class A common stock and the software and technology sectors in general. Statements that include words such as “estimate,” “project,” “plan,” “intend,” “expect,” “anticipate,” “believe,” “would,” “should,” “could,” “seek,” “may” and similar statements of a future or forward-looking nature identify forward-looking statements for purposes of the federal securities laws or otherwise. All forward-looking statements are necessarily estimates or expectations, and not statements of historical fact, reflecting the best judgment of our management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. These forward looking statements should, therefore, be considered in light of various important factors, including those set forth in this prospectus and the documents incorporated by reference herein.

Factors that could cause actual results to differ materially from those suggested by the forward looking statements include:

|

|

|

|

•

|

our limited operating history, which makes it difficult to predict our future operating results;

|

|

|

|

|

•

|

our lack of profitability historically and uncertainty about achieving or maintaining future profitability;

|

|

|

|

|

•

|

our revenue growth rate may not be indicative of our future performance;

|

|

|

|

|

•

|

our quarterly results may fluctuate significantly and may not fully reflect the underlying performance of our business;

|

|

|

|

|

•

|

our efforts to increase use of our Wdesk platform in applications other than SEC filings may not succeed and may reduce our revenue growth rate;

|

|

|

|

|

•

|

any inability to compete effectively with the intense competition we face in the marketplace could adversely affect our operating results;

|

|

|

|

|

•

|

our efforts to augment our direct-sales channels by developing relationships with third parties may not be successful, which could affect our revenue growth;

|

|

|

|

|

•

|

any failure to establish and maintain relationships with partners that can provide complementary technology offerings and software integrations may limit our ability to grow our business;

|

|

|

|

|

•

|

our solutions may become less competitive if we do not keep pace with technological changes, which could result in our business becoming less competitive;

|

|

|

|

|

•

|

our existing customers may experience service outages and new customers may experience delays in the deployment of our solutions if we fail to manage our technical operations infrastructure;

|

|

|

|

|

•

|

our third-party data center hosting facilities may suffer interruptions or delays, which could impair the delivery of our service and harm our business;

|

|

|

|

|

•

|

our internet infrastructure, bandwidth providers, data center providers, other third parties or our own systems for providing our solutions to customers could experience a failure or interruption, which could negatively impact our business;

|

|

|

|

|

•

|

any failure to offer high-quality technical support services would adversely affect our relationships with our customers and our financial results;

|

|

|

|

|

•

|

our revenue recognition practices related to the fact that our platform is offered on a subscription basis is more sensitive to downturns or upturns in sales, which may not be immediately reflected in our operating results;

|

|

|

|

|

•

|

our ability to accurately predict subscription renewal or upgrade rates and the impact these rates may have on our future revenue and operating results;

|

|

|

|

|

•

|

our labor costs related to increased competition for employees, higher employee turnover rates and required wage increases and health benefit coverage, lawsuits or labor union activity may subject us to financial risks;

|

|

|

|

|

•

|

any inability to maintain the licenses for third-party licensed software for use in or with our solutions could result in increased costs or reduced service levels, which would adversely affect our business;

|

|

|

|

|

•

|

the impact of changes in laws and regulations related to the internet or changes in the internet infrastructure itself may diminish the demand for our solutions and could have a negative impact on our business;

|

|

|

|

|

•

|

any failure to comply with U.S. and foreign data privacy and protection laws and regulations as well as contractual privacy obligations could subject us to fines and damages and would harm our reputation and business;

|

|

|

|

|

•

|

any failure to protect our intellectual property rights could impair our ability to protect our proprietary technology and our brand; or

|

|

|

|

|

•

|

any failure to comply with the terms of one or more of our solutions that utilize open source software could negatively affect our business.

|

The factors listed above should be not construed as exhaustive and should be read in conjunction with the Risk Factors that are referenced below. We undertake no obligation to publicly update or review any forward looking statement, whether to reflect any change in our expectations with regard thereto, or as a result of new information, future developments or otherwise, except as required by law.

OUR COMPANY

Workiva is a leading provider of cloud-based solutions for connected reporting and compliance. Our platform, Wdesk, is used by thousands of public and private companies, government agencies and higher-education institutions. Wdesk offers controlled collaboration, data linking, data integrations, granular permissions, process management and a full audit trail. Wdesk users are able to combine narrative with their data, which greatly improves insight in their financial, regulatory and management reporting processes.

We were formed in California in August 2008 as WebFilings LLC. In July 2014, we changed our name to Workiva LLC, and we converted into a Delaware limited liability company in September 2014. On December 10, 2014, Workiva LLC was converted into a Delaware corporation and renamed Workiva Inc. Our principal executive offices are located at 2900 University Boulevard, Ames, Iowa 50010, and our telephone number is (888) 275-3125. Our website address is www.workiva.com.

RISK FACTORS

Investment in our Class A common stock involves risks. Before acquiring any of our Class A common stock, you should carefully consider the risk factors incorporated by reference to our most recent annual report on Form 10-K, any subsequent quarterly reports on Form 10-Q and any current reports on Form 8-K filed subsequent to the end of the year covered by that annual report, together with any amendments or supplements thereto, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors (if any) and other information contained in any applicable prospectus supplement or free writing prospectus. The materialization of any of these risks, as well as additional risks not known to us or that we believe are immaterial, could materially and adversely affect our business, financial condition, results of operations and prospects, could cause the trading price of our shares of Class A common stock to decline, and could cause you to lose all or part of your investment in the offered securities. Please also refer to the section above entitled “Cautionary Note Regarding Forward-Looking Statements.”

USE OF PROCEEDS

We are not selling any shares under this prospectus and we will not receive any proceeds from the sale of shares of our Class A common stock by the selling stockholders. Net proceeds from the sale of the shares offered by this prospectus will be received by the selling stockholders.

SELLING STOCKHOLDERS

Information regarding the names of the selling stockholders, the beneficial ownership of our Class A common stock by the selling stockholders, the number of shares being offered by the selling stockholders and the number of shares beneficially owned by the selling stockholders after the applicable offering will be set forth in a prospectus supplement, post-effective amendment or filings we make with the SEC under the Exchange Act that are incorporated by reference herein.

PLAN OF DISTRIBUTION

The selling stockholders may sell the Class A common stock in any one or more of the following ways:

|

|

|

|

•

|

directly to investors, including through a specific bidding, auction or other process;

|

|

|

|

|

•

|

to investors through agents;

|

|

|

|

|

•

|

to or through brokers or dealers;

|

|

|

|

|

•

|

to the public through underwriting syndicates led by one or more managing underwriters;

|

|

|

|

|

•

|

to one or more underwriters acting alone for resale to investors or to the public; and

|

|

|

|

|

•

|

through a combination of any of those methods of sale.

|

If the selling stockholders sell shares of Class A common stock to a dealer acting as principal, the dealer may resell those shares at varying prices to be determined by the dealer in its discretion at the time of resale without consulting with us or the selling stockholders, and the resale prices may not be disclosed in the applicable prospectus supplement.

Any underwritten offering may be on a best efforts or a firm commitment basis.

Sales of the Class A common stock may be effected from time to time in one or more transactions, including negotiated transactions:

|

|

|

|

•

|

at a fixed price or prices, which may be changed;

|

|

|

|

|

•

|

at market prices prevailing at the time of sale;

|

|

|

|

|

•

|

at prices related to prevailing market prices; or

|

Any of the prices may represent a discount from the then-prevailing market prices.

In connection with the sale of Class A common stock, underwriters or agents may receive compensation from the selling stockholders in the form of underwriting discounts or commissions and may also receive compensation from purchasers of the Class A common stock, for whom they may act as agents, in the form of discounts, concessions or commissions. Underwriters may sell the Class A common stock to or through dealers, and the dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions from the purchasers for whom they may act as agents. Discounts, concessions and commissions may be changed from time to time. Dealers and agents that participate in the distribution of the Class A common stock may be deemed to be underwriters under the Securities Act of 1933, and any discounts, concessions or commissions they receive from the selling stockholders and any profit on the resale of Class A common stock they realize may be deemed to be underwriting compensation under applicable federal and state securities laws.

The applicable prospectus supplement will, where applicable:

|

|

|

|

•

|

identify any underwriter, dealer or agent;

|

|

|

|

|

•

|

describe any compensation in the form of discounts, concessions, commissions or otherwise received from the selling stockholders by each underwriter or agent and in the aggregate by all underwriters and agents;

|

|

|

|

|

•

|

describe any discounts, concessions or commissions allowed by underwriters to participating dealers;

|

|

|

|

|

•

|

identify the amounts underwritten; and

|

|

|

|

|

•

|

identify the nature of the underwriter’s or underwriters’ obligation to take the Class A common stock.

|

Until the distribution of the Class A common stock is completed, rules of the SEC may limit the ability of any underwriters and selling group members to bid for and purchase the Class A common stock. As an exception to these rules, underwriters are permitted to engage in some transactions that stabilize the price of the Class A common stock. Those transactions consist of bids or purchases for the purpose of pegging, fixing or maintaining the price of the shares.

Underwriters may engage in overallotment. If any underwriters create a short position in the Class A common stock in an offering in which they sell more shares than are set forth on the cover page of the applicable prospectus supplement, the underwriters may reduce that short position by purchasing the shares in the open market.

The lead underwriters may also impose a penalty bid on other underwriters and selling group members participating in an offering. This means that if the lead underwriters purchase Class A common stock in the open market to reduce the underwriters’ short position or to stabilize the price of the shares, they may reclaim the amount of any selling concession from the underwriters and selling group members who sold those shares as part of the offering.

In general, purchases of Class A common stock for the purpose of stabilization or to reduce a short position could cause the price of the shares to be higher than it might be in the absence of those purchases. The imposition of a penalty bid might also have an effect on the price of the shares to the extent that it were to discourage resales of the shares before the distribution is completed.

Neither we nor the selling stockholders make any representation or prediction as to the direction or magnitude of any effect that the transactions described above might have on the price of the Class A common stock. In addition, neither we nor the selling stockholders make any representation that underwriters will engage in those transactions or that the transactions, once commenced, will not be discontinued without notice.

Under agreements into which the selling stockholders may enter, underwriters, dealers and agents who participate in the distribution of the Class A common stock may be entitled to indemnification by the selling stockholders against or contribution towards certain civil liabilities, including liabilities under the applicable securities laws.

If the selling stockholders offer Class A common stock in a subscription rights offering to our existing stockholders, the selling stockholders may enter into a standby underwriting agreement with dealers, acting as standby underwriters. The selling stockholders may pay the standby underwriters a commitment fee for the Class A common stock they commit to purchase on a standby basis. If the selling stockholders do not enter into a standby underwriting arrangement, the selling stockholders may retain a dealer-manager to manage a subscription rights offering on their behalf.

Underwriters, dealers and agents may engage in transactions with the selling stockholders or perform services for the selling stockholders in the ordinary course of business.

To comply with applicable state securities laws, the Class A common stock offered by this prospectus will be sold, if necessary, in such jurisdictions only through registered or licensed brokers or dealers. In addition, Class A common stock may not be sold in some states unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

DESCRIPTION OF CAPITAL STOCK

The following description of the material terms of our capital stock includes a summary of specified provisions of our certificate of incorporation and bylaws. This description also summarizes relevant provisions of the Delaware General Corporation Law, or “DGCL.” The terms of our certificate of incorporation and bylaws and the DGCL are more detailed than the general information below. Therefore, please carefully consider the actual provisions of these documents, which have been filed with the SEC as exhibits to the registration statement of which this prospectus forms a part,

or may be incorporated by reference in this prospectus or any applicable prospectus supplement,

and the DGCL.

General

Under our certificate of incorporation, we have two classes of common stock: Class A common stock, which has one vote per share, and Class B common stock, which has ten votes per share. Any holder of Class B common stock may convert all or a portion of his shares at any time into shares of Class A common stock on a share-for-share basis. In addition, Class B common stock will convert automatically into Class A common stock upon the occurrence of specified events, including any transfer, except for certain permitted transfers described below. Except as specified below, the holders of Class A and Class B common stock vote together as a single class. Except as expressly provided in our certificate of incorporation, including with respect to voting rights and conversion rights, the rights of the two classes of common stock are identical. In addition, our certificate of incorporation authorizes shares of undesignated preferred stock, the rights, preferences and privileges of which may be designated from time to time by our board of directors.

As of July 31, 2019, our authorized capital stock consisted of 1,600,000,000 shares, each with a par value of $0.001 per share, of which:

|

|

|

|

•

|

1,000,000,000 shares are designated as Class A common stock;

|

|

|

|

|

•

|

500,000,000 shares are designated as Class B common stock; and

|

|

|

|

|

•

|

100,000,000 shares are undesignated preferred stock.

|

As of August 2, 2019, there were

36,762,217

shares of our Class A common stock outstanding and

9,265,596

shares of our Class B common stock outstanding. No shares of preferred stock are outstanding.

Common Stock

Dividend Rights

Subject to preferences that may apply to shares of preferred stock outstanding at the time, the holders of outstanding shares of our Class A common stock are entitled to receive dividends out of funds legally available if our board of directors, in its discretion, determines to issue dividends and only then at the times and in the amounts that our board of directors may determine.

Voting Rights

The holders of our Class B common stock are entitled to ten votes per share, and holders of our Class A common stock are entitled to one vote per share. The holders of our Class A common stock and Class B common stock vote together as a single class, unless otherwise required by our certificate of incorporation or law. Delaware law requires either holders of our Class A common stock or our Class B common stock to vote separately as a single class in the following circumstances:

If we were to seek to amend our certificate of incorporation to increase or decrease the par value of a class of stock, then that class would be required to vote separately to approve the proposed amendment; and

If we were to seek to amend our certificate of incorporation in a manner that alters or changes the powers, preferences or special rights of a class of stock in a manner that affected its holders adversely, then that class would be required to vote separately to approve the proposed amendment.

In addition, the affirmative vote of the holders of the Class B common stock is required to amend the provisions of our certificate of incorporation that relate to our dual class structure.

Under our certificate of incorporation, we are not able to engage in certain mergers or other transactions in which the holders of Class A common stock and Class B common stock are not given the same consideration, without the affirmative vote of the holders of a majority of the outstanding shares of Class A common stock, voting separately as a class, and Class B common stock, voting separately as a class. No separate class vote will be required, however, if the holders of each class of common stock receive equity securities in the surviving entity with voting and related rights substantially similar to the rights of the class of common stock held by the holders prior to the merger or other transaction. In addition, we may not issue any new shares of Class B common stock, other than shares issued in connection with stock dividends, stock splits, reclassifications and similar transactions.

Stockholders do not have the ability to cumulate votes for the election of directors. Our certificate of incorporation provides for a classified board of directors consisting of three classes of approximately equal size, each serving staggered three-year terms. Only one class of directors will be elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms.

No Preemptive or Similar Rights

None of our common stock is entitled to preemptive rights and is not subject to redemption or sinking fund provisions.

Right to Receive Liquidation Distributions

Upon our dissolution, liquidation or winding-up, the assets legally available for distribution to our stockholders are distributable ratably among the holders of our common stock, subject to prior satisfaction of all outstanding debt and liabilities and the preferential rights and payment of liquidation preferences, if any, on any outstanding shares of preferred stock.

Conversion

Our Class A common stock is not convertible into any other shares of capital stock. Each outstanding share of Class B common stock is convertible at any time at the option of the holder into one share of Class A common stock. In addition, each share of Class B common stock will convert automatically into one share of Class A common stock upon the occurrence of specified events, including any transfer, whether or not for value, except for certain transfers described in our certificate of incorporation, including transfers to family members, trusts solely for the benefit of the stockholder or the stockholder’s family members, and individuals or entities controlled by the stockholder or the stockholder’s family members, and transfers by operation of law pursuant to a qualified domestic order or in connection with a divorce settlement. Each share of Class B common stock will also convert automatically into one share of Class A common stock upon the death of a Class B common stockholder, except if the shares are transferred in accordance with the foregoing sentence. Further, each share of Class B common stock will convert into one share of Class A common stock if the conversion is approved by the holders of at least two-thirds of the then-outstanding shares of Class B common stock. Once converted into Class A common stock, a share of Class B common stock may not be reissued.

Preferred Stock

Our board of directors is authorized, subject to limitations prescribed by Delaware law, to issue preferred stock in one or more series, to establish from time to time the number of shares to be included in

each series and to fix the designation, powers, preferences and rights of the shares of each series and any of its qualifications, limitations or restrictions. Our board of directors also can increase or decrease the number of shares of any series, but not below the number of shares of that series then outstanding, without any further vote or action by our Class A stockholders. Our board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our Class A common stock.

Anti-Takeover Provisions

So long as the outstanding shares of our Class B common stock represent a majority of the combined voting power of common stock, our Class B holders will, if voting together, effectively control all matters submitted to our stockholders for a vote, as well as the overall management and direction of our company, which could have the effect of delaying, deferring or discouraging another person from acquiring control of our company. In addition, the provisions of Delaware law, our certificate of incorporation and our bylaws may have the same effect.

Section 203 of the Delaware General Corporation Law

We are governed by the provisions of Section 203 of the DGCL. Section 203 generally restricts Delaware corporations from engaging, under some circumstances, in a business combination, which includes certain mergers or sales of at least 10% of the corporation’s assets, with any interested stockholder, which is generally defined to mean any person or entity that (i) is the owner of 15% or more of the corporation’s outstanding voting stock, or (ii) is an affiliate or associate of the corporation and was the owner of 15% or more of the outstanding voting stock of the corporation at any time within the three-year period immediately prior to the date on which it is sought to be determined whether that person is an interested stockholder, and the affiliates and associates of that person unless:

|

|

|

|

•

|

prior to the time the stockholder became an “interested stockholder,” the board of directors approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

|

|

|

|

|

•

|

upon consummation of the transaction that resulted in the stockholder’s becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced; or

|

|

|

|

|

•

|

at or subsequent to the time that the stockholder became an interested stockholder the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders (and not by written consent) by the affirmative vote of at least two-thirds of the outstanding voting stock that is not owned by the interested stockholder.

|

A Delaware corporation may “opt out” of these provisions with an express provision in its original certificate of incorporation or an express provision in its certificate of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a majority of the outstanding voting shares. We have not opted out of these provisions. As a result, mergers or other takeover or change in control attempts of us may be discouraged or prevented.

Certificate of Incorporation and Bylaw Provisions

Our certificate of incorporation and our bylaws include a number of provisions that may have the effect of deterring hostile takeovers or delaying or preventing changes in control of our management team, including the following:

Dual Class Stock

. As described above in “Common Stock—Voting Rights,” our certificate of incorporation provides for a dual class common stock structure, which gives the beneficial owners of our Class B common stock the ability to control the outcome of matters requiring stockholder approval, even if they own significantly less than a majority of the shares of our outstanding Class A and Class B common

stock on a combined basis. These matters include the election of directors and significant corporate transactions, such as a merger or other sale of our company or our assets.

Supermajority Approvals

. Our certificate of incorporation provides that certain amendments to our certificate of incorporation or bylaws by stockholders require the approval of two-thirds of the combined vote of our then-outstanding shares of Class A and Class B common stock. This has the effect of making it more difficult to amend our certificate of incorporation or bylaws to remove or modify any existing provisions.

Board of Directors Vacancies

. Our certificate of incorporation and bylaws authorize only our board of directors, and not our stockholders, to fill vacant directorships. These provisions could prevent a stockholder from increasing the size of our board of directors and gaining control of our board of directors by filling the resulting vacancies with its own nominees.

Classified Board

. Under our certificate of incorporation, our board of directors is divided into three classes of directors, each of which will hold office for a three-year term. In addition, directors may only be removed from the board of directors for cause and only by the affirmative vote of the holders of at least a majority of the combined voting power of the then-outstanding shares of our Class A and Class B common stock. The existence of a classified board could delay a successful tender offeror from obtaining majority control of our board of directors, and the prospect of that delay might deter a potential offeror.

Stockholder Action; Special Meeting of Stockholders

. Our certificate of incorporation does not permit our stockholders to take action by written consent, and as a result, they are only able to take action at annual or special meetings of our stockholders. Our certificate of incorporation and bylaws further provide that special meetings of our stockholders may be called only by a majority of our total number of directors, the chairman of our board of directors, our chief executive officer, or our president (in the absence of a chief executive officer). This could have the effect of preventing or delaying significant corporate actions that would otherwise be taken by the holders of at least a majority of the combined voting power of our Class A and Class B common stock.

Advance Notice Requirements for Stockholder Proposals and Director Nominations

. Our bylaws provide advance notice procedures for stockholders seeking to bring business before our annual meeting of stockholders, or to nominate candidates for election as directors at any meeting of stockholders. Our bylaws also specify certain requirements regarding the form and content of a stockholder’s notice. These provisions may deter our stockholders from bringing matters before our annual meeting of stockholders or from making nominations for directors at our meetings of stockholders.

Authorized but Unissued Shares; Undesignated Preferred Stock

. The authorized but unissued shares of our Class A common stock are available for future issuance without stockholder approval. These additional shares may be utilized for a variety of corporate purposes, including future public offerings to raise additional capital, corporate acquisitions and employee benefit plans. In addition, our board of directors may issue, without stockholder approval, up to 100,000,000 shares of undesignated preferred stock with rights and preferences, including voting rights, designated from time to time by the board of directors. The existence of authorized but unissued shares of Class A common stock or preferred stock enables our board of directors to make more difficult or to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise.

Choice of Forum

Our certificate of incorporation provides that the Court of Chancery of the State of Delaware will be the exclusive forum for any derivative action or proceeding brought on our behalf; any action asserting a breach of fiduciary duty owed to us; any action asserting a claim arising pursuant to the DGCL, our certificate of incorporation or our bylaws; any action to interpret, apply, enforce or determine the validity of any provision of our certificate of incorporation or our bylaws; or any action asserting a claim that is governed by the internal affairs doctrine. The enforceability of similar choice of forum provisions in other

companies’ certificates of incorporation has been challenged in legal proceedings, and it is possible that a court could find these types of provisions to be inapplicable or unenforceable.

Transfer Agent and Registrar

The transfer agent and registrar for our Class A common stock is Computershare Trust Company, N.A., located at 150 Royall Street, Canton, Massachusetts 02021.

LEGAL MATTERS

Unless otherwise specified in the prospectus supplement accompanying this prospectus, Drinker Biddle & Reath LLP will provide an opinion regarding the authorization and validity of the Class A common stock and other legal matters. Any underwriters, dealers or agents will be advised about the validity of the Class A common stock and other legal matters by their own counsel, which will be named in the prospectus supplement.

EXPERTS

The consolidated financial statements of Workiva Inc. appearing in Workiva Inc.’s Annual Report (Form 10-K) for the year ended December 31, 2018, and the effectiveness of Workiva Inc.’s internal control over financial reporting as of December 31, 2018, have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their reports thereon, included therein, and incorporated herein by reference. Such financial statements are, and audited financial statements to be included in subsequently filed documents will be, incorporated herein in reliance upon the reports of Ernst & Young LLP pertaining to such financial statements and the effectiveness of our internal control over financial reporting as of the respective dates (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information reporting requirements of the Exchange Act and, in accordance with these requirements, we are required to file periodic reports and other information with the SEC. Our filings are available to the public on the Internet, through a database maintained by the SEC at http://www.sec.gov.

Additionally, we make our SEC filings available, free of charge, on our website at https://investor.workiva.com/investors/overview/default.aspx as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC. We do not intend our website address to be an active link and information contained on our website does not constitute a part of this prospectus or any accompanying prospectus supplement (or any document incorporated by reference herein or therein), and you should not rely on that information in making your investment decision unless that information is also in this prospectus or has been expressly incorporated by reference into this prospectus.

INFORMATION INCORPORATED BY REFERENCE

We are “incorporating by reference” into this prospectus certain information we file with the SEC, which means that we are disclosing important information to you by referring you to those documents. The information we incorporate by reference in this prospectus is legally deemed to be a part of this prospectus, and later information that we file with the SEC will automatically update and supersede the information included in this prospectus and the documents listed below. We incorporate the documents listed below:

|

|

|

|

•

|

our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, filed with the SEC on February 20, 2019;

|

|

|

|

|

•

|

our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2019 and June 30, 2019, filed with the SEC on May 1, 2019 and August 6, 2019, respectively;

|

|

|

|

|

•

|

the information specifically incorporated by reference into our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 from our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 25, 2019;

|

|

|

|

|

•

|

our Current Reports on Form 8-K filed with the SEC on June 13, 2019; and

|

|

|

|

|

•

|

the description of our Class A common stock contained in our registration statement on

Form 8-A

(Registration No. 001-36773) filed with the SEC on December 5, 2014 under Section 12(b) of the Exchange Act, including any amendments or reports filed for the purpose of updating the description.

|

All reports and definitive proxy or information statements filed by us pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the filing of the registration statement of which this prospectus is a part and prior to the filing of a post-effective amendment that indicates that all shares of Class A common stock offered hereby have been sold or that deregisters all Class A common stock then remaining unsold shall be deemed to be incorporated by reference into this prospectus and to be a part hereof from the date of filing of the documents, except as to documents or information deemed to have been furnished and not filed in accordance with the rules of the SEC. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in any subsequently filed document that also is deemed to be incorporated by reference herein modifies or supersedes the earlier statement.

Documents incorporated by reference are available from the SEC as described above or from Workiva Inc. without charge, excluding any exhibits to those documents unless the exhibit is specifically incorporated by reference as an exhibit in this document. You can obtain documents incorporated by reference in this prospectus by requesting them in writing or by telephone at the following address:

Workiva Inc.

2900 University Blvd

Ames, IA 50010

(888) 275-3125

______________________

Class A Common stock

______________________

Prospectus

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the estimated expenses in connection with the issuance and distribution of the Class A common stock being registered, other than any underwriting discounts, commissions and transfer taxes. Other than the SEC registration fee and the FINRA fee, all of the amounts listed are estimates.

|

|

|

|

|

|

|

SEC Registration Fee

|

$

|

(1)(2)

|

|

FINRA Fee

|

|

14,000

|

|

Accounting Fees and Expenses

|

|

(2)

|

|

Legal Fees and Expenses

|

|

(2)

|

|

Miscellaneous

|

|

(2)

|

|

Total

|

|

(2)

|

|

|

|

|

(1)

|

Omitted because the registration fee is being deferred pursuant to Rule 456(b) and Rule 457(r).

|

|

|

|

|

(2)

|

The expenses of the issuance and distribution of the securities cannot be determined at this time. The estimates of such expenses in connection with securities offered and sold pursuant to this registration statement will be included in the applicable prospectus supplement.

|

Item 15. Indemnification of Directors and Officers.

Sections 145 and 102(b)(7) of the DGCL authorize a court to award, or a corporation’s board of directors to grant, indemnity to its directors and officers under certain circumstances and subject to certain limitations. The terms of Sections 145 and 102(b)(7) of the DGCL are sufficiently broad to permit indemnification under certain circumstances for liabilities, including reimbursement of expenses incurred, arising under the Securities Act.

As permitted by the DGCL, our certificate of incorporation contains provisions that eliminate the personal liability of directors of the Company for monetary damages for any breach of fiduciary duties as a director, except liability for the following:

|

|

|

|

•

|

any breach of the director’s duty of loyalty to the Company or its stockholders;

|

|

|

|

|

•

|

any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

|

|

|

|

|

•

|

unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the DGCL; or

|

|

|

|

|

•

|

any transaction from which the director derived an improper personal benefit.

|

Our bylaws provide that we are required to indemnify directors and officers of the Company to the maximum extent not prohibited by the DGCL and that we may indemnify other employees and agents as set forth in the DGCL. Subject to certain limitations, our bylaws also require we advance expenses as incurred by directors and officers of the Company for the defense of any action for which indemnification is required or permitted. In addition, under the DGCL, we may be required to indemnify our directors and officers under certain other circumstances.

In addition to the indemnification under our certificate of incorporation and bylaws, we have entered into separate indemnification agreements with our directors and executive officers. These agreements, among other things, provide that we will indemnify these directors and executive officers for certain

expenses (including attorneys’ fees), judgments, fines, penalties and settlement amounts incurred by a director or executive officer in any action or proceeding arising out of his or her services as one of our directors or executive officers, or any other company or enterprise to which the person provides services at our request.

We carry and intend to maintain directors’ and officers’ liability insurance on behalf of each and any person who is or was a director or officer of the Company against any loss arising from any claim asserted against him or her and incurred by him or her in that capacity, subject to certain exclusions.

Item 16. Exhibits

Reference is made to the Exhibit Index filed as part of this registration statement. All exhibits have been previously filed unless otherwise noted.

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in the volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission, or the SEC, pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however,

that paragraphs (1)(i), (1)(ii) and (1)(iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

(5)

That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit

Number

|

Exhibit Description

|

|

1.1

|

Form of Underwriting Agreement †

|

|

4.1

|

|

|

4.2

|

|

|

4.3

|

|

|

5.1

|

|

|

23.1

|

|

|

23.2

|

|

|

24.1

|

|

|

|

|

|

†

|

To be filed by amendment to this Registration Statement or incorporated by reference from documents filed or to be filed with the SEC under the Exchange Act.

|

SIGNATURES AND POWER OF ATTORNEY

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Ames, State of Iowa, on this 12th day of August, 2019.

|

|

|

|

|

|

|

WORKIVA INC.

|

|

|

|

|

By:

|

|

/s/ Martin J. Vanderploeg, Ph.D

|

|

|

|

Martin J. Vanderploeg, Ph.D.

President and Chief Executive Officer

|

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints Martin J. Vanderploeg, Ph.D. and J. Stuart Miller, and each of them, his true and lawful attorneys-in-fact and agent, with full power of substitution and re-substitution, for him in his name, place and stead, in any and all capacities, to sign any and all amendments to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, and hereby grants to such attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent or his substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons on behalf of the Registrant in the capacities and on the dates indicated.

|

|

|

|

|

|

|

Signature

|

Title

|

Date

|

|

|

|

|

|

/s/ Martin J. Vanderploeg, Ph.D.

|

President, Chief Executive Officer and Director

(Principal Executive Officer)

|

August 12, 2019

|

|

Martin J. Vanderploeg, Ph.D.

|

|

|

|

|

|

|

/s/ J. Stuart Miller

|

Executive Vice President and Chief Financial Officer

(Principal Financial Officer)

|

August 12, 2019

|

|

J. Stuart Miller

|

|

|

|

|

|

|

/s/ Jill Klindt

|

Senior Vice President, Treasurer and Chief Accounting Officer

(Principal Accounting Officer)

|

August 12, 2019

|

|

Jill Klindt

|

|

|

|

|

|

|

/s/ Brigid A. Bonner

|

Director

|

August 12, 2019

|

|

Brigid A. Bonner

|

|

|

|

|

|

|

/s/ Michael M. Crow, Ph.D.

|

Director

|

August 12, 2019

|

|

Michael M. Crow, Ph.D.

|

|

|

|

|

|

|

/s/ Robert H. Herz

|

Director

|

August 12, 2019

|

|

Robert H. Herz

|

|

|

|

|

|

|

/s/ Eugene S. Katz

|

Director

|

August 12, 2019

|

|

Eugene S. Katz

|

|

|

|

|

|

|

/s/ David S. Mulcahy

|

Director

|

August 12, 2019

|

|

David S. Mulcahy

|

|

|

|

|

|

|

/s/ Suku Radia

|

Director

|

August 12, 2019

|

|

Suku Radia

|

|

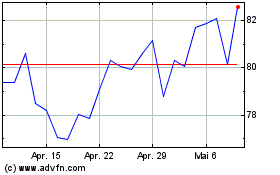

Workiva (NYSE:WK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Workiva (NYSE:WK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024