German Industrial Firm Thyssenkrupp Posts Loss, Cuts Outlook -- WSJ

09 August 2019 - 9:02AM

Dow Jones News

By Ruth Bender

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 9, 2019).

German steel-to-elevators group Thyssenkrupp AG on Thursday

lowered its full-year earnings target as price pressure in steel,

slowing demand in the automotive sector and higher raw-material

costs dragged down profits in the latest quarter.

Thyssenkrupp's warning is the latest example of a German

export-reliant industrial group suffering from a worsening economy

weighed down by global trade frictions. Siemens AG last week warned

that a weakening global economic environment was dragging down its

key industrial businesses, while chemicals maker BASF SE in July

slashed its profit forecasts citing the ongoing Chinese-U.S. trade

frictions and sluggish demand in the auto market.

For Thyssenkrupp, the warning comes at a delicate time as the

company has for months been trying to come up with a plan to

reinvent itself as a more profitable organization.

Under pressure from activist investors, the group, which makes

steel, elevators and auto components, abandoned in May a previous

plan to split the company into two separately-listed units. Now it

is working on a plan to list its lucrative elevators business and

is cutting costs drastically to improve its performance.

Additionally, Thyssenkrupp said Thursday that it placed under

review three industrial business operations that it currently sees

as uncompetitive and where market conditions are particularly

tough: springs and stabilizers, which makes chassis components for

auto component makers, system engineering, which makes production

lines for auto companies, and heavy plate, part of the steels

business.

Thyssenkrupp said these three businesses contribute 4% of the

group's revenue but burn a lot of cash, accounting for a quarter of

the company's expected negative cash flow this year.

While the company has been trying to overhaul itself, results

have disappointed again and again. Last year, Thyssenkrupp issued

two profit warnings.

When announcing the new strategic plan in May this year,

Thyssenkrupp already warned of a net loss for the full year after

integrating its steel division back into forecasts when it

abandoned the split and a planned European joint venture with

India's Tata Steel (500470.BY).

In the quarter to the end of June, Thyssenkrupp posted a net

loss of 94 million euros ($105.3 million), a slight improvement on

the EUR131 million posted the same quarter last year, while

adjusted earnings before interest, a key number looked at by

analysts, fell 32% to EUR226 million. Sales were flat at EUR10.78

billion.

Chief Executive Guido Kerkhoff said the group's performance so

far this year was "not satisfying", but said that was why its plan

was exactly the right one. For the full financial year Thyssenkrupp

now expects adjusted EBIT to reach around EUR800 million, compared

with a previous forecast of between EUR1.1 billion and EUR1.2

billion.

Write to Ruth Bender at ruth.bender@wsj.com

(END) Dow Jones Newswires

August 09, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

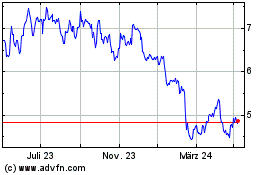

Thyssenkrupp (TG:TKA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Thyssenkrupp (TG:TKA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024