Car-Parts Giant Pivots to Electric -- WSJ

08 August 2019 - 9:02AM

Dow Jones News

By William Boston

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 8, 2019).

BERLIN -- One of the world's biggest car-parts makers is

preparing for a future without the internal combustion engine --

the machine that has been at the heart of the auto industry for

well over a century.

In a major strategy shift, Continental AG said Wednesday that it

would cut investment in conventional engine parts because of a

faster-than-expected fall in demand as major auto makers accelerate

their shift to electric vehicles.

The move by the Hanover, Germany-based maker of tires,

lubricants, powertrains and other core components shows how tougher

regulation of greenhouse-gas emissions is pushing the industry

toward electric models and forcing manufacturers to redraw their

supply chains.

Continental said its board had voted to halt the expansion of

its hydraulics components business, largely focused on fuel

injectors and pumps for gasoline and diesel engines, to shift its

focus and future investments to components for electric

vehicles.

"The future is electric. We are convinced of this," said Andreas

Wolf, head of Continental's powertrain division, which is

reorganizing under the name Vitesco Technologies.

The auto industry's multiyear boom after the financial crisis

came to a sudden end this year, as trade conflicts and slower

economic growth caused new vehicle sales to start declining.

Analysts say 2018 marked not only a cyclical peak in sales of

new cars with internal combustion engines, but also likely was the

beginning of a decline in their share of the overall market.

AlixPartners, an auto industry consulting firm, predicts that the

combined share of gasoline and diesel engines in new car sales will

fall from 95% in 2018 to 56% by 2030, replaced by battery electric,

hybrid and plug-in hybrid vehicles.

The biggest shift is expected in Europe. Driven by tough limits

on greenhouse-gas emissions, forcing car makers to go electric, the

share of gasoline and diesel engines is expected to fall to 42% by

2030, compared with 59% in the U.S. and 50% in China.

Continental made the announcement as it released earnings for

the three months to the end of June, reporting a 41% drop in net

profit to EUR485 million ($543 million) and a 1% decline in sales

to EUR11.3 billion. It attributed the weakness in the second

quarter to a global slowdown in automotive production.

Mr. Wolf said that although the auto industry would continue to

use conventional internal combustion engines for many years, it was

becoming difficult to justify the high cost of improving components

to make gasoline and diesel engines less polluting.

As car makers accelerate development of electric vehicles and

demand fewer components for combustion engines, the traditional

business of suppliers like Continental promises to offer "only

selective growth opportunities" in the future, the company

said.

"Investments in research and development and in production

capacity for innovations are becoming less profitable," Mr. Wolf

said in a statement.

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

August 08, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

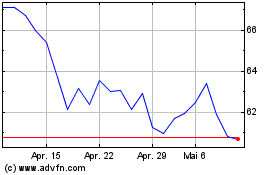

Continental (TG:CON)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Continental (TG:CON)

Historical Stock Chart

Von Apr 2023 bis Apr 2024