Weak Earnings, Trade Tensions Weigh on Global Stocks

18 Juli 2019 - 3:29PM

Dow Jones News

By Lauren Almeida and Anna Isaac

Equities fell around the world Thursday as another snag in

U.S.-China trade talks and weak earnings shook investor

confidence.

In U.S. offhours trading, shares in Netflix fell 11% after the

streaming giant said its number of subscribers in the U.S. declined

for the first time in nearly a decade. Ebay rose 5.7% after the

online marketplace raised its profit outlook and notched

better-than-expected quarterly results. Meanwhile, Qualcomm dropped

0.9% after the European Union announced a second antitrust fine

against the telecommunications giant.

Futures tied to the Dow Jones Industrial Average slipped 0.1%, a

day after U.S. stocks fell as the start of earnings season exposed

weaknesses in the growth outlook for some companies. Microsoft is

set to report second-quarter results later Thursday.

In Europe, the benchmark Stoxx Europe 600 index was almost flat,

with declines in the technology and energy sectors offset by gains

in health care. Shares in SAP dropped 6.9% after the German

business-software maker reported disappointing second-quarter

results. Nordea Bank fell 5.7% after the Helsinki-based lender

reported a 39% drop in profit.

Novartis led pharmaceutical stocks higher with a 4.5% jump after

the Swiss drugmaker raised its full-year forecast for the second

time this year.

While the European economy is doing well, "it's more about

downside risk coming from trade wars combined with the everlasting

Brexit risk," said Jorge Garyao, global head of inflation strategy

at Société Générale. The trade tensions that are currently focused

on U.S.-China "could easily move into the eurozone," he said.

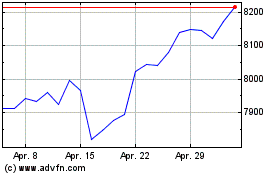

The U.K.'s FTSE 100 index continued to trade down 0.5% after the

government spending watchdog, the Office for Budget Responsibility,

warned of a recession lasting at least a year if Britain quits the

European Union without a deal. The report said that a no-deal

Brexit could cause the U.K. economy to shrink 2.1%.

In Asia, the Shanghai Composite Index fell 1%. Progress toward a

trade deal has stalled while the Trump administration determines

how to address Beijing's demands that it ease restrictions on

Huawei Technologies, people familiar with the talks said. No

face-to-face meetings have taken place or been scheduled since

President Trump and President Xi Jinping of China met last month in

Japan and agreed to resume talks.

"Markets don't seem to be taking the comments on trade tensions

very well," said Fritz Louw, a currency analyst for Mitsubishi UFJ

Financial Group. He added that investors are likely to see several

days of volatility as they await progress in talks between China

and the U.S.

The Nikkei 225 gauge dropped nearly 2% after Japan's exports

tumbled for the seventh straight month in June, hit by a sharp drop

in shipments of chip-making tools and automobile parts to

China.

The yield on the 10-year Treasury fell to 2.071% from 2.102% on

Wednesday, according to data from Factset. Yields fall when bond

prices rise. The WSJ Dollar Index, which measures the currency

against a basket of peers, was down 0.07%.

--Caitlin Ostroff contributed to this article.

Write to Lauren Almeida at lauren.almeida@wsj.com and Anna Isaac

at anna.isaac@wsj.com

(END) Dow Jones Newswires

July 18, 2019 09:14 ET (13:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024