Filed by Ingersoll-Rand plc

Pursuant to Rule 425 under the Securities Act of 1933, as amended

Subject Company: Ingersoll-Rand plc

Commission File No.: 001-34400

Transcript of Ingersoll Rand and Gardner Denver

Joint Ingersoll Rand Industrial Town Hall

Moderator:

Mike Lamach

July 12, 2019

8:00 a.m. ET

|

|

|

|

Carrie Ruddy:

|

Welcome from Davidson, North Carolina. Good morning. Good evening. I’m Carrie Ruddy. I lead the communications team for Ingersoll Rand, and I am pleased to be here with you today for this special town hall.

|

We’ve got a great agenda. We’re going to be talking about the transformational opportunity to form a new industrial company, and we will have plenty of time for your questions. Please be thinking about what you might like to ask as we move through the program.

Today, we’re thrilled to have with us Mike Lamach, Chairman and CEO of Ingersoll Rand, and Vicente Reynal, CEO of Gardner Denver and CEO of the future new Ingersoll Rand.

We also have other leadership team members from both companies here with us in Davidson who can assist during the Q&A, and we’ve got thousands of our industrial team members joining us from around the world which is exciting and we’re glad to have you today.

A few tips if you’re connected remotely, please turn off your VPN for a smoother webcast. And if you experience any issues, you can switch to the phone option and you’ll find that information on My Ingersoll Rand.

We will also be posting a replay on My Ingersoll Rand next week so you’ll have that if any of your colleagues miss today’s town hall.

And now I will turn it over to Mike Lamach to get us started.

|

|

|

|

Mike Lamach:

|

Thanks, Carrie. Good morning, everybody here in Davidson and everybody joining in the phone especially the people in Asia. It’s Friday night. It’s 8 o’clock, so thank you to our team in Asia for joining.

|

It’s exciting to be here. It’s hard to believe it’s been a little over a couple of months. In some ways I feel like - it feels like you could blink and it’s gone by. In other ways it’s been a lot of work and it feels like a long time.

I’m excited also to have Vicente here with me on stage and really the discussion this morning is his discussion with all of you around the vision for the new Ingersoll Rand. I did want to take a few minutes up front, though, to set some context, and I can’t help but go back to an analogy stuck in my head around a jigsaw puzzle.

Let me ask you, people in the room, how many people have ever worked on a jigsaw puzzle? OK, how many people have actually finished a jigsaw puzzle? OK, glad to see that the majority of our people are not quitters.

So when I think about this, when you look at a jigsaw puzzle, you go to a store, you buy it. All these beautiful pictures of puzzles, you’ve got to select one. You pick one that’s relevant for you.

You pick one that’s meaningful to you, it’s inspiring to you. And generally the ones that are the most beautiful are the ones that are the most complex when you open the box. It’s the beautiful pictures.

It’s like a vision you have for a new company, and a couple months ago I showed you the top of the box. I said, “look, this is the vision for what we want to do as a company,” and you had a chance to react to it. We went out and talked to shareholders and let them react to that box top, to that vision.

I got to tell you in the 20 years that I’ve been talking to shareholders in a meaningful way, I’ve never had a situation that was so overwhelmingly in support of what we were trying to do. In other words, agreeing that the vision that we’re trying to complete was valuable.

And then from our point of view not just valuable to a shareholder which clearly the value’s been reflected in Ingersoll Rand stock and in Gardner Denver stock, and very

seldom do you see that reflected in that way with both companies achieving the kind of shareholder growth that we’ve had.

But it’s also about the ability to construct something and build something, and there’s one thing about building a puzzle is it starts with you’ve got this vision. You open the box - you open the box and say, “wow, there’s a lot of pieces here.”

And the good news is we’ve got lots of people to help put the puzzle together. You’ve got all the Ingersoll Rand team that’s a part of the industrial business going forward. We’ve got the Gardner Denver team helping us as well, but you take the pieces out of the box and you got to get organized.

And what I would tell you is the way we’ve organized this is we said look, fundamentally for the sake of the analogy anyway, we’ve taken the pieces and cut them in half and said, “Ingersoll Rand, we’ve got to work on the separation part of the puzzle. We’ve got to essentially take this integrated company we have and stand up an industrial company and a climate company so that Gardner Denver who leads the integration and planning can actually help integrate that, take the lead integrating that”

So we take our puzzle pieces, we turn them all over color side up, we find the edges, we start putting a few pieces together, and you look up and you see Vicente and his team have got all the pieces turned over with the color, you’ve got all the borders lining up, and we’re now start sort of in the position here where we’re snapping together the frame, the outline.

The planning is being completed, the teams are being formed, and we get a sense and get a perimeter of this thing - the perimeter of the puzzle. You feel a sense of accomplishment about that, but then you look and say that’s actually not the hard part of the puzzle.

The flat edges are not the hard part. The hard part’s in the middle. And so, we’re going through the hard work right now of all the separation planning, all the integration planning on the GDI side that eventually we all start to participate in that more realistic - fully together because we all want the same thing which is a really beautiful vision executed around what the company could be.

And I think it is a fantastic vision for what Ingersoll Rand Industrial can be, but the standalone focused industrial company that’s a global leader in mission-critical flow creation and industrial technologies with platforms that can be built on in the industrial segment for growth and a bright future I think in the marketplace that has a strong legacy both that the people here and on the phone have helped create and certainly all the people at GDI for a long period of time have helped make possible.

So as I said, the shareholder response, this has been absolutely fantastic. Our focus was to move as quickly as we could to try to close some of the gaps that we have and to make sure the communication was flowing to you as quickly as we could.

And one of the most important things that we needed to do happened this week which was literally thousands of conversations happening across the globe - personal conversations, letters.

We came to people to say this is where we see the alignment going forward. We think that you have a bright future in the industrial business. We think that we would like for you to stay in the climate business, and we tried to make sure that everybody in the organization, and I believe we’ve got through everybody in the organization to know where it that we’re intending for that future to be.

Everyone here today has been invited really to be part of that industrial journey that we’re - that Vicente’s going to talk about in a few minutes. Still a lot of questions and a lot of questions that we don’t know answers to because we really haven’t yet got into the detailed work around that middle of the puzzle to make it all work together and answer some of those.

Other questions we perhaps cannot answer for legal reasons. One of the difficult things about where we are is that we can do a lot of integration planning, we can do some integration work, but we’re required, right, by law and by rules to make sure that we’re running as two independent companies until the day of close and, in fact, in some of the business we overlap and we compete. It’s especially important there that we do that.

With that being said, there’s a lot we can do around integration planning to make this as smooth as possible, to start in a positive way. And by the way, and that’s the subject for

today to be sure to start the climate company in a very positive way about its future. And so, this is all critically important for us to get done.

So as the questions come up today, we’re looking forward. Vicente, I’m sure primarily you’ll want to ask him and he’ll want to answer as many of those questions as he possibly can. To the extent that I can help with anything on my end, I’m happy to do that as well.

I want to say I’ve been able to spend a significant amount of time with Vicente over the months, and it’s really important to me that not only the deal makes sense from a strategic point of view and that the pieces work together and we create more value as a whole, but it’s very important to think about how the company would be led.

A leader has to have principles, has to have a set of values that can help build a culture around a company and combine a company and lead it in a way to really realize that future.

And what I knew or else I wouldn’t have done the transaction and what I’ve reaffirmed throughout the process is Vicente really is that guy. So I want to introduce Vicente to you. Please welcome him to the stage - he will be our new CEO of Ingersoll Rand.

|

|

|

|

Vicente Reynal:

|

Thank you, Mike. Thank you, Mike, and good morning to everyone here. Good morning to those of you on the webcast. And like Mike said, thanks to those of you in Asia joining, those of you in Europe. I was actually talking to our China team this morning at 5 a.m., so it is always exciting to be such a global company.

|

It’s very exciting for me to be here. I can tell you that ever since I joined Gardner Denver in 2015, the combination of Ingersoll Rand and Gardner Denver has been top of mind. And I will categorize it as a dream transaction.

You’re going to see today through the presentation why that is and why we think that there’s just so much commonalities and so much competencies that we can put together to just create a phenomenal company together.

Before I start, just a little bit of background on myself because I know everyone is asking questions about who is this guy, what does he do and all that stuff. I was born

and raised in Puerto Rico. Just a week ago, I celebrated my 17

th

wedding anniversary with my wife.

Together we have three girls. Even though my wife is from Panama, I grew up in Puerto Rico. My parents are in Spain. My oldest - my two oldest daughters were actually born here in Charlotte, so it’s very exciting.

I lived in Charlotte for four years probably 11 years ago, and we’re very excited to come back to Charlotte and make Charlotte our home again. Like my oldest says, we’re going back to the beginning of her long 11-years of life.

But we had tremendous fun here in Charlotte. I mean, we did a lot of good work in the community, and I’m really looking forward to getting back and picking up a lot of the things that we were doing here.

So enough about myself. Just kind of highlights on Gardner Denver of today, and I’ll talk a little bit about a few things on what we do just to give you a perspective and so that you can get a sense that there’s just a lot of good things that we do that you are also doing, and that’s why I think the integration should be fairly smooth.

At the same time, there’s a lot of things that Ingersoll Rand is doing that we’re learning from, that we’re just going to take the best of both worlds and really create just a phenomenal company going forward.

So Gardner Denver, we’re a global leader in mission critical, flow creation products and technologies and solutions. Basically compressors, blowers, vacuums. Anything that it is mission critical where there is low cost. Our products are low cost to the overall system, but if our products fail, it’s a high cost of failure.

In America in our medical products, we make pumps that are this size that go onto dialysis machines, wound therapy machines, gene therapy, cancer research, so very important devices to move flow in liquids, chemicals, and gases.

And then on the other hand we have also very large pumps such as in the oil and gas industry, probably the size of this platform, that produce up to 10,000 PSI or the pressure to really frack the shale and really generate oil and gas.

And over the past few years, it’s what has led to a lot of the energy independence really in the U.S. and it is fantastic and phenomenal that we were able to participate in some of that, but at the same time, work on very sustainable things such as gas. Natural gas is one of the better energy uses and consumptions in the U.S. and growing and has created a great presence for the U.S. economic growth.

We’re fairly a global company although you can see in Asia-Pacific plenty of room to improve. That’s why we’re very excited with the business that Ingersoll Rand has created in Asia-Pacific, and I know (Arnold Li) has done a fantastic job and we’re looking forward to continue to work with the team here to accelerate that.

We like to say at Gardner Denver that our execution over the past few years has been around four strategic imperatives, and when you read these words, you can think about the imperatives that you’re also driving which are very similar. Just a slight tweak and different words but we have actually similar initiatives amongst both of us.

We start with deploy talent, and at the core of deploy talent is how we engage employees. And we believe that the mindset of ownership and engagement of employees can create a powerful combination.

I’ll talk about that here in a minute, but the main takeaway from today is that employee engagement, it is core to my priority. It is always the number one strategic imperative that I always talk about externally and internally, and we’ll continue to see that in the company moving forward.

Accelerating growth, a lot of focus we have done on innovation. I know at Ingersoll Rand you have done that, too, as well. We infuse our innovation with what we call demand generation which is a lot of use of digital marketing tools.

Margin expansion, we are big proponents on direct material cost reductions. Seventy percent of our cost of goods sold is direct material. That’s where we put a lot of focus and attention. We put a lot of focus and attention because we see a lot of value.

And when we talk about synergies on how we can work together in the new IR, new Ingersoll Rand, it has to do with a lot of direct material things that we can do - products, suppliers, supply chain, logistics, a lot of value that we can create because we

have common technologies in many cases and common platforms that we can build upon.

And allocate capital effectively. I truly believe that with the growth and the margin we generate a lot of cash and we can put that cash into investments, investments internally but also externally. Since we went and did the IPO in 2017, we have purchased six different companies with much more room for us to continue accelerating that growth and our portfolio of as we build the portfolio of companies that we have.

Let’s talk about employee engagement. We have a strong belief that high degree of employee engagement combined with an ownership mindset will be the catalyst of our company moving forward. And our belief is grounded on the fact that when we did the IPO, we awarded equity to all 6,000 employees across Gardner Denver, across the entire world.

And we gave equity to employees that were not in the management equity participation. So for example, I did not receive equity; my team did not receive equity. It was to the employees. And when we did that, we stayed very focused on some core employment priorities. One of those was networking capital and cash.

And we trained our 6,000 employees on what does it mean to be an owner of a company and what does it mean to think like an owner. So we train everyone on cash conversion cycles and how we could accelerate cash. And the improvements were phenomenal in just a matter of two years; close to 600 basis points improvement and much more room to improve.

Same thing with engagement, 300 basis points improvements and an immense amount of improvement that we can still do moving forward. And talking to Mike, there’s just so many fantastic things that you’re doing around employee engagement that we’re just looking forward to absorbing that and putting that together and working together.

One of those is around diversity and inclusion. I just signed a pledge around diversity and inclusion because it is crucial and very important for me personally, for our company, for our community and for our employees. This is something that I know at Ingersoll Rand, there’s just been a lot of great work that has been done here. And I know that we will be able to learn and continue to build upon that.

So that’s why when we announced signing of the transaction, we said that we want that same engagement and ownership mentality in the new Ingersoll Rand and we were confident and comfortable that day to talk about that we will be awarding equity to all employees of the new Ingersoll Rand.

A lot of the details of that obviously has to wait and will come at the day of close in early Q1 of 2020. But we want to do it because we want employees to have skin in the game. We want employees to have that runway of the performance that we will all be able to accomplish together, because ultimately as shareholders, we will have the same goal in mind.

And it is that type of mentality and how we operate internally with a high level of degree of agility, high level degree of nimbleness that a lot of our employees are saying that hey, I feel the culture of Gardner Denver to be, simply stated, it’s a 160 year old startup company.

Great legacy, great history but movement at a speed of a new company that we like to fail fast, we learn by doing. And we learn by learning from mistakes. And you’re going to try things in order to learn from that.

Many of you have heard about the Gardner Denver Execution Excellence or GDX. And I’m only going to show this here for a moment so that you get a perspective in terms of what it is. And just because it says GDX Gardner Denver Execution Excellence, it doesn’t mean that that’s what we’re going to push for in the new company. We’re going to learn about the Ingersoll Rand business operating system and take the best of both worlds.

What I can tell you that works really well with GDX is that it starts with the core values. Core values on the outer ring, strategic imperatives, and then what is very unique to us is the execution tools because we like to say that this is not an operating system, this is an execution process that allows employees to be engaged and creates self-directed work teams in the company to drive performance.

A performance that obviously can see some on the left-hand side but you’re going to learn more that growth in the concept s something that today we have about 70 of those

across Gardner Denver. And it allows me to be in touch with over 500 employees every quarter and how they’re driving performance.

And it is very nimble, very quick. It’s a quick 40 minute per week kind of conversation. But it allows that level of engagement and that weekly touch point creates a very agile environment.

What is important is that it starts with the core values. And when you look at the core values of Gardner Denver and Ingersoll Rand, very common language, that’s why we’re very excited that this level of integration is going to go very smooth. We want it to. That’s why we’re doing a lot of planning, a lot of work, a lot of things are happening backstage for us to be able to accomplish that.

What’s very exciting is that right now we know that we speak some common language. Common language that is based with a strong foundation on trust, and trust we believe can be a competitive advantage. And trust we start at a high level and we keep it at a high level. I don’t have anything to not trust all of you, and you have nothing to not trust me.

So I think that’s the type of mentality that we want to continue to work because as long as we’re openly communicating with each other, we’re going to continue to build that trust and make it a competitive advantage in the new company.

So it is with the building of trust that we’re combining two premiere companies, Gardner Denver Ingersoll Rand industrial segment to create a global leader of mission critical flow creation and industrial technologies.

And the big benefit for our customers is that we’re going to have a company with greater global reach and scale across technologies such as vacuums, compressors, pumps, fluid management as well as having some great presence in technologies such as power tools, material and handling and small electric vehicles.

The financial profile of the new company is very compelling. That’s why as Mike said, it has been very well received by shareholders and the investor community. It’s going to be a company with close to $7 billion, a $6.6 billion revenue company where 40 percent is recurring after market. So a $2.5 billion platform that creates recurring volume.

And that is very exciting for investors. It’s great. On day one, we’ll have 21 percent EBITDA margins so shareholders are excited that it is a highly profitable company that obviously can continue to do more in order to create the cash flow that we need to continue penetrating the market that we want to play in.

And with roughly $7 billion revenue, we’re going to be playing in a roughly $30 to $40 billion market, we estimate. So that’s our own internal estimates and we’re doing a lot of work in a market that is highly fragmented with a lot of potential of continue acquisitions that we can have.

So we’re excited that this is going to be at play for long-term shareholder value creation. That’s why we believe that we want employees to be shareholders for the long-term value creation that we all can achieve together.

So the combined company that we’re going to build together over 300 years of history will be based in headquarters here in Davidson, North Carolina. As Mike said, right now, the announcement has been only the CEO and the chairman, Pete Stavros who is the current chairman of Gardner Denver and who’s a fantastic individual, true believer and passionate about employee engagement as well and ownership mentality.

The business leadership officials will be communicated over the next couple months, hopefully sooner. Trust me, I’m eager to get all that done so that we can get going with everything. And we’ll talk more about how we’re kind of re-segmenting the business and structuring the business to make it a very P&L focused business as that’s how we drive our business today.

In terms of the timing, this is a bit of a highlight milestones. And what is actually exciting is that on June 29th, we got the expiration of HSR. That means U.S. antitrust, which was a major milestone for us to get through. As Mike said, we are in some cases competing against each other but obviously not a core concern on the antitrust thing.

So that’s a very good milestone for us. And you can see in parallel, we continue to work together on the integration planning. This is not a Gardner Denver integration game plan. This is a Gardner Denver and Ingersoll Rand integration game plan. And that’s how we play. And that’s how we will continue to play.

So that when we get close to expectation of closing, we’re going to be forming that new Ingersoll Rand company. You see that obviously we kept the same name of Ingersoll Rand and we’ll see what the stock symbol might be but we think it could be IR, stock symbol. Still a lot of work to be done on that.

So, I’ll just leave you with maybe three words that for me have a lot of meaning, trust, engage and create. Trust us, I trust you, trust we because we’re creating this very unique company. This is the time that you have to continually get engaged in the integration planning as well.

This is a time for us to think about how do we improve our engagement in the company moving forward, because ultimately we want to create something unique that we as shareholders of this company will create and engage that long-term shareholder value creation. So then with that, we’ll leave it open for the most exciting part, the Q&A. I always measure how many questions I get in every town hall meeting.

|

|

|

|

Carrie Ruddy:

|

Thank you so much. If those of you in the room will start thinking about your questions, I’ll start with some that came in pre-submitted over the webcast and through our e-mail channel. And you can submit through the corporate communication mailbox or through the webcast button.

|

So first of all, Vicente, we’ve been hearing about your lean organizational structure that is a bit more decentralized than what we’ve had at Ingersoll Rand. How do you think you’ll approach that going forward with the new company?

|

|

|

|

Vicente Reynal:

|

Yes, I think when I think about lean, it means that we’re looking at ways on reducing complexity. So think about it as just because we may say or it’s been said that we’re lean, it’s all about complexity elimination. Always thinking about how can we do better things with the ultimate goal of the customer and the employee and obviously the shareholders which ultimately get rewarded.

|

So I think it’s all about more on how in the new company how do we - and today we’re doing a lot of what we call blueprinting. So we’re doing value stream mapping of current processes and then we do value stream mapping of the future process in terms of how do we remove some of the non-value added steps in the processes so that we can remove the complexity and obviously become more efficient and more effective.

|

|

|

|

Carrie Ruddy:

|

That’s good to hear. And it sounds familiar. We’ve been talking a lot about complexity reduction as well, so.

|

|

|

|

|

Carrie Ruddy:

|

Good. What are you talking to customers about in - with regard to the merger and what are you hearing from customers?

|

|

|

|

|

Vicente Reynal:

|

Customers, the feedback that I have received from customers and as we get to know each other, I mean you see I’m on the road constantly at the factory level. I was yesterday in Mocksville and it was very exciting to be there. I told the team that for me naturally it’s exciting to get that smell of coolant.

|

Because that’s where I grew up, I grew up in operations and I grew up in a factory. That’s my background. When I go and talk to customers and employees, everyone is very excited.

And it’s because what I just said very subtly is that we’re having - we’re going to have a global scale and global reach on product offerings. I’m an engineer, so we have plotted basically pressure points and flow maps of all of our technologies. And that’s how we have to apply our innovation to fill some of the gaps in those flow maps.

And when we do the combination, everything is so complimentary from obviously the compressors, from the blowers, it is exciting. So I think customers view it the same way. And when we talk to them, they view that they can now have a greater solution set from one company and for customers it’s very exciting.

|

|

|

|

Carrie Ruddy:

|

That’s great. We’ve had several questions come in on commercial integration which I know we may not be able to fully answer yet. But any early thoughts on the overall kind of product and brand plan and what we’re thinking about whether products would be positioned as multi-brands or some product line integration.

|

|

|

|

|

Vicente Reynal:

|

Yes. No, great question. I’m a strong believer that if there’s a strategy or multi-brand, multichannel, it works. There’s got to be a strategy and we execute the strategy. But multi-brand, multichannel works very well. Even though today we’re called Gardner Denver, we have over 35 different brands and we leverage that based on markets, based on countries, based on end markets and even based on customers.

|

So it can work and it will work, and that’s why we continue to see Ingersoll Rand is a great fantastic brand, so is Gardner Denver in some kind of markets. So I think we’ll continue to have this multi-brand multichannel strategy working.

|

|

|

|

Carrie Ruddy:

|

Great. You touched a little bit earlier on demand generation. And so I wondered if you could expand a little bit; there was a question around your views on innovation and demand generation as it relates to that.

|

|

|

|

|

Vicente Reynal:

|

Yes, demand generation is something that I enjoy. It's in the sense that - think about it that today, obviously we know direct to consumer marketing, how it happens in the digital space and digital world. Believe it or not, in the industrial space, it doesn’t happen that often because it is more difficult to get to that to engineer, to get to that end user.

|

And when you look at our customer base, which is also similar to the customers of Ingersoll Rand, it is highly fragmented customer base. We don’t have a single customer that is more than 2 percent of the total revenue. Multitude of customers, multitude of end markets. So best way is for us to be able to reach in a very cost efficient way.

And when you think about the path of innovation that we want to launch, it is very important to launch new innovation, but it's more important to educate customers on what that innovation does. So you've got to have a great way for reaching that to the masses, and today we have what we call (demand generation center) for roughly 25, 30 people and growing in one location, and these are kind (inaudible).

Its great A.I. individuals - artificial intelligence individuals that basically that all they do every day, they wake up thinking about how can I generate leads, right? And that's really exciting and something that we continue to evolve and accelerate and I'm sure we’ll learn about what Ingersoll Rand is doing in this space, but we’ll be able to share that platform.

|

|

|

|

Carrie Ruddy:

|

Interesting. Let's go to the room and see if anybody would like to ask a question here in Davidson. Please raise your hand. We’ve got one there in the back, I think.

|

|

|

|

|

Carmi Spicer:

|

Hi, good morning. I haven’t talked much, sorry.

|

|

|

|

|

Vicente Reynal:

|

Good morning.

|

|

|

|

|

Carmi Spicer:

|

My name is Carmi Spicer, I'm a project manager. Vicente, I'm interested what's the view on responsibility in terms of environmental impact in the company of Gardner Denver right now, and how do you see that moving forward when combining with the brands from Ingersoll Rand?

|

|

|

|

|

Vicente Reynal:

|

I mean, fantastic question and (probably missed when I was talking) about that in my presentation. It seems that when we think about innovation, number one requirement on all of our products when we innovate is energy efficiency. And if you look at our blowers, it sounds simple, a blower, you think about that's just a simple fan. Our blowers, it's got high engineered blowers in mission critical applications.

|

So one example of that is waste water treatment facilities. When you go to a waste water treatment facility, you see a big tank and something that kind of moves around, our blowers are basically what creates the aeration in a waste water treatment facility to remove waste from the water.

Believe it or not, 60 percent of the energy consumed in a waste water treatment facility is consumed by the blowers because those are pushing air at very high flow - low pressure but high flow, 24/7. So our focus has been on, how do we help that? How do we help reduce the energy consumption? So we launched a product that basically cuts that energy consumption by 50 percent. Same thing we do with our compressors.

So I would say that our environmental sustainability is evolving. We started really by looking at our products and how do we improve our products in the (environment). Obviously with a very high-level focus of energy efficiency, and that has been the main driver for us. I think I will definitely be able to learn a lot of what Ingersoll Rand is doing around footprint because it's an area that we do have a lot of potential work.

As simple as it may sound, we just are converting one of our major factories from halogen lights to LED lights. It's like $1.5 million savings. It requires some CapEx improvement, but we're doing it. When the team came by and said this is fantastic, it not helped the environment, creates some savings, great opportunity.

So I think there is a lot of things that we can do and I'm really looking forward to learning more from what I have learned from Mike and what Ingersoll Rand is going, which is very fantastic things, and apply that into any company.

|

|

|

|

Carrie Ruddy:

|

Vicente, we had a question on plant performance. And here at Ingersoll Rand, we've had a plant recognition system that ranks plants on different criteria. How do you assess plants?

|

|

|

|

|

Vicente Reynal:

|

Yes, good question. I mean, we simplistically look at it as, what we call in our daily management board, plus Q-DIP, the plus is safety.. So safety, quality, delivery, inventory, productivity. That's how we manage our factories. Every day, not only at the factory level but at the cell level.

|

And we haven’t gotten to the point of globally comparing one against each other because we think we know that there are differences, but I will definitely be looking for to learn more from what Ingersoll Rand is doing and how do we leverage that comparison into a best practice. But today we do it best on safety is number one, and then the other KPIs come in and we tried that from a factory to factory perspective.

|

|

|

|

Carrie Ruddy:

|

OK. We’ve had a question on if you will be visiting Inersoll Rand's industrial plants before close, and also your thoughts - early thoughts on any sort of combined manufacturing footprint?

|

|

|

|

|

Vicente Reynal:

|

Yes, so (to emphasize), yes. Yesterday I was in (Mocksville). We're planting a trip for the end of August to be in China, and I'm sure more will come through the process and the plan of integration, and that is very helpful for us to see all the great things that Ingersoll Rand is doing so that we can help understand how do we create that better synergy, right?

|

I mean so for example, I mean, I know obviously in a compressor market, you make airends, we make airends. We make airends across three of four different factories, we make it across two factories. How do we create better economies of scale of making something as simple as making something like an airend?

But that's a lot of the work that we're doing. And I was very exciting to see all the technology and the advancements and implemented in Mocksville, and that was very exciting for me to see.

|

|

|

|

Carrie Ruddy:

|

Great. Can you share a little bit about your operational excellence work at Gardner Denver? And if you have OpEx resources out in the field and in different facilities, or if you have more than a centralized approach?

|

|

|

|

|

Vicente Reynal:

|

Yes. So think - the philosophy that we have is that every employee in the company should be thinking always about continuous improvement. That's why we're all owners and shareholders of the company. I know it comes with some level of expertise, that's why when we awarded the equity, we train all employees on cash and we put in very simple concepts. We said hey, think about inventory as when you go home and you buy groceries ,you don’t buy groceries and put them in your home for like 120 days because a lot of that is going to go stale.

|

The same thing happens with our inventory. If you buy too much, it goes stale. So how do we help you think and then we say, well, Kanban are something unique that helps trigger the right amount of purchases.

And not only Kanban , but when you trigger, you look at the forecast and then you know. So I think we view it in a very simplistic way of saying, what are the tools that we can help implement across the organization? How do we train employees and how do we give them access to these technologies?

And in some cases we bring some expertise - we may call it operational excellence - into those factories to help them with the training and coaching. But at the end, ultimately it needs to happen by either the plant manager, the P&L leader, the commercial leader. There has to be that desire of continuous improvement for those improvements to stick.

Because one thing that you can improve and you do a Kaizen event, and then if the leader of that area has not bought into it, it’s going to go backwards. So I think it’s how do we create that buy-in through the process and that is kind of how we think about that philosophy of operational excellence and continuous improvement.

|

|

|

|

Carrie Ruddy:

|

Great, let's go back to the room here in Davidson. We've got one back here.

|

|

|

|

|

Thomas Steen:

|

Hello, Thomas Steen, the engineering leader in CTS. When I joined Ingersoll Rand a couple years ago, I was introduced to new concept called the PGT, a product growth team that was not in the company I previously came from, and this is where an engineering leader, manufacturing leader and product manager would get together and drive growth in the product. So I was just wondering from Gardner Denver, do you guys do something similar? What do you do in that sense, and get your thoughts on that.

|

|

|

|

|

Vicente Reynal:

|

Yes, no, great question, and this is something that, when Mike and I, we were having a lot of conversations, we said growth rooms, we call it PGT, I'm looking forward to learning more about how you do your PGTs and combined of best of both worlds. But the growth room is exactly that.

|

We call growth room as, you have a mini board of directors of the business and there's like five or six - five KPIs; sales, marketing, innovation and so on, and that is what we drive on the growth room. So we’re going to be very similar, with a twist, but I am sure by taking the best of both worlds, we could create something that is going to be even better than what we both each other have.

|

|

|

|

Carrie Ruddy:

|

Any other questions here in the room? I've got one here.

|

|

|

|

|

Jason Grizzi:

|

Hello, Jason Grizzi, I lead marketing, which includes to (manage generations sales) for the compression business. Just a question, a lot of people in this room are excited about the integration work and have lots of ideas on how to put that puzzle together, so a lot of us had been thinking about that.

|

The question is, what's your view about how we engage in that process or the timing in which you'll see people engaging that process and how we should be kind of collecting those ideas and being ready for the time?

Vicente Reynal:

Yes, so we have a pretty good rigorous process, Mark Majocha is helping us with that. And I think this is part of that evolution. I think there were some very important steps to go through the timeline, like HSR. The anti-trust, it was very concerning and we said, let's just go through that to then see then how can we then after that get more acceleration?

And yesterday, the senior leadership team from Ingersoll Rand and myself and some of my team members, we came and we had a very great discussion, and I think you're going to see more of that. I know it is happening. It is happening on the finance where there's conversations about that. It is happening with the I.T. team where conversations are happening with the manufacturing, with operations.

I think that the demand generation has been more -so far, has been in the bucket of commercial and commercial was a very critical concept around HSR area that could not be touched, and I think we just need to walk cautiously on the commercial side just because of the regulatory sides. But there are a few things like demand generation and marketing on processes and tools that we could definitely start having those conversations.

So I think you're going to definitely see more of that and as that we announced, more of the steering committee and everyone else from the Ingersoll Rand, you'll have - like a point and channel person that you can go to and say hey, I really want to get involved, I have some ideas, I want to learn and let's just do it together.

|

|

|

|

Mike Lamach:

|

If I could add, Jason, to your question, you're getting back to this puzzle analogy, when you think about the starting point, the separation management, right, there's no integration if you can't properly separate. And we found about 500 different milestones that we've got to hit internally on the separation, and we found over 500 interdependencies. You can think about I.T. touching everything as an example. But there are more than just I.T.

|

So we need a couple three months head start to get organized around separation management. Get ourselves in a position where we feel like we can execute against the actual separation itself. We then need to screen it against some of the legal thresholds just to make sure we’re not doing anything to put you or the company or anybody in jeopardy around what is referred to as gun jumping, getting out in front or somehow competing inappropriately in the business.

Having said that, all that is solvable and so we're - Vicente and I - our goal - and it would be our goal - and believe me, with PFS and others, it was our goal, we want to integrate as soon as possible. The complexity of this one is a little bit different in that

the separation - because you all know how integrate is, right? There's a lot to take that apart.

So what we did yesterday was, we tried to identify a handful of areas that it would be helpful both from separation and integration to accelerate those. And then some areas where we need to do a little bit more work from a separation perspective, to be in a position o really engage.

What were going to try to go is just systemically try to drive more engagement around the integration without jeopardizing the separation, if that makes sense for you. so that - I would say that the brakes on the integration are more on our side for sure, and part of the effort yesterday was to help make sure that the GDI team knew that that wasn’t because we’re difficult people to deal with, it's because there's an immense amount of work to be performed to separate what has been heavily integrated. Thanks, Jason.

|

|

|

|

Carrie Ruddy:

|

I had a question for you, Vicente, that came in around how you run the P&Ls. And so we've heard that you might be organized a little bit differently today at Gardner Denver where plants are responsible for revenues down there operating income. And so wondered if you could expand a little bit on that and kind of what you see as maybe go-forward approach.

|

|

|

|

|

Vicente Reynal:

|

Sure, yes. So our philosophy is around that level of accountability that if you have a general manger your running a P&L, you want to be able to let that general manager drive everything from orders to revenue to profitability. And that includes have the Salesforce, having engineers, having the factories, having the marketing team, having the HR team, having everything that is needed for that general manager that we're trusting with that P&L.

|

We do a lot of that. I mean we were - just before coming on Thursday here, on Wednesday, we were having one of our growth room sessions, where we had one of our general managers, I think he's now - he's probably in his mid-30's

He’s managing a $75 million P&L. And he has everything. He has responsibility for the factory, sales team, operations, marketing, and you cannot believe the amount of entrepreneurship that has come out of that business from that, what we call a GM. But we cannot call a general manager a general manager if the general manager doesn’t

have the ownership and the accountability to drive that business. So that’s just our belief.

Is that we want to ensure that whether a factory is (in measure of revenue). We measure the revenue is a P&L and the P&L supports the output of the factory. So that’s how we think about it.

|

|

|

|

Carrie Ruddy:

|

Great. Could you talk a little bit about the most exciting part of the industrial technology side of the business versus the flow control?

|

|

|

|

|

Vicente Reynal:

|

So repeat that one more time…

|

|

|

|

|

Carrie Ruddy:

|

Industrial technologies…yes. Yeah.

|

|

|

|

|

Vicente Reynal:

|

Oh OK, I got it, so Industrial technologies, yes, the power tools, and…

|

|

|

|

|

Vicente Reynal:

|

I think everything is really - there’s just a lot of excitement across everything. When I look to the team at Club Car, the amount of growth and the demographics and when you look at the trends - and I did some conversations with customers and competitors.

|

And everyone speaks incredibly highly about the power train that the team in Club Car has developed. And how that can be transformative across all the investments that you’re doing in the commercial and the utility market.

And how when you look at and you travel and go around the world and see that there’s cities like Paris or Amsterdam, that they’re preventing or thinking about preventing cars to go into the city and they need small transportation vehicles, it is core to us.

It is core to what - what the team at Club Car is developing, so that’s really exciting. When we look at the power tools and - in the U.S. we have a compressor brand that we call Champion and Champion basically is sold to - through about 3,000 different agents and distributors really core.

And when you look at what that bag is within those agents and distributors for that specific brand, they don’t have power tools. So I mean how do we continue to ensure that we work together commercially on something like that or how do we continue to

evolve on the conversion from nomadic to DC on the power tool side, which I think is very exciting.

I just think that there is a lot of good things that are happening across the entire spectrum of both sides that is difficult to pinpoint one or the other. I know there is a lot of great innovation that Todd will tell me about on the - on the compressor side.

So - and the conversations that I had with Nick on PFS as well. ARO has been a great product line that we have watched and obviously tried to mimic into a lot of cases in our medical space. We do have diaphragm pumps.

So basically we take the same technology, miniaturize it, applicable that into medical devices. So these are just a lot of great cross technology that we can do really well together.

|

|

|

|

Carrie Ruddy:

|

Definitely. Could you talk a little bit about your current go to market strategy in terms of third-party distribution versus direct?

|

|

|

|

|

Vicente Reynal:

|

It varies and it varies across the product line that we serve, across the segment, and across the end market. So in the compressor side, for example, we do tend to go in the U.S. We tend to go through a distribution.

|

We have a very loyal distributors at the Gardner Denver level. It’s about a hundred-plus distributors. Then we have another brand that we call Champion that’s kind of more of an entry-level that we do sell to about 3,000 distributors.

But in the U.S., it’s primarily distribution. You may be thinking that in the U.S. Ingersoll Rand goes direct. We actually like that because there are so many technologies that we’re - it’s not that we are going to take our channel - move away from that channel and then put everything direct.

I think we can leverage both channels. An example here is when you go to California, we only have one dealer for the entire state of California. I’m sure there is going to be a better way to create coverage in the state of California when we work together.

When you look at technologies that were launching like oil free Ultima compressor, oil free Quantima compressor, we’ve been doing a lot of work on the oil free market. So

that’s Ingersoll Rand. We think that technology can be better served with a way of better educating end-users and customers about the total cost of ownership and in different technologies.

So I think there is just a lot of great combination that we can do together that we’re going to be developing that together as part of integrations. So I think regardless of where we are today we’re going to take the best of both worlds and create great combination, all in mind to ensuring that we’re creating value for the customer and value for all of us as shareholders.

|

|

|

|

Carrie Ruddy:

|

We had a question come in about, wondering your thoughts on our engineering and technology centers.

|

|

|

|

|

Vicente Reynal:

|

I think what - and I’m looking forward - that’s another place that would like to visit for example, going to India to see the ETC. I think what you have done there is - looks fantastic. And it is something that that we have tried.

|

Not as successful, obviously we are journeying to the engineering service - engineering the ETCs, engineering service centers, we call it. We’re at the early stages. So I think what you have done can really accelerate what we wanted to do. So we’re looking forward to learn more of what has been done so that we can emphasize and move forward.

|

|

|

|

Carrie Ruddy:

|

That’s great. Let’s check back with the room. Anybody have a question out there? Here we go, right here in the center

|

|

|

|

|

Mark Dudek:

|

Morning, Vicente. My name’s Mark Dudek, I have the pleasure of helping to lead our services business for the compression technology segment. Just love to hear your thoughts on maybe some of the synergies, the benefits that Gardner Denver can bring to IR and vice versa in the services realm.

|

|

|

|

|

Vicente Reynal:

|

Yes, I think in the service - you will remember when I talked about the new combined company, we’ll have 40 percent of recurrent revenue. It is very important. It’s a very core strategy for us to continue to grow aftermarket. Obviously service being part of the aftermarket, that recurring revenue.

|

When you look at the percentage of revenue that Gardner Denver generates from aftermarket is much lower than what Ingersoll Rand is generating. So I can tell you that we’re really excited to learn more about how you do it, so that we can replicate that in the Gardner Denver team and the gap is flexible.

So I think that’s an area that we have talked about and we have given some of like 50 ish - is roughly 50 percent, industrial space is 35 percent, I want that 35 to be 50. So I want to learn how you do it so we can do it.

We can apply those principles and those techniques in the same way of what you have done. So I think about - those are the great things in the combination that we - we have similar technologies and there is good things and great things on each other’s side.

And now combining them and creating something more unique, that’s what’s going to be pretty exciting.

|

|

|

|

Carrie Ruddy:

|

Vicente, here’s an interesting one that came in. How do the current Gardner Denver people feel about the merger?

|

|

|

|

|

Vicente Reynal:

|

Oh they - yes, as you know, the Gardner Denver - when you - when I joined Gardner Denver in 2015, Gardner Denver has a 160-year-old history. It got taken from public to private in 2013 by KKR and then we went public again to the market in ‘17, and I came in the middle of it.

|

And Gardner Denver had to go through a lot of transformation. One thing that I found at Gardner Denver is that the hearts and minds of the employees are in the company. And when I found that out by going to all the factories, I said man, this is a fantastic foundation.

Because if you have the hearts and minds of the company, as we say, our employees are bleeding red, Gardner Denver or bleeding blue Compare or bleeding blue Robuschi, that’s a very winning recipe. And then it’s all about management, how do we improve those things.

So a lot of our employees at Gardner Denver have been in business for quite some time. A long time and they have known Ingersoll Rand for a long time too as well.

Obviously when you look at the founding times, we’re within five or six years of each other.

I think Ingersoll Rand was founded first and then Gardner Denver a few years later. So we both have like 160 years of history, roughly. So our employees are very excited that now we’re going to be able to learn from each other.

We’re going to be able to combine the power of these two premium brands, winning cultures, talented employees, long histories of innovation, and just create a very powerful new company. That’s why I do think that when you look at the last three words of trust, engage, and create, it is the perfect time to do those three things.

We can create a great company. In order to do that, we got to get engaged. We need everyone to be engaged in doing exactly what we said. I have some ideas on how we can improve things. We do want to know that. are you going to trust us though that we’re going to work through the implementation and through the - those improvement initiatives to then create this fantastic company that we will all be very proud of for long-term value creation.

|

|

|

|

Carrie Ruddy:

|

That’s a perfect note on which to end on.

|

|

|

|

|

Carrie Ruddy:

|

I think we’re about out of time. It’s been - and we probably could have loads more. We’re - it’s been great to hear from you. We appreciate all your thoughts, and any closing thoughts before I pass it to Mike?

|

|

|

|

|

Vicente Reynal:

|

No, I think - I think from my side I just want to obviously thank think Mike and the leadership team at Ingersoll Rand. I mean, there was a lot of great work. Mike and I had I think it was a lunch that turned into a dinner, so it was a very long meeting.

|

And we just - this is amazing and from many fronts. I mean, from a lot of their core values, core views on family values, company values. And so, thank you Mike for trusting and get this combination going, so thank you.

|

|

|

|

Mike Lamach:

|

Thank you, Vicente. So everybody around the world, thanks for being with us. I think you can tell why I’m excited about this. Hopefully you walk out of here today with a

|

lot less trepidation about what’s in front of us. I think you got a sense for Vicente in terms of what’s important and values.

And so, trust, engage, create seems like the way to go. There’s a lot of discussion I know about the integration and questions about the other industrial businesses, and I couldn’t help but think because we just came out of the quarterly operating reviews for the last couple of days, and one of the sort interesting things about each of the businesses, Club Car told me that on one night, two nights ago 188 people got online and ordered and Onward. That’s right, Mark, right?

A hundred and eighty-eight people at $10,000 or so a pop that didn’t exist a year and a half ago or two years ago through innovation. And so, what a growth story that’s been. I go to material handling and I remember that being the most profitable part of the company when times were good. I remember that being at the very, very bottom of I think I’ve ever seen a P&L look like, but we stuck with it.

We stuck with it. We said we’re going to ride it through. We did. The business is in the black. It’s recovering. It’s fantastic. That’s an accomplishment. I got to the tools business and I look at even what we’ve been able to create with specialty tools with QS, with that whole line as the vehicle services business drop, and I just see great things happening across all the industrial businesses.

So we would pay a lot of attention to the CTS business as larger, but a lot of great things that are happening across the business and good things to build on and to take with you to the new Ingersoll Rand.

So my appeal to you is keep doing what you’re doing. Keep running the business successfully. Keep doing the things that I mentioned because that makes a difference, and it makes a difference because the best way to have a strong company is to have a strong company before the spin actually happens. Keep it strong so that we’re in a good position.

And part of my job is actually to make sure the climate company is getting a running start as well on having a very strong opening position. One thing I would tell you is it’s the hottest days of summer.

It’s going to transition for a minute. This is when accidents tend to happen. It’s when accidents happen across the world. Remind our people to be safe. Remind our people to pay attention to what’s happening at work and what’s happening at home and to keep an eye on each other, keep an eye on yourself.

Don’t sit on the sidelines of the change here. I recognize that we can’t quite turn everybody loose on integration. I get that, but there’s a lot of discussion happening around the company, and one of the things that you can do not to sit on the sidelines is to let your mind work and be open to the things that are possible through the combination of really great companies.

So just make sure that you have an open mind of this. There’s a tremendous amount of talent and capabilities required to construct a $7 billion company that I think is going to be a much larger company in the industrial space as this time progresses and I think Vicente is the kind of leader that can help get that done.

So today’s the first of what I hope’s going to be a number of opportunities (to listen to) Vicente before we actually make the transition itself. We’ll plan those out at the right milestones and times to have that be meaningful.

And then when Vicente isn’t here, we’re going to remain committed to communicating as much as we possibly can about (where) we’re doing, what we’re doing , where we’re at to keep you formatted as very best that we can. I hope you see that we’re trying to do that (by virtue of what we’re) doing today and what we try to do this week.

So thanks for everything that you’re doing. Appreciate it very much and look forward to talking to you soon. Thank you.

END

Additional Information and Where to Find It

In connection with the proposed transaction, Gardner Denver and Ingersoll Rand U.S. HoldCo, Inc. (“Ingersoll-Rand Industrial”) will file registration statements with the Securities and Exchange Commission (the “SEC”) registering shares of Gardner Denver common stock and Ingersoll Rand Industrial common stock in connection with the proposed transaction. Gardner Denver will also file a proxy statement, which will be sent to the Gardner Denver shareholders in connection with their vote required in connection with the proposed transaction. If the transaction is effected in whole or in part via an exchange offer, Ingersoll Rand will also file with the SEC a Schedule TO with respect thereto.

Ingersoll Rand shareholders are urged to read the prospectus and / or information statement that will be included in the registration statements and any other relevant documents when they become available, and Gardner Denver shareholders are urged to read the proxy statement and any other relevant documents when they become available, because they will contain important information about Gardner Denver, Ingersoll Rand Industrial and the proposed transaction.

The proxy statement, prospectus and/or information statement and other documents relating to the proposed transaction (when they become available) can be obtained free of charge from the SEC’s website at www.sec.gov. The proxy statement, prospectus and/or information statement and other documents (when they are available) will also be available free of charge on Ingersoll Rand’s website at http://ir.ingersollrand.com/investors/ or on Gardner Denver’s website at https://investors.gardnerdenver.com/.

No Offer or Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

This communication is not a solicitation of a proxy from any security holder of Gardner Denver. However, Ingersoll Rand, Gardner Denver and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders of Gardner Denver in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Ingersoll Rand may be found in its Annual Report on Form 10-K filed with the SEC on February 12, 2019 and its definitive proxy statement relating to its 2019 Annual Meeting of Shareholders filed with the SEC on April 23, 2019. Information about the directors and executive officers of Gardner Denver may be found in its Annual Report on Form 10-K filed with the SEC on February 27, 2019, and its definitive proxy statement relating to its 2019 Annual Meeting of Shareholders filed with the SEC on March 26, 2019.

Forward-Looking Statements

This communication includes “forward-looking statements” as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements regarding the proposed transaction between Ingersoll Rand and Gardner Denver. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “forecast,” “outlook,” “target,” “endeavor,” “seek,” “predict,” “intend,” “strategy,” “plan,” “may,” “could,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or the negative thereof or variations thereon or similar terminology generally intended to identify forward-looking statements. All statements, other than historical facts, including, but not limited to, statements regarding the expected timing and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, the expected benefits of the proposed transaction, including future financial and operating results and strategic benefits, the tax consequences of the proposed transaction, and the combined company’s plans, objectives, expectations and intentions, legal, economic and regulatory conditions, and any assumptions underlying any of the foregoing, are forward looking statements.

These forward-looking statements are based on Gardner Denver's and Ingersoll Rand’s current expectations and are subject to risks and uncertainties, which may cause actual results to differ materially from Gardner Denver's and Ingersoll Rand’s current expectations. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) that one or more closing conditions to the transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations or restrictions in connection with such approvals or that the required approval by the stockholders of Gardner Denver may not be obtained; (2) the risk that the proposed transaction may not be completed on the terms or in the time frame expected by Ingersoll Rand or Gardner Denver, or

at all, (3) unexpected costs, charges or expenses resulting from the proposed transaction, (4) uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; (5) failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the proposed transaction or integrating the businesses of Gardner Denver and Ingersoll Rand Industrial, or at all, (6) the ability of the combined company to implement its business strategy; (7) difficulties and delays in the combined company and ClimateCo achieving revenue and cost synergies; (8) inability of the combined company and ClimateCo to retain and hire key personnel; (9) the occurrence of any event that could give rise to termination of the proposed transaction; (10) the risk that stockholder litigation in connection with the proposed transaction or other settlements or investigations may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability, (11) evolving legal, regulatory and tax regimes; (12) changes in general economic and/or industry specific conditions; (13) actions by third parties, including government agencies; and (14) other risk factors detailed from time to time in Ingersoll Rand and Gardner Denver’s reports filed with the SEC, including Ingersoll Rand's and Gardner Denver’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents filed with the SEC. The foregoing list of important factors is not exclusive.

Any forward-looking statements speak only as of the date of this communication. Neither Ingersoll Rand nor Gardner Denver undertakes any obligation to update any forward-looking statements, whether as a result of new information or development, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

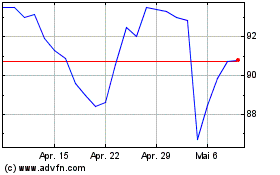

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024