By Sara Germano

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 13, 2019).

BERLIN -- German efficiency has taken a hit this year as many of

the country's most recognizable corporate names wrestle with a

slowing local economy, questionable business decisions and trouble

shifting to a digital world.

In the past week, Deutsche Bank AG abandoned its global

ambitions and initiated layoffs, and the chief executive of BMW AG

said he would step down. Profit warnings from BASF SE and Daimler

AG -- which issued its second in less than a month on Friday --

have rattled markets.

Those setbacks add to a worrisome mix that includes Bayer AG's

legal trouble with its acquisition of Monsanto, the maker of

weedkiller Roundup, and the challenge to German auto makers from a

depressed global car market and continued fallout from the

diesel-emissions scandal. Meanwhile, German blue chips -- from

software maker SAP SE to industrial giant Thyssenkrupp AG -- have

announced tens of thousands of job cuts combined this year.

Roughly one in three large public companies in Germany's DAX

index have reported profit warnings, job cuts or restructurings, or

are dealing with formidable legal disputes or investigations from

authorities. Firms based here are slipping from the ranks of the

world's most-valuable companies, leading consulting firm Ernst

& Young to conclude this month that "German companies are

losing their importance."

While specific challenges loom large for some companies, broad

trends are also working against them. Analysts cite the effects of

global trade disputes on Germany's export-oriented economy, the

increased pressure to digitize and a degree of complacency after

years of robust growth.

"There is a crisis at the moment. The German economy was so good

for such a long time, people thought we'd go on and go on and go

on," said Markus Schön, managing director of DVAM Asset Management

in Detmold, Germany.

The nation's economy grew just 0.7% in the 12 months through

March, far behind others in the eurozone, and Berlin earlier this

year slashed its growth forecast for 2019 gross domestic product to

0.5% from 1.8%. "German companies were not prepared for this

situation," Mr. Schön said.

German auto makers, in particular, have been blindsided. The

collapse in demand for diesel vehicles because of emissions curbs

and a global slowdown in car sales have hit them at a time when

they are spending heavily on electric and autonomous vehicle

development.

BMW as well as Mercedes-Benz maker Daimler have lowered their

financial guidance this year, while Volkswagen AG announced it

would cut 7,000 jobs. In turn, the difficulties of large car makers

have filtered down through a network of smaller suppliers and

service providers in the country.

Volkswagen was at the center of an emissions-cheating scandal

that surfaced in 2015, and it is still feeling the effects. In

March, the U.S. Securities and Exchange Commission sued the auto

maker and former Chief Executive Martin Winterkorn, alleging they

defrauded U.S. investors. And a month later, German prosecutors

indicted Mr. Winterkorn and four others, accusing them of

fraud.

Volkswagen called the SEC complaint "legally and factually

flawed" and said it would contest the charges. A lawyer for Mr.

Winterkorn declined to comment at the time of the charges and

didn't respond to a request for comment Friday.

Other German companies say their problems are closer to home.

Last month, days after Deutsche Lufthansa AG said aggressive

competition from European low-cost carriers hurt its profit, Chief

Executive Carsten Spohr acknowledged that the airline had made

missteps navigating the local short-haul market, including efforts

to capitalize on the 2017 bankruptcy of rival Air Berlin.

"Did we underestimate the complexity? We did," he said. In an

effort to reassure investors, Mr. Spohr affirmed the company's

commitment to being dependable and efficient. "In the end, we're

boring. We're German."

Another contributor to German corporate troubles is the

country's legally mandated board structure -- which flanks the

management board with a powerful supervisory board, half of whose

members represent workers. While such checks and balances have

helped maintain labor peace at large companies, they can also

inhibit quick decision-making and discourage risk-taking.

"It can be an advantage to have a strong CEO, who can react

quickly in times of crisis," said Christian Lawrence, a partner at

consulting firm Brunswick Group in Munich. "Whereas if you have a

German system, the CEO is one of many making decisions and there

must be consensus for things to be done."

Hubert Barth, chief executive of Ernst & Young Germany, said

some German blue chips aren't keeping pace with the transformation

of the economy toward "more digitized business models."

German companies and the government espouse a commitment to

digitization. This week, German economics minister Peter Altmaier

traveled to Silicon Valley to meet with executives from Alphabet

Inc.'s Google, Apple Inc. and others, part of a continuing effort

to raise Germany's profile in digital industry.

At the same time, there is a pervasive feeling, analysts and

executives say, that German companies can't keep up with the tech

giants from the U.S. and elsewhere. One impediment is the strong

limitation that German and European privacy laws put on companies'

ability to collect, store and monetize user data.

"Tell me one company in Germany which is playing a role in

platforms, the area of Facebook and Amazon," said Mr. Barth of

Ernst & Young. "There's no obvious German company that plays a

significant role."

In May, executives from Bertelsmann SE met to discuss ways the

media conglomerate can work with, and compete against, American

tech companies.

"We will never be able to gather the same amount of data as

Google, Facebook or Amazon," said one executive at the meeting.

"This is a fact, and we just have to deal with it. They are on

their own planet."

The performance of Germany's large companies isn't a perfect

measure of the health of the national economy. While the country is

home to many global brands, the backbone of its industry is the

vast number of small- and midsize private businesses known as the

Mittelstand.

Those traditionally family-owned private firms haven't

encountered the same challenges as large public companies, Mr.

Lawrence said, in part because their management system is less

complex and they aren't subject to the restrictions of the public

market.

But this economic structure has other negative consequences.

According to a report from the International Monetary Fund this

week, about 60% of corporate assets and profits in Germany are

generated by closely held firms, contributing to rising wealth

inequality in Germany, the biggest divide in Europe behind the

Netherlands and Austria.

"The concentration of privately held and publicly listed firm

ownership in the hands of industrial dynasties and institutional

investors is especially prevalent in Germany," the IMF report

said.

Write to Sara Germano at sara.germano@wsj.com

(END) Dow Jones Newswires

July 13, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

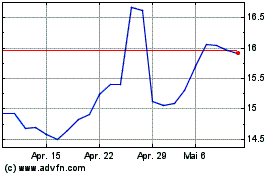

Deutsche Bank (TG:DBK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Deutsche Bank (TG:DBK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024