Europe Stocks Edge Down Ahead of Fed Testimony

10 Juli 2019 - 12:14PM

Dow Jones News

By Nathan Allen

-- U.S. futures, European equities decline

-- Asian stocks mostly advance

-- Pound weakens amid continuing U.K. political uncertainty

European stocks slipped on Wednesday as investors awaited

Federal Reserve Chairman Jerome Powell's congressional testimony,

where he will face questions on the central bank's interest rate

intentions.

The pan-continental Stoxx Europe 600 fell 0.2% midmorning to

extend Tuesday's losses, dragged down by food-and-beverage and

media stocks. Benchmark indexes in France and Germany also posted

modest declines.

In the U.S., futures for the S&P 500 and the Dow Jones

Industrial Average both fell around 0.1%. Futures don't necessarily

predict moves after the market open. The yield on 10-year U.S.

Treasurys rose to 2.107% from 2.058% on Tuesday. Yields and prices

move in opposite directions.

Data showed the British economy returned to growth in May,

reversing a two-month slowdown and easing fears of a contraction in

the second quarter. A 24% rise in car production drove the uptick,

as auto makers restarted factories they had idled in anticipation

of Brexit, which was originally scheduled to take place in

April.

However, analysts cautioned that the broader economic picture in

the U.K. remains subdued, despite the improvement in

manufacturing.

"Recent PMIs indicate that the service sector -- which makes up

the lion's share of the U.K. economy -- has struggled to regain

momentum amid mounting Brexit uncertainty," said James Smith, ING

developed markets economist, adding that he expects business

investment to resume its downward trend over the summer.

The pound rose slightly after the data but still hovered around

multi-month lows against the euro, while the FTSE 100 index edged

down 0.1%.

Global stock markets rallied in June amid hopes for an

interest-rate cut, but strong jobs data from the U.S. reduced the

case for such an intervention, adding to uncertainty around the

Fed's policy direction.

In addition to the Fed chief's testimony, minutes from the

central bank's recent policy meeting are due for release later

Wednesday, which could provide additional detail on how officials

viewed the economic environment.

Asian markets were mostly higher ahead of the closing bell,

although Shanghai-listed stocks slipped after Chinese consumer

inflation held steady in June. The consumer-price index rose 2.7%

on year, in line with expectations, as slowing nonfood prices

offset faster gains in food prices.

The Mexican peso continued to trade lower against the dollar on

Wednesday after the country's finance minister Carlos Urzúa

resigned on Tuesday, citing disagreements with left-wing President

Andrés Manuel López Obrador's economic policy.

Elsewhere, the Bank of Canada is expected to keep rates steady

at its monetary-policy meeting later today.

In commodities, global oil benchmark Brent crude rose 1.7% to

$65.23 a barrel after data from U.S. industry group American

Petroleum Institute on Tuesday showed a sharp drop in oil stocks.

Gold fell 0.4%.

(END) Dow Jones Newswires

July 10, 2019 05:59 ET (09:59 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

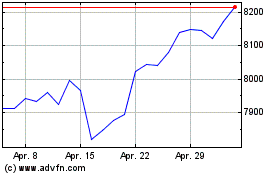

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024