Celgene Deal Faces Antitrust Delays -- WSJ

25 Juni 2019 - 9:02AM

Dow Jones News

By Joseph Walker

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 25, 2019).

Bristol-Myers Squibb Co. said its $74 billion merger with

Celgene Corp. would be delayed as the company works to allay

concerns of federal regulators by selling off Otezla, Celgene's

anti-inflammatory drug that had global sales of $1.6 billion last

year.

Bristol-Myers now expects to complete the deal at the end of

this year or early 2020, the company said Monday. It had previously

expected the merger to close in the third quarter of this year.

The company hopes the planned divestiture of Otezla will resolve

the U.S. Federal Trade Commission's anticompetitive concerns about

clearing the merger.

The divestiture came as a surprise to analysts, who said it was

the latest signal that regulators are taking a tougher stance in

their scrutiny of pharmaceutical industry mergers.

The delay appeared to create uncertainty among investors about

the merger being completed, analysts said. Celgene's stock fell

5.5% to $93.47 Monday; shares of Bristol-Myers declined 7.4% to

$45.68.

Brian Skorney, an R.W. Baird analyst, said Bristol-Myers's plan

to divest itself of Otezla signaled the company had found a way to

resolve the FTC's concerns and increased the probability of the

deal closing.

"It's feedback on what the FTC wants, and it seems like this is

the major thing to come from the FTC discussions," Mr. Skorney said

in an interview.

Otezla is used to treat forms of psoriasis, a skin-disease in

which an overreaction by the immune system causes itchy rashes to

form on the body. Bristol doesn't currently sell psoriasis

medicines, but has an experimental drug for the disease in

late-stage trials.

Historically, antitrust regulators would only raise concerns

about drugs in overlapping disease areas if both products were

already on the market, Mr. Skorney said. That now appears to be

changing.

Earlier this month, Roche Holding AG said the FTC had requested

additional information regarding its planned takeover of Spark

Therapeutics Inc.

Analysts speculated that the FTC's concerns were related to

overlap between Roche's hemophilia treatment Hemlibra and an

experimental gene therapy for the disease being developed by

Spark.

"Both of these deals have gotten more scrutiny than people

expected," said Mr. Skorney. "How does that impact how pharma

acquirers look at deals going forward?"

Otezla was Celgene's third-largest drug by sales last year and

represented about 10.6% of the company's total revenue.

It is uncertain how long the drug will retain market

exclusivity; R.W. Baird estimates that it could lose patent

protection after 2023. Otezla could fetch $6 billion to $10 billion

in a sale, Mr. Skorney said.

Separately, New York-based Bristol Myers said Monday that its

late-stage study of cancer immunotherapy Opdivo didn't meet the

main goals in a study probing its use in a common liver cancer but

showed an improvement in the overall survival of patients treated

with the drug compared with Bayer AG's Nexavar, which is the

current standard of treatment.

Kimberly Chin and Dave Sebastian contributed to this

article.

Write to Joseph Walker at joseph.walker@wsj.com

(END) Dow Jones Newswires

June 25, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

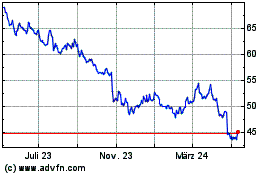

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

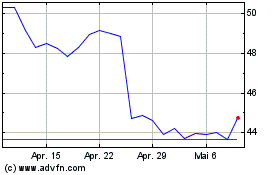

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024