TIDMVOD

RNS Number : 7504C

Vodafone Group Plc

19 June 2019

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO, OR TO

ANY PERSON RESIDENT AND/OR LOCATED IN, ANY JURISDICTION WHERE SUCH

RELEASE, PUBLICATION OR DISTRIBUTION IS UNLAWFUL

VODAFONE GROUP PLC ANNOUNCES FINAL RESULTS OF TER OFFERS

(Newbury, Berkshire - England) - June 19, 2019 Vodafone Group

Plc ("Vodafone" or the "Company") announces today the results of

its previously announced cash tender offers (the "Offers") to

purchase any and all of the outstanding debt securities listed

below (the "Notes") on the terms of, and subject to the conditions

set forth in, the offer to purchase dated June 12, 2019 (the "Offer

to Purchase"). Capitalized terms not otherwise defined in this

announcement have the same meaning as assigned to them in the Offer

to Purchase. The Offers expired at 5.00 p.m., Eastern time, on June

18, 2019.

According to information provided by the Information and Tender

Agent for the Offers, U.S.$227,569,000 aggregate principal amount

of the 2021 Notes, U.S.$402,755,000 aggregate principal amount of

the 2022 Notes, and U.S.$704,481,000 aggregate principal amount of

the 2023 Notes were validly tendered at or prior to the Expiration

Time and not validly withdrawn, which amounts include

U.S.$1,675,000 aggregate principal amount of the 2021 Notes,

U.S.$8,730,000 aggregate principal amount of the 2022 Notes and

U.S.$3,226,000 aggregate principal amount of the 2023 Notes that

remain subject to the guaranteed delivery procedures described in

the Offer to Purchase. The Company will accept for purchase, and

pay for, the validly tendered Notes; such payment is expected to be

made on June 20, 2019. The following table sets forth the aggregate

principal amount of Notes validly tendered and not withdrawn in the

Offers:

Title of Security CUSIP Outstanding Principal Aggregate Principal Aggregate Principal

Amount Amount Tendered(1) Amount Tendered

Using Guaranteed

Delivery Procedures

----------------------- ----------------------- ---------------------- --------------------- ---------------------

4.375% Notes due 2021 92857WAV2 /

("2021 Notes") US92857WAV28 $500,000,000 $225,894,000 $1,675,000

----------------------- ----------------------- ---------------------- --------------------- ---------------------

2.50% Notes due 2022 92857WAZ3 /

("2022 Notes") US92857WAZ32 $1,000,000,000 $394,025,000 $8,730,000

----------------------- ----------------------- ---------------------- --------------------- ---------------------

2.950% Notes due 2023 92857WBC3 /

("2023 Notes") US92857WBC38 $1,600,000,000 $701,255,000 $3,226,000

(1) Excluding principal amounts of Notes tendered using guaranteed delivery procedures.

In addition to the Consideration, all Holders of Notes accepted

for purchase will also receive accrued and unpaid interest on such

Notes, from the last interest payment date up to, but not

including, the Settlement Date. Interest will cease to accrue on

the Settlement Date for all Notes accepted.

On June 12, 2019, the Company priced an offering (the "New Notes

Offering") of $1,750,000,000 4.875% Notes due 2049 and $500,000,000

5.125% Notes due 2059, the proceeds of which are expected to fund

the Offers. The New Notes Offering is expected to be completed on

June 19, 2019, which will satisfy the Financing Condition (as

defined in the Offer to Purchase).

Questions regarding procedures for tendering Notes may be

directed to Global Bondholder Services at +1 (866) 470-3800 (toll

free), +1 (212) 430-3774 (collect) or by email to

contact@gbsc-usa.com. For additional information, please contact

the Dealer Managers at Merrill Lynch International at +1 (888)

292-0070 (toll free), +1 (980) 387-3907 or +44-20-7996-5420 (in

London) or by email to dg.lm_emea@baml.com, to Morgan Stanley &

Co. LLC at +1 (212) 761-1057 (collect), +1 (800) 624-1808 (toll

free) or by email to liabilitymanagement@morganstanley.com, to RBC

Capital Markets, LLC at +1 (877) 381-2099 (toll free), +1 (212)

618-7843, +44 20 7029 7063 (Europe) or by email to

liability.management@rbccm.com and to UBS AG London Branch, at +44

20 7568 1121 (Europe), +1 888 719 4210 (toll free), +1 203 719 4210

or by email to ol-liabilitymanagement-eu@ubs.com. This announcement

is for informational purposes only and does not constitute an offer

to sell, or a solicitation of an offer to buy, any security. No

offer, solicitation, or sale will be made in any jurisdiction in

which such an offer, solicitation, or sale would be unlawful. The

Offers are only being made pursuant to the Offer to Purchase.

Holders of the Notes are urged to carefully read the Offer to

Purchase before making any decision with respect to the Offers.

The distribution of announcement in certain jurisdictions may be

restricted by law. Persons into whose possession this announcement

comes are required by each of the Company, the Dealer Managers and

the Information and Tender Agent to inform themselves about and to

observe any such restrictions.

Offer and Distribution Restrictions

Italy

None of the Offers, this announcement, the Offer to Purchase or

any other document or materials relating to the Offers have been or

will be submitted to the clearance procedures of the Commissione

Nazionale per le Società e la Borsa ("CONSOB") pursuant to Italian

laws and regulations. Each Offer is being carried out in Italy as

an exempted offer pursuant to article 101-bis, paragraph 3-bis of

the Legislative Decree No. 58 of 24 February 1998, as amended (the

"Financial Services Act") and article 35-bis, paragraph 4 of CONSOB

Regulation No. 11971 of 14 May 1999, as amended. Holders or

beneficial owners of the Notes that are located in Italy can tender

Notes for purchase in the Offers through authorized persons (such

as investment firms, banks or financial intermediaries permitted to

conduct such activities in the Republic of Italy in accordance with

the Financial Services Act, CONSOB Regulation No. 16190 of 29

October 2007, as amended from time to time, and Legislative Decree

No. 385 of 1 September 1993, as amended) and in compliance with

applicable laws and regulations or with requirements imposed by

CONSOB or any other Italian authority.

Each intermediary must comply with the applicable laws and

regulations concerning information duties vis-à-vis its clients in

connection with the Notes and/or the Offers.

United Kingdom

The communication of this announcement and the Offer to Purchase

and any other documents or materials relating to the Offers is not

being made and such documents and/or materials have not been

approved by an authorised person for the purposes of section 21 of

the Financial Services and Markets Act 2000. Accordingly, such

documents and/or materials are not being distributed to, and must

not be passed on to, the general public in the United Kingdom. The

communication of such documents and/or materials as a financial

promotion is only being made to those persons in the United Kingdom

falling within the definition of investment professionals (as

defined in Article 19(5) of the Financial Services and Markets Act

2000 (Financial Promotion) Order 2005 (the "Financial Promotion

Order")) or persons who are within Article 43(2) of the Financial

Promotion Order or any other persons to whom it may otherwise

lawfully be made under the Financial Promotion Order.

France

The Offers are not being made, directly or indirectly, to the

public in the Republic of France ("France"). Neither this

announcement, the Offer to Purchase nor any other document or

material relating to the Offers has been or shall be distributed to

the public in France and only (i) providers of investment services

relating to portfolio management for the account of third parties

(personnes fournissant le service d'investissement de gestion de

portefeuille pour compte de tiers) and/or (ii) qualified investors

(investisseurs qualifiés), acting for their own account, with the

exception of individuals, within the meaning ascribed to them in,

and in accordance with, Articles L.411-1, L.411-2 and D.411-1 of

the French Code monétaire et financier, and applicable regulations

thereunder, are eligible to participate in the Offers. Neither this

announcement nor the Offer to Purchase has been or will be

submitted for clearance to nor approved by the Autorité des Marchés

Financiers.

Belgium

Neither the Offer to Purchase nor any other documents or

materials relating to the Offers have been submitted to or will be

submitted for approval or recognition to the Belgian Financial

Services and Markets Authority (Autoriteit voor financiële diensten

en markten / Autorité des services et marchés financiers) and,

accordingly, the Offers may not be made in Belgium by way of a

public offering, as defined in Articles 3 and 6 of the Belgian Law

of 1 April 2007 on public takeover bids as amended or replaced from

time to time. Accordingly, the Offers may not be advertised and the

Offers will not be extended, and neither the Offer to Purchase nor

any other documents or materials relating to the Offers (including

any memorandum, information circular, brochure or any similar

documents) has been or shall be distributed or made available,

directly or indirectly, to any person in Belgium other than

"qualified investors" in the sense of Article 10 of the Belgian Law

of 16 June 2006 on the public offer of placement instruments and

the admission to trading of placement instruments on regulated

markets, acting on their own account. Insofar as Belgium is

concerned, the Offer to Purchase has been issued only for the

personal

use of the above qualified investors and exclusively for the

purpose of the Offers. Accordingly, the information contained in

the Offer to Purchase may not be used for any other purpose or

disclosed to any other person in Belgium.

General

This announcement does not constitute an offer to buy or the

solicitation of an offer to sell Notes (and tenders of Notes in the

Offers will not be accepted from Holders) in any circumstances in

which such offer or solicitation or acceptance is unlawful. In

those jurisdictions where the securities, blue sky or other laws

require the Offers to be made by a licensed broker or dealer and

any Dealer Manager or any of the Dealer Managers' affiliates is

such a licensed broker or dealer in any such jurisdiction, the

Offers shall be deemed to be made by such Dealer Manager or such

Dealer Manager's affiliate, as the case may be, on behalf of the

Company in such jurisdiction.

Forward-Looking Information

This announcement contains certain forward-looking statements

which reflect the Company's intent, beliefs or current expectations

about the future and can be recognized by the use of words such as

"expects," "will," "anticipate," or words of similar meaning. These

forward-looking statements are not guarantees of any future

performance and are necessarily estimates reflecting the best

judgment of the senior management of the Company and involve a

number of risks and uncertainties that could cause actual results

to differ materially from those suggested by the forward-looking

statements. As a consequence, these forward-looking statements

should be considered in light of various important factors that

could cause actual results to differ materially from estimates or

projections contained in the forward-looking statements, which

include, without limitation, the risk factors set forth in the

Offer to Purchase. The Company cannot guarantee that any

forward-looking statement will be realized, although it believes it

has been prudent in its plans and assumptions. Achievement of

future results is subject to risks, uncertainties and assumptions

that may prove to be inaccurate. Should known or unknown risks or

uncertainties materialize, or should underlying assumptions prove

inaccurate, actual results could vary materially from those

anticipated, estimated or projected. The Company undertakes no

obligation to update publicly or release any revisions to these

forward-looking statements to reflect events or circumstances or to

reflect the occurrence of unanticipated events, except as required

by applicable law.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

RTEFMGMVRLGGLZG

(END) Dow Jones Newswires

June 19, 2019 04:45 ET (08:45 GMT)

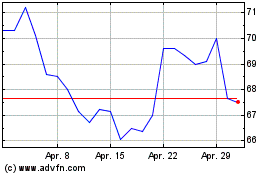

Vodafone (LSE:VOD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

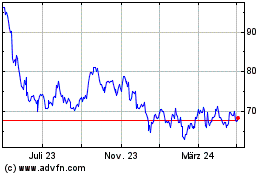

Vodafone (LSE:VOD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024