Merck to Buy Cancer Drug Maker Peloton Therapeutics -- Update

21 Mai 2019 - 2:23PM

Dow Jones News

By Kimberly Chin

Merck & Co. agreed to acquire cancer drug developer Peloton

Therapeutics Inc. for $1.05 billion in cash, adding to a list of

deals in 2019 by pharmaceutical companies looking to bolster their

cancer treatment portfolios.

Merck would acquire all shares outstanding of Peloton through a

subsidiary, the company said Tuesday.

In addition to the initial $1.05 billion consideration, Peloton

shareholders are also eligible to receive an additional $1.15

billion if the company achieves certain regulatory and sales

milestones.

"This acquisition exemplifies Merck's strategy to pursue novel

therapeutic candidates based on exceptionally promising and

innovative research," said Roger Perlmutter, president of Merck

Research Laboratories, in prepared remarks.

The companies expect the transaction to close in the third

quarter.

Peloton, which is based in Dallas, is a closely held drug

discovery and development company focused on oral medicines for

cancer and other non-oncology diseases. Peloton's leading drug

candidate PT2977 is a novel oral inhibitor for late-stage renal

cell carcinoma.

The $123 billion world-wide market for cancer drugs is one of

the biggest pharmaceutical sectors. Earlier this year, Eli Lilly

& Co. acquired Loxo Oncology Inc. for roughly $8 billion in

cash and Bristol-Myers Squibb Co. said it was buying Celgene Corp.

in a deal valued at about $74 billion. The transaction is expected

to close in the third quarter.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

May 21, 2019 08:08 ET (12:08 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

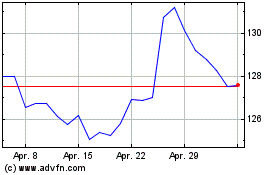

Merck (NYSE:MRK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

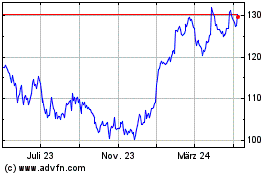

Merck (NYSE:MRK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024