Credit Markets: Investors Grab $20 Billion in IBM Debt -- WSJ

09 Mai 2019 - 9:02AM

Dow Jones News

By Sam Goldfarb

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 9, 2019).

International Business Machines Corp. sold $20 billion of bonds

Wednesday to help fund its purchase of Red Hat Inc., adding to a

busy week for corporate-debt issuance a day after Bristol-Myers

Squibb Co. sold $19 billion of bonds to finance its acquisition of

Celgene Corp.

IBM's sale is the largest of the year -- overtaking the

Bristol-Myers deal -- and tied for the seventh-largest on record,

according to Dealogic.

Despite signs that the trade tensions between the U.S. and China

could continue longer than expected, investors said Wednesday that

strong demand for corporate debt persists, given paltry

government-bond yields and a recent run of encouraging U.S.

economic data.

While it has ticked up in recent days, the extra yield, or

spread, that investors demand to hold investment-grade bonds over

Treasurys still finished Tuesday at 1.14 percentage points, down

from 1.53 percentage points at the end of 2018, according to

Bloomberg Barclays data. That decline has come as the average U.S.

Treasury yield has also dropped to 2.39% from 2.62%, largely due to

signals from the Federal Reserve that it won't raise interest rates

this year.

"Notwithstanding mark-to-market wiggles and near-term political

jitters, the fundamentals of the global economy look decent,

especially the U.S. economy, and companies are being opportunistic

and issuing while they can," said Mike Collins, a portfolio manager

at PGIM Fixed Income.

The Dow Jones Industrial Average stabilized Wednesday, a day

after logging its largest one-day decline since Jan. 3.

But Tuesday's stock declines hardly slowed the bond market.

Along with the Bristol-Myers sale, businesses with

speculative-grade credit ratings, including United Continental

Holdings Inc. and power company NRG Energy Inc., announced and then

sold $5.4 billion of bonds on Tuesday. That was the first time

so-called drive-by issuance has totaled at least $5 billion in more

than two years, according to LevFin Insights.

Meeting solid demand from investors, IBM on Wednesday was able

to reduce the spread on its longer-maturity bonds by 0.1 percentage

point from initial guidance, somewhat less than Bristol-Myers a day

earlier. IBM sold $3.25 billion of 10-year bonds at a 3.53% yield,

or 1.05 percentage-point spread, compared with initial guidance of

1.15 percentage points.

Appetite for newly issued corporate bonds extended into the

secondary market. Bristol-Myers' new 3.4% bonds due 2029 traded

late Wednesday at 99.364 cents on the dollar, translating to a

yield-premium of 0.99 percentage point relative to Treasurys,

according to MarketAxess. The bonds were sold Tuesday at 99.125

cents and a 1.05 percentage-point spread.

Both IBM and Bristol-Myers notably carry high credit ratings

even by the standards of investment-grade companies. Despite a

roughly $50 billion debt load that will grow with the Red Hat

purchase, Moody's Investors Service said in October that it will

likely downgrade the company by just one notch to A2 from A1 after

completing a review. IBM has said it will suspend share repurchases

in 2020 and 2021 to pay down debt.

Moody's similarly indicated last week that it would likely

downgrade Bristol-Myers' credit rating one notch to A3 from A2.

That sets both businesses apart from many others that have recently

settled at the bottom rung of the investment-grade credit ladder, a

trend that has raised concerns about downgrades to junk if there is

an economic downturn.

IBM last month reported a third consecutive quarter of declining

revenue, which it blamed in part on clients in the Asia-Pacific

region delaying business decisions. The company's planned

acquisition of Red Hat, an open-source software and services

company, is part of IBM Chief Executive Ginni Rometty's larger

effort to revitalize the computing giant by focusing on its

cloud-computing business. The deal, valued at around $33 billion,

is IBM's largest-ever acquisition and is expected to close in the

second half of the year.

An IBM spokesman said the company "has a strong balance sheet,"

and would be able to use the cash it generates to invest in "high

value-segments of our industry as well as provide continued

dividend growth."

Write to Sam Goldfarb at sam.goldfarb@wsj.com

(END) Dow Jones Newswires

May 09, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

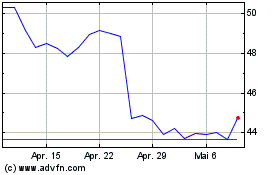

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

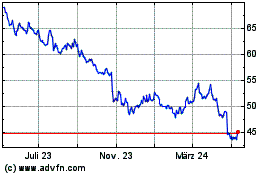

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024