U.S. Dollar Advances On Fading Rate Cut Hopes

02 Mai 2019 - 5:09AM

RTTF2

The U.S. dollar strengthened against its major counterparts in

the Asian session on Thursday, after the Federal Reserve kept its

interest rate on hold, but dashed investors' hopes for a near-term

interest rate cut.

In his post-monetary policy meeting press conference, Powell

said a fall in inflation this year could be due to transitory

factors.

Powell said the Fed would take persistently low inflation into

account when setting policy but currently expects inflation to

return to the 2 percent objective.

The Fed reiterated it will be patient as it determines future

adjustments to interest rates due to global economic and financial

developments and muted inflation.

The Fed maintained the target range for the federal funds rate

at 2.25 to 2.50 percent for the third consecutive meeting.

Investors await U.S. reports on weekly jobless claims, labor

productivity and costs, and factory orders today, as well as

monthly jobs report on Friday.

The greenback advanced to a 2-day high of 111.67 against the

yen, from a low of 111.35 hit at 6:00 pm ET. The greenback is seen

finding resistance around the 113.00 level.

The greenback was trading higher at 1.1199 against the euro, up

from near a 2-week low of 1.1265 seen on Wednesday. Next key

resistance for the greenback is seen around the 1.10 level.

The greenback edged up to 1.3038 against the pound, following a

low of 1.3060 touched at 9:15 pm ET. On the upside, 1.28 is

possibly seen as the next resistance level for the greenback.

The U.S. currency ticked up to 1.0184 against the franc, after

falling to 1.0170 at 6:30 pm ET. The next key resistance for the

greenback is likely seen around the 1.03 region.

Looking ahead, PMI reports from major European economies are due

in the European session.

At 7:00 am ET, the Bank of England announces its interest rate

decision. Economists widely forecast the benchmark to remain at

0.75 percent and asset purchase program at GBP 435 billion.

In the New York session, U.S. weekly jobless claims for the week

ended April 27 and factory orders for March are scheduled for

release.

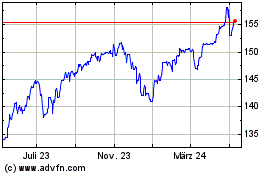

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

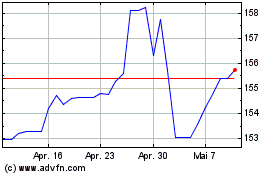

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024