Q1 Subscription and Support Revenue of $56.1

Million, up 20.8% from Q1 2018

Q1 Total Revenue of $70.0 Million, up 16.8%

from Q1 2018

Workiva (NYSE:WK), the leading cloud provider of connected data,

reporting and compliance solutions, today announced financial

results for its first quarter ended March 31, 2019.

"We once again posted strong results for the first quarter of

2019,” said Marty Vanderploeg, Chief Executive Officer of Workiva.

"We exceeded quarterly guidance for revenue and operating results,

and we are raising our full year 2019 revenue guidance."

"While we are pleased with our progress on operating margin,

accelerating growth in subscription revenue remains our number one

priority from a financial perspective," said Stuart Miller, Chief

Financial Officer of Workiva. "We plan to increase hiring in areas

where we see the most opportunities for revenue growth."

"Over the next few quarters, we plan to focus our investments on

building more data integrations, expanding in Europe and increasing

Wdesk use for integrated risk and global statutory reporting," said

Vanderploeg. "As we expand our global footprint, it is essential

that Wdesk is tightly integrated with our customers' systems of

record and other core enterprise applications."

"Improvement in operating cash flow remains our second highest

financial priority," said Miller. "Even with our targeted new

investments, we expect operating cash flow to improve significantly

in 2019 as compared to 2018."

First Quarter 2019 Financial

Highlights

- Revenue: Total revenue for the

first quarter of 2019 reached $70.0 million, an increase of 16.8%

from $59.9 million in the first quarter of 2018. Subscription and

support revenue contributed $56.1 million, up 20.8% versus the

first quarter of 2018. Professional services revenue was $13.8

million, an increase of 3.0% compared to the same quarter in the

prior year.

- Gross Profit: GAAP gross profit

for the first quarter of 2019 was $50.4 million compared with $43.4

million in the same quarter of 2018. GAAP gross margin was 72.1%

versus 72.4% in the first quarter of 2018. Non-GAAP gross profit

for the first quarter of 2019 was $51.2 million, an increase of

17.1% compared with the prior year's first quarter, and non-GAAP

gross margin was 73.2% compared to 73.0% in the first quarter of

2018.

- Loss from Operations: GAAP loss

from operations for the first quarter of 2019 was $7.3 million

compared with a loss of $9.5 million in the prior year's first

quarter. Non-GAAP income from operations was $0.9 million, compared

with non-GAAP loss from operations of $3.6 million in the first

quarter of 2018.

- Net Loss: GAAP net loss for the

first quarter of 2019 was $7.5 million compared with a net loss of

$9.6 million for the prior year's first quarter. GAAP net loss per

basic and diluted share was $0.17 compared with a net loss per

basic and diluted share of $0.22 in the first quarter of 2018.

- Non-GAAP net income for the first

quarter of 2019 was $0.7 million compared with a net loss of $3.7

million in the prior year's first quarter. Non-GAAP net income per

basic and diluted share was $0.02 and $0.01, respectively, compared

with a net loss per basic and diluted share of $0.09 in the first

quarter of 2018.

- Balance Sheet: As of

March 31, 2019, Workiva had cash, cash equivalents and

marketable securities totaling $114.4 million, compared with

$98.3 million as of December 31, 2018. Financing

obligations totaled $18.1 million as of March 31,

2019.

Key Metrics and Non-financial

Highlights

- Customers: Workiva had 3,366

customers as of March 31, 2019, a net increase of 247

customers from March 31, 2018.

- Revenue Retention Rate: As of

March 31, 2019, Workiva's revenue retention rate (excluding

add-on revenue) was 95.7%, and the revenue retention rate including

add-on revenue was 110.7%. Add-on revenue includes changes for

existing customers in new solutions, new seats and pricing.

- Large Contracts: As of

March 31, 2019, Workiva had 493 customers with an annual

contract value (ACV) of more than $100,000, up 47.2% from 335

customers at March 31, 2018. Workiva had 207 customers with an

ACV of more than $150,000, up 37.1% from 151 customers in the first

quarter of 2018.

- New Offices in Frankfurt and

Paris: Workiva opened new offices in Germany and France to

attract and support customers in those countries.

Financial OutlookAs

of May 1, 2019, Workiva is providing guidance for its

second quarter 2019 and full year 2019 as follows:

Second Quarter 2019 Guidance:

- Total revenue is expected to be in the

range of $68.6 million to $69.1 million.

- GAAP loss from operations is expected

to be in the range of $13.1 million to $13.6 million.

- Non-GAAP loss from operations is

expected to be in the range of $4.2 million to $4.7 million.

- GAAP net loss per basic and diluted

share is expected to be in the range of $0.29 to $0.30.

- Non-GAAP net loss per basic and diluted

share is expected to be in the range of $0.10 to $0.11.

- Net loss per basic and diluted share is

based on 46.1 million weighted-average shares outstanding.

Full Year 2019 Guidance:

- Total revenue is expected to be in the

range of $284.0 million to $286.0 million.

- GAAP loss from operations is expected

to be in the range of $50.0 million to $52.0 million.

- Non-GAAP loss from operations is

expected to be in the range of $15.0 million to $17.0 million.

- GAAP net loss per basic and diluted

share is expected to be in the range of $1.09 to $1.13.

- Non-GAAP net loss per basic and diluted

share is expected to be in the range of $0.34 to $0.38.

- Net loss per basic and diluted share is

based on 46.3 million weighted-average shares outstanding.

Quarterly Conference

CallWorkiva will host a conference call today at 5:00

p.m. ET to review the Company’s financial results for the first

quarter 2019, in addition to discussing the Company’s outlook for

the second quarter and full year 2019. To access this call, dial

833-287-0800 (domestic) or 647-689-4434 (international). The

conference ID is 8385167. A live webcast of the conference call

will be accessible in the "Investor Relations" section of Workiva’s

website at www.workiva.com. A replay of this conference call can

also be accessed through May 8, 2019 at 800-585-8367 (domestic) or

416-621-4642 (international). The replay pass code is 8385167. An

archived webcast of this conference call will also be available an

hour after the completion of the call in the "Investor Relations"

section of the Company’s website at www.workiva.com.

About WorkivaWorkiva, the

leading cloud provider of connected data, reporting and compliance

solutions, is used by thousands of enterprises across 180

countries, including more than 75 percent of Fortune 500®

companies, and by government agencies. Our customers have linked

over five billion data elements to trust their data, reduce risk

and save time. For more information about Workiva (NYSE:WK), please

visit workiva.com.

Read the Workiva blog: www.workiva.com/blogFollow Workiva on

LinkedIn: www.linkedin.com/company/workivaLike Workiva on Facebook:

www.facebook.com/workivaFollow Workiva on Twitter:

www.twitter.com/workiva

Claim not confirmed by FORTUNE or Fortune Media IP Limited.

FORTUNE® and FORTUNE 500® are registered trademarks of Fortune

Media IP Limited and are used under license. FORTUNE and Fortune

Media IP Limited are not affiliated with, and do not endorse

products or services of, Workiva Inc.

Non-GAAP Financial

MeasuresThe non-GAAP adjustments referenced herein

relate to the exclusion of stock-based compensation. A

reconciliation of GAAP to non-GAAP historical financial measures

has been provided in Table I at the end of this press release. A

reconciliation of GAAP to non-GAAP guidance has been provided in

Table II at the end of this press release.

Workiva believes that the use of non-GAAP gross profit and gross

margin, non-GAAP income (loss) from operations, non-GAAP net income

(loss) and non-GAAP net income (loss) per share is helpful to its

investors. These measures, which are referred to as non-GAAP

financial measures, are not prepared in accordance with generally

accepted accounting principles in the United States, or GAAP.

Non-GAAP gross profit is calculated by excluding stock-based

compensation expense attributable to cost of revenues from gross

profit. Non-GAAP gross margin is the ratio calculated by dividing

non-GAAP gross profit by revenues. Non-GAAP loss from operations is

calculated by excluding stock-based compensation expense from loss

from operations. Non-GAAP net loss is calculated by excluding

stock-based compensation expense, net of tax, from net loss.

Non-GAAP net loss per share is calculated by dividing non-GAAP net

loss by the weighted- average shares outstanding as presented in

the calculation of GAAP net loss per share. Because of varying

available valuation methodologies, subjective assumptions and the

variety of equity instruments that can impact a company’s non-cash

expenses, Workiva believes that providing non-GAAP financial

measures that exclude stock-based compensation expense allows for

more meaningful comparisons between its operating results from

period to period. Workiva’s management uses these non-GAAP

financial measures as tools for financial and operational decision

making and for evaluating Workiva’s own operating results over

different periods of time.

Non-GAAP financial measures may not provide information that is

directly comparable to that provided by other companies in

Workiva’s industry, as other companies in the industry may

calculate non-GAAP financial results differently. In addition,

there are limitations in using non-GAAP financial measures because

the non-GAAP financial measures are not prepared in accordance with

GAAP, may be different from non-GAAP financial measures used by

other companies and exclude expenses that may have a material

impact on Workiva’s reported financial results. Further,

stock-based compensation expense has been and will continue to be

for the foreseeable future a significant recurring expense in

Workiva’s business and an important part of the compensation

provided to its employees. The presentation of non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with GAAP. Investors should review the reconciliation

of non-GAAP financial measures to the comparable GAAP financial

measures included below, and not rely on any single financial

measure to evaluate Workiva’s business.

Safe Harbor StatementCertain

statements in this press release are "forward-looking statements"

within the meaning of Section 21E of the Securities Exchange Act of

1934, as amended, and are subject to the safe harbor created

thereby. These statements relate to future events or the Company’s

future financial performance and involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

levels of activity, performance or achievements of the Company or

its industry to be materially different from those expressed or

implied by any forward-looking statements. In particular,

statements about the Company’s expectations, beliefs, plans,

objectives, assumptions, future events or future performance

contained in this press release are forward-looking statements. In

some cases, forward-looking statements can be identified by

terminology such as "may," "will," "could," "would," "should,"

"expect," "plan," "anticipate," "intend," "believe," "estimate,"

"predict," "potential," "outlook," "guidance" or the negative of

those terms or other comparable terminology.

Please see the Company’s documents filed or to be filed with the

Securities and Exchange Commission, including the Company’s annual

reports filed on Form 10-K and quarterly reports on Form 10-Q, and

any amendments thereto for a discussion of certain important risk

factors that relate to forward-looking statements contained in this

report. The Company has based these forward-looking statements on

its current expectations, assumptions, estimates and projections.

While the Company believes these expectations, assumptions,

estimates and projections are reasonable, such forward-looking

statements are only predictions and involve known and unknown risks

and uncertainties, many of which are beyond the Company’s control.

These and other important factors may cause actual results,

performance or achievements to differ materially from those

expressed or implied by these forward-looking statements. Any

forward-looking statements are made only as of the date hereof, and

unless otherwise required by applicable securities laws, the

Company disclaims any intention or obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

WORKIVA INC.CONSOLIDATED STATEMENTS OF

OPERATIONS(in thousands, except share and per share

amounts) Three months ended March

31, 2019 2018 (unaudited)

Revenue Subscription and support $ 56,123 $ 46,470

Professional services 13,840 13,436 Total revenue 69,963 59,906

Cost of revenue Subscription and support (1) 9,809 8,802

Professional services (1) 9,727 7,709 Total cost of revenue 19,536

16,511 Gross profit 50,427 43,395 Operating expenses Research and

development (1) 22,011 20,127 Sales and marketing (1) 25,365 21,006

General and administrative (1) 10,383 11,768 Total operating

expenses 57,759 52,901 Loss from operations (7,332) (9,506)

Interest expense (440) (450) Other income, net 320 343 Loss before

provision for income taxes (7,452) (9,613) Provision for income

taxes 11 5 Net loss $ (7,463) $ (9,618) Net loss per common share:

Basic and diluted $ (0.17) $ (0.22) Weighted-average common shares

outstanding - basic and diluted 45,229,279 42,858,756

(1) Includes stock-based compensation

expense as follows:

Three months ended March 31, 2019

2018 (unaudited) Cost of revenue Subscription

and support $ 357 $ 171 Professional services 409 150 Operating

expenses Research and development 1,900 1,021 Sales and marketing

1,964 1,113 General and administrative 3,563 3,450

WORKIVA INC.CONSOLIDATED BALANCE SHEETS(in

thousands) March

31, 2019 December 31, 2018 (unaudited)

Assets Current assets Cash and cash equivalents $ 78,736 $

77,584 Marketable securities 35,668 20,764 Accounts receivable, net

50,560 65,107 Deferred commissions 9,500 8,178 Other receivables

1,395 1,181 Prepaid expenses and other 7,656 4,417 Total current

assets 183,515 177,231 Property and equipment, net 41,049 41,468

Operating lease right-of-use assets 17,057 — Deferred commissions,

non-current 11,296 10,569 Intangible assets, net 1,322 1,266 Other

assets 2,042 577 Total assets $ 256,281 $ 231,111

Liabilities

and Stockholders’ Equity (Deficit) Current liabilities Accounts

payable $ 3,182 $ 5,461 Accrued expenses and other current

liabilities 33,416 36,353 Deferred revenue 149,943 148,545 Current

portion of financing obligations 1,253 1,222 Total current

liabilities 187,794 191,581 Deferred revenue, non-current 25,933

25,171 Other long-term liabilities 969 6,891 Operating lease

liabilities, non-current 20,846 — Financing obligations,

non-current 16,883 17,208 Total liabilities 252,425 240,851

Stockholders’ equity (deficit) Common stock 45 44 Additional

paid-in-capital 318,151 297,145 Accumulated deficit (314,490)

(307,027) Accumulated other comprehensive income 150 98 Total

stockholders’ equity (deficit) 3,856 (9,740) Total liabilities and

stockholders’ equity (deficit) $ 256,281 $ 231,111

WORKIVA INC.CONSOLIDATED STATEMENTS OF CASH

FLOWS(in thousands) Three months

ended March 31, 2019 2018

(unaudited) Cash flows from operating activities Net

loss $ (7,463) $ (9,618) Adjustments to reconcile net loss to net

cash provided by operating activities: Depreciation and

amortization 903 872 Stock-based compensation expense 8,193 5,905

(Recovery of) provision for doubtful accounts (187) 44 (Accretion)

amortization of premiums and discounts on marketable securities,

net (81) 18 Deferred income tax (18) — Changes in assets and

liabilities: Accounts receivable 14,818 6,542 Deferred commissions

(2,029) (1,649) Operating lease right-of-use asset 668 — Other

receivables (214) 27 Prepaid expenses (3,236) 231 Other assets

(1,464) (58) Accounts payable (1,562) 2,677 Deferred revenue 1,987

(2,345) Operating lease liability (655) — Accrued expenses and

other liabilities (4,541) (863) Net cash provided by operating

activities 5,119 1,783

Cash flows from investing activities

Purchase of property and equipment (1,743) (9) Purchase of

marketable securities (22,155) — Maturities of marketable

securities 7,390 500 Purchase of intangible assets (84) (64) Net

cash (used in) provided by investing activities (16,592) 427

Cash flows from financing activities Proceeds from option

exercises 11,055 3,075 Taxes paid related to net share settlements

of stock-based compensation awards (390) (1,342) Proceeds from

shares issued in connection with employee stock purchase plan 2,149

1,370 Principal payments on capital lease and financing obligations

(294) (298) Net cash provided by financing activities 12,520 2,805

Effect of foreign exchange rates on cash 105 (92) Net increase in

cash and cash equivalents 1,152 4,923 Cash and cash equivalents at

beginning of period 77,584 60,333 Cash and cash equivalents at end

of period $ 78,736 $ 65,256

TABLE IWORKIVA

INC.RECONCILIATION OF NON-GAAP INFORMATION(in

thousands, except share and per share)

Three months ended March 31, 2019

2018 Gross profit, subscription and support $ 46,314

$ 37,668 Add back: Stock-based compensation 357 171 Gross profit,

subscription and support, non-GAAP $ 46,671 $ 37,839 As a

percentage of subscription and support revenue, non-GAAP 83.2%

81.4% Gross profit, professional services $ 4,113 $ 5,727

Add back: Stock-based compensation 409 150 Gross profit,

professional services, non-GAAP $ 4,522 $ 5,877 As a percentage of

professional services revenue, non-GAAP 32.7% 43.7% Gross

profit $ 50,427 $ 43,395 Add back: Stock-based compensation 766 321

Gross profit, non-GAAP $ 51,193 $ 43,716 As percentage of revenue,

non-GAAP 73.2% 73.0% Research and development $ 22,011 $

20,127 Less: Stock-based compensation 1,900 1,021 Research and

development, non-GAAP $ 20,111 $ 19,106 As percentage of revenue,

non-GAAP 28.7% 31.9% Sales and marketing $ 25,365 $ 21,006

Less: Stock-based compensation 1,964 1,113 Sales and marketing,

non-GAAP $ 23,401 $ 19,893 As percentage of revenue, non-GAAP 33.4%

33.2% General and administrative $ 10,383 $ 11,768 Less:

Stock-based compensation 3,563 3,450 General and administrative,

non-GAAP $ 6,820 $ 8,318 As percentage of revenue, non-GAAP 9.7%

13.9% Loss from operations $ (7,332) $ (9,506) Add back:

Stock-based compensation 8,193 5,905 Income (loss) from operations,

non-GAAP $ 861 $ (3,601) As percentage of revenue, non-GAAP 1.2%

(6.0)% Net loss $ (7,463) $ (9,618) Add back: Stock-based

compensation 8,193 5,905 Net income (loss), non-GAAP $ 730 $

(3,713) As percentage of revenue, non-GAAP 1.0% (6.2)% Net

loss per basic and diluted share: $ (0.17) $ (0.22) Add back:

Stock-based compensation 0.19 0.13 Net income (loss) per basic

share, non-GAAP $ 0.02 $ (0.09) Net income (loss) per diluted

share, non-GAAP $ 0.01 $ (0.09) Weighted-average common

shares outstanding - basic, non-GAAP 45,229,279 42,858,756

Weighted-average common shares outstanding - diluted, non-GAAP

50,550,143 42,858,756

TABLE IIWORKIVA

INC.RECONCILIATION OF NON-GAAP GUIDANCE(in thousands,

except share and per share data)

Three months endingJune 30,

2019

Year endingDecember 31,

2019

Loss from operations, GAAP range $

(13,100) - $ (13,600) $ (50,000) - $ (52,000) Add back: Stock-based

compensation 8,900 8,900 35,000 35,000

Loss from operations, non-GAAP range $ (4,200) - $ (4,700) $

(15,000) - $ (17,000) Net loss per share, GAAP range $

(0.29) - $ (0.30) $ (1.09) - $ (1.13) Add back: Stock-based

compensation 0.19 0.19 0.75 0.75 Net

loss per share, non-GAAP range $ (0.10) - $ (0.11) $ (0.34) - $

(0.38) Weighted-average common shares outstanding - basic

and diluted 46,100,000 46,100,000 46,300,000 46,300,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190501005902/en/

Investor Contact:Adam RogersWorkiva

Inc.investor@workiva.com(515) 663-4493

Media Contact:Kevin McCarthyWorkiva

Inc.press@workiva.com(515) 663-4471

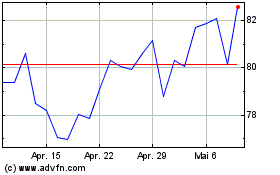

Workiva (NYSE:WK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Workiva (NYSE:WK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024