UK Mortgage Approvals Lowest Since 2017; Consumer Borrowing Slows Sharply

01 Mai 2019 - 10:03AM

RTTF2

UK mortgage approvals for house purchase fell to its lowest

level in over a year in March and consumer credit growth was the

weakest in nearly five-and-a-half years as the original Brexit

deadline approached, figures from the Bank of England showed on

Wednesday.

Mortgage approvals for house purchase fell to 62,341 in March

from a revised 65,340 in February. Economists had forecast 64,400

approvals.

Approvals were the lowest since December 2017, when they were

61,508.

In contrast, data released last week by UK Finance had shown

that mortgage approvals hit a nine-month high in March.

Net mortgage lending grew to GBP 4.1 billion in March versus GBP

3.3 billion in February. Economists had forecast GBP 3.5 billion

lending.

UK house prices rose at the fastest annual pace in five months

in April, but inflation remained subdued, survey data from the

Nationwide housing society showed earlier on Wednesday. The house

price index rose 0.9 percent year-on-year following a 0.7 percent

increase in March. Economists had expected the inflation rate to

remain unchanged.

Consumer credit grew by GBP 0.5 billion in March after a GBP 1.2

billion increase in February. Economists had forecast GBP 1 billion

growth.

The latest increase was the lowest since November 2013 and the

weakness was largely due to a fall in new lending for car finance,

the bank said. Stronger repayments led to a fall in credit card

borrowing.

The annual growth rate of consumer credit fell to 6.4 percent in

March, which was the lowest since September 2014, when it was 6.1

percent. Meanwhile, the growth rate of credit card lending ticked

up for the first time since June 2018, to 6.6 percent.

"The subdued rise in borrowing in March may be because Brexit

has sapped households' desire to borrow to buy big items," Capital

Economics economist Paul Dales said.

"At the aggregate level, low interest rates mean that debt is

still manageable."

The UK's departure from the European Union was originally

scheduled to take place on March 29. However, the lack of a

post-Brexit deal led the EU to set a new deadline of October

31,

Due to the lack of agreement on a Brexit deal, UK Prime Minister

Theresa May requested for an extension of the original deadline of

March 29 for the UK to exit the European Union. Consequently, the

EU agreed that the country should leave the union by October

31.

Annual growth in lending to large non-financial businesses eased

to 3.9 percent from 5.6 percent in the previous month, the central

bank data showed. Loans to small and medium enterprises decreased

0.1 percent annually, reversing the similar size growth in the

previous month.

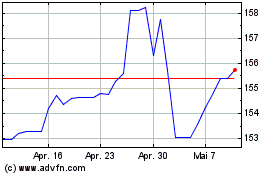

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

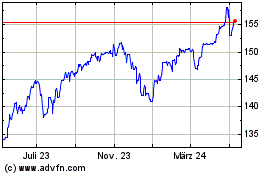

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024