Chicago Business Barometer Unexpectedly Drops To Two-Year Low In April

30 April 2019 - 12:00PM

RTTF2

MNI Indicators released a report on Tuesday unexpectedly showing

a continued slowdown in the pace of growth in Chicago-area business

activity in the month of April.

The report said the Chicago business barometer dropped to 52.6

in April after tumbling to 58.7 in March, hitting its lowest level

since January of 2017.

While a reading above 50 still indicates growth in Chicago-area

business activity, economists had expected the barometer to inch up

to 59.0.

The unexpected decrease by the Chicago business barometer came

as the new orders index fell for the second consecutive month,

dipping below both its three and twelve-month averages.

Reflecting the recent weakness in orders, the production index

also pulled back sharply, dropping to its lowest level since May of

2016.

MNI Indicators said the pullback in demand and production was

matched by reduced demand for labor, with the employment index

falling to its lowest level since October of 2017.

"This was a disappointing start to the second quarter, with more

firms cutting back on both production and employment against a

backdrop of softer domestic demand and the global slowdown," said

Shaily Mittal, Senior Economist at MNI.

She added, "Most Barometer components have dived below their

respective 12-month averages, pointing towards greater business

uncertainty among firms."

On the inflation front, the report said factory gate prices saw

the biggest monthly drop since December of 2008, taking the

indicator to its lowest level since March of 2016.

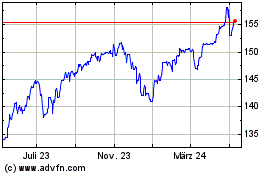

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

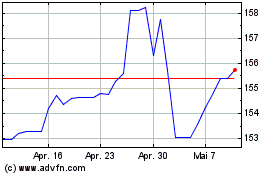

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024