Gardner Denver to Merge With Ingersoll-Rand Division

30 April 2019 - 2:05PM

Dow Jones News

By Kimberly Chin

Gardner Denver Holdings Inc. agreed to merge with the industrial

division of Ingersoll-Rand PLC, a tie-up that would create the

world's second-largest manufacturer of industrial pumps and

compressors.

In the deal, Ingersoll plans to spin off its industrial segment,

which includes its heating, ventilation and air-and

temperature-controlled transport business for buildings, homes and

transportation, and then combine it with Gardner Denver.

Ingersoll shareholders would receive 50.1% of the shares in the

combined company, valued at roughly $5.8 billion, the companies

said Tuesday. Gardner Denver shareholders will own 49.9% of the

company. The combined firm would generate about $6.6 billion in

revenue this year on a pro forma basis.

The Wall Street Journal reported Sunday the companies were

nearing a deal.

The deal would be structured as a so-called Reverse Morris

Trust, a tax efficient way for companies to sell off a

division.

The new company would be second to Atlas Copco Group, a Swedish

industrial conglomerate.

Employees of the combined company who aren't already eligible

for equity awards will be granted stock, with distributions

totaling about $150 million, the companies said.

The merged company would be led by Gardner Denver Chief

Executive Vicente Reynal and the management team will have

executives from both companies.

Gardner Denver is part-owned by private-equity firm KKR &

Co. Pete Stavros, who runs KKR's industrial group in the Americas,

will remain as chairman of Gardner Denver's board. Meanwhile, the

board at Ingersoll-Rand will remain in place and be led by its

current chairman and CEO Mike Lamach.

Gardner Denver had revenue of $2.69 billion in 2018, while

Ingersoll's industrial segment, which includes the businesses that

will be merged with Gardner Denver, had revenue of $3.32 billion,

according to company filings.

Incorporated in Dublin, Ireland, Ingersoll's North American

headquarters is in Davidson, N.C., where the combined company will

be located.

On Tuesday, Gardner Denver and Ingersoll separately reported its

financial results for the first quarter.

Gardner Denver posted a quarterly profit of $47.1 million, or 23

cents a share, and revenue of $620.3 million. Ingersoll posted a

net income of $199.9 million, or 82 cents a share, and revenue of

$3.58 billion.

Miriam Gottfried contributed to this article.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

April 30, 2019 07:50 ET (11:50 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

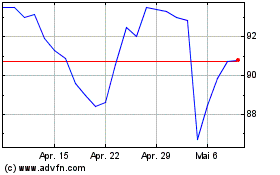

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ingersoll Rand (NYSE:IR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024