Citi Bank Abandons Plan for Native Crypto

18 März 2019 - 5:30PM

ADVFN Crypto NewsWire

Bitcoin Global News (BGN)

March 18, 2019 -- ADVFN Crypto NewsWire -- At one point, we

might have effectively ended up with two JPM Coins. While nearly

every crypto fanatic in existence is likely following JPMorgan

Chase’s foray into crypto development, many might not be aware that

Citi Bank was planning to do the same in the past.

Reportedly, all the way back in

2015, which may seem like an eternity to most people in this space,

Citi Bank had been testing the waters related to using a

token to make payments around the world easier and more

efficient.

At the end of what was apparently a

closed pilot, Citi Bank went public with information to the effect

that the use case for a blockchain-based token was not strong

enough to warrant abandoning any existing frameworks in favor of

it. They even doubled down in saying that they would be on board

with more research being done with the SWIFT Network.

Still, they have not entirely

abandoned the idea that the blockchain does present a real utility

for traditional banks. With projects like CitiConnect, that aims to

work on increasing the liquidity of the global private securities

market, which includes making its’ transactions more cost

efficient.

With this, JPM Coin, and other

ventures like Bakkt in mind, it is clear that traditional financial

institutions realize the blockchain’s power. However, since they

seem to shy away from using it to help the average consumer, it is

easy to argue that many of them want to keep that power locked up

for the elite.

Knowing how Bitcoin and just about

any reliable blockchain network works means knowing that even if

this is true, such an approach will not last. If Bitcoin persists,

it will become a global currency, in some sort of major

context.

By: BGN Editorial Staff

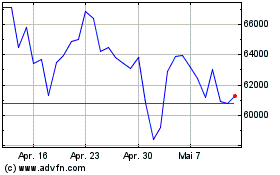

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024