U.S. Stocks Edge Higher on Economic Data

13 März 2019 - 3:24PM

Dow Jones News

By Avantika Chilkoti

U.S. stocks edged higher Wednesday, lifted by fresh signs of

stability in the manufacturing sector and muted inflation.

The Dow Jones Industrial Average climbed 100 points, or 0.4%, to

25654 shortly after the opening bell. The S&P 500 added 0.3%

and was on track for a third consecutive advance. The benchmark

equity gauge has climbed near a four-month high after falling in

every session last week. The tech-heavy Nasdaq Composite rose

0.4%.

Renewed faith in U.S. economic growth and a patient approach by

the Federal Reserve regarding interest-rate increases have powered

this year's stock rebound, pushing the S&P 500 up 11% for the

year entering Wednesday's session and within 4.8% of its September

record.

Data Wednesday showed demand for long-lasting goods produced by

U.S. factories rose in January for the third consecutive month, a

sign of momentum for manufacturers.

And producer prices edged higher last month, the latest sign

that underlying inflation pressures remain tepid and a positive

development for investors hoping contained inflation will prevent

the Fed from raising rates this year.

Bond yields stabilized after the data, with the yield on the

benchmark 10-year U.S. Treasury note climbing to 2.618%, according

to Tradeweb, from 2.605% a day earlier. Yields rise as prices fall.

They had dropped to a two-month low following Friday's

weaker-than-expected hiring data.

Boeing shares also rebounded Wednesday, supporting the Dow

industrials after the largest component in the price-weighted index

tumbled to start the week. Several countries have suspended flights

of the Boeing 737 MAX after the model was involved in a second

deadly crash in less than five months on Sunday. The stock inched

up 0.5% Wednesday.

Shares of the aerospace company are still up 17% for the year

despite their recent slide, part of a resurgence in cyclical stocks

often tied to sentiment toward economic growth.

Some analysts remain concerned that slow economic activity

overseas could ripple to the U.S. as trade talks between the U.S.

and China continue. After the European Central Bank slashed its

2019 eurozone growth forecasts last week while unveiling new

stimulus measures, uncertainty about the U.K.'s departure from the

European Union has swung markets in recent days.

British lawmakers rejected a Brexit deal Tuesday, and the U.K.'s

parliament was set to vote Wednesday on whether they want to leave

the EU without a divorce deal. The U.K. also cut its forecasts for

2019 economic growth Wednesday to 1.2% from 1.6%.

"The questions surrounding China, the strength of the economy,

the Chinese trade wars and Brexit all combined is particularly

sensitive for Europe," said David Slater, a portfolio manager at

London hedge fund Trium Capital.

The British pound trimmed some of its recent slide against the

dollar Wednesday, and the U.K.'s FTSE 100 index edged higher.

The Stoxx Europe 600 inched up 0.4%.

Asian stocks were mostly lower, with the Shanghai Composite down

1.1%, Hong Kong's Hang Seng Index dipping 0.4% and Japan's Nikkei

dropping 1%.

-- Amrith Ramkumar contributed to this article.

Write to Avantika Chilkoti at Avantika.Chilkoti@wsj.com

(END) Dow Jones Newswires

March 13, 2019 10:09 ET (14:09 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

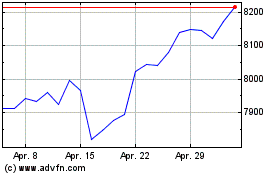

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024