By Anna Wilde Mathews and Sarah Nassauer

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 16, 2019).

CVS Health Corp. is battling Walmart Inc. over the cost of

filling prescriptions, a clash that could result in a split between

the retail behemoth and the health-care giant.

Walmart is expected to leave CVS Caremark pharmacy networks over

the dispute, a split that could occur as soon as early February,

though CVS said it has asked for an extension through April 30. The

two sides could also still end up hammering out a deal, despite the

current public hostilities.

Different versions of how the dispute played out quickly

emerged.

CVS Caremark, the pharmacy-benefits unit of CVS Health, said

Monday that Walmart is seeking an increase in what the retailer

gets paid for prescriptions, which would "ultimately result in

higher costs for our clients and consumers." CVS Caremark, which is

separate from CVS's retail drugstores, reimburses pharmacies when

shoppers with CVS Caremark prescription coverage buy medicine.

But a person familiar with Walmart's position said Walmart

didn't ask CVS to increase the amount it pays the retailer when

shoppers fill a prescription. Walmart asked CVS to maintain rates

at current levels, said this person. In response, a CVS spokesman

pointed to the company's earlier statement.

Negotiations over rates reached a boiling point last week when

Walmart sent a contract termination letter to CVS, according to

people familiar with the situation. Walmart continued to negotiate

with CVS as recently as last Friday, said one of these people.

Walmart aims to continue discussions with CVS Caremark and is

"trying to find a solution that benefits all parties," said a

spokeswoman for the retailer. "We are committed to providing value

to our customers across our business, including our pharmacy, but

we don't want to give that value to the middleman.... Walmart is

standing up to CVS's behaviors that are putting pressure on

pharmacies and disrupting patient care."

The Walmart spokeswoman said problems can come up when a PBM has

strong power to influence where people can get their prescriptions

filled.

CVS said in its statement that it remains "open to continuing

timely good faith negotiations with Walmart in the hopes of

reaching an agreement to provide quality pharmacy care at a

reasonable cost."

If the two giants part ways, it will affect people whose

employers have CVS Caremark-administered drug benefits, as well as

Medicaid enrollees with CVS drug coverage. Their plans wouldn't pay

for prescriptions filled at Walmart. Walmart is one of the

country's largest retail pharmacy players, offering pharmacies in

nearly all of its approximately 4,600 U.S. stores.

CVS said it retains a large network of more than 63,000

pharmacies without Walmart, and less than 5% of its members

enrolled in affected plans use only Walmart for prescriptions.

But the impact could be heavier for the employees of clients in

rural areas and the South, where Walmart is a particularly

important presence, said Nadina Rosier, who is head of the pharmacy

practice at advisory firm Willis Towers Watson. "It truly depends

on your vantage point," she said. "If you're a member who works for

an employer where Walmart is the dominant player, you're going to

feel the pain."

The public spat shows how tensions are rising between

pharmacies, pharmacy-benefit managers and insurers amid steep

pressure from consumers, employers and politicians to stem rising

drug costs. Pharmacy-benefit managers, as well as drug

manufacturers, have come under scrutiny amid complaints about

opaque pricing practices, and PBMs are under pressure to wring out

more cost.

A similar high-profile battle between a pharmacy-benefit manager

and a pharmacy company played out in 2012, when millions of Express

Scripts Holding Co. customers had to switch prescriptions to

different pharmacies because Walgreen Co. dropped out of the PBM's

network. The clash was resolved after seven months.

Now, the issues are complicated by mergers that are creating new

competitive fault lines in the industry. CVS recently completed its

nearly $70 billion acquisition of health insurer Aetna, creating an

industry giant that combines a retail pharmacy, pharmacy-benefit

management and Aetna's insurance businesses. Insurer Cigna Corp.

also recently closed its $54 billion acquisition of Express

Scripts.

CVS is also closely aligned with Walmart competitor Target

Corp., buying up the pharmacies inside Target stores in 2015.

Walmart has considered diving deeper into the health-care space.

Last spring, Walmart held preliminary talks with health insurer

Humana Inc., The Wall Street Journal has reported, but those talks

have cooled.

CVS Caremark said the dispute with Walmart doesn't affect the

pharmacy networks in its Medicare plans, and the split also doesn't

involve Sam's Club stores, Walmart's chain of warehouse stores. The

issue won't materially impact CVS's financial results, it said.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Sarah

Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

January 16, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

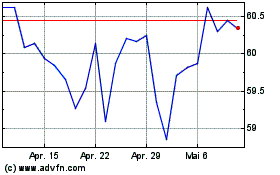

Walmart (NYSE:WMT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Walmart (NYSE:WMT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024