By Russell Gold, Sara Randazzo and Rebecca Smith

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 16, 2019).

PG&E Corp.'s plan to file for bankruptcy protection has

enormous repercussions for everyone from the homeowners suing the

utility for California wildfire damages to the companies that

furnish it with green energy.

California's largest utility said Monday it was preparing to

file for Chapter 11 protection before the end of the month as it

faces more than $30 billion in potential liability costs related to

its role in sparking wildfires in recent years. Electricity and

natural gas would continue to flow to homes and businesses,

PG&E said.

But a bankruptcy process would complicate attempts to recover

wildfire damages and likely affect the state's plans to reduce

carbon emissions, according to lawyers, legislators and energy and

bankruptcy experts.

The more than 750 civil suits brought by thousands of homeowners

and insurers suing PG&E over wildfire damages would be

immediately halted and resolved in a bankruptcy proceeding along

with other claims.

Meanwhile some of the long-term contracts PG&E struck to buy

electricity from wholesale power providers could be dissolved in a

bankruptcy. Many of the contracts to buy power from wind and solar

farms are well above current market rates because PG&E was

among the first utilities to buy large quantities of green power,

when it was far more costly than it is today.

PG&E declined to comment for this article.

PG&E has $34.5 billion worth of renewable energy contracts

for electricity deliveries between now and 2043, according to a

filing with the Federal Energy Regulatory Commission. In 2017, it

said it procured about $3.3 billion worth of electricity, mostly

wind and solar energy, and related services from Consolidated

Edison Inc., NextEra Energy Inc. and other suppliers.

ConEd said it was monitoring PG&E developments. NextEra

declined to comment.

Jan Smutny-Jones, head of the Independent Energy Producers

Association, a California trade group that represents power

suppliers, said he expects a significant percentage of PG&E's

renewable energy contracts could be torn up because they are

expensive. He expressed frustration with California's response to

the crisis.

"Basically PG&E is lying on the ground clutching its chest

and the regulator is saying, we'll figure out what's wrong in a

proceeding," he said.

Two renewable energy projects have already had their debt

ratings downgraded in recent weeks because they rely on PG&E

for the bulk of their revenues, including Topaz Solar, owned by

Berkshire Hathaway Inc.

"Maintaining credit-worthy California purchasers for renewable

projects is important to meeting the state's renewable goals," said

Berkshire Hathaway Energy, its utility unit.

California Gov. Gavin Newsom urged PG&E to honor its

contracts with power providers even in bankruptcy. The impending

PG&E filing is emerging as the first major challenge for the

new Democratic governor, who took office this month.

"We would like to see it avoided, but we are not naive, and it

is not at all costs," he told reporters regarding a PG&E

bankruptcy Monday.

PG&E's announcement that it is planning for bankruptcy came

hours after Chief Executive Geisha Williams said she was stepping

down. Shares plummeted 52.4% Monday to close at $8.38, down 82.9%

since the middle of October.

That shares didn't fall further is a sign that some investors

believe there is a chance of a political deal that would preserve

some value for stockholders. Under a new state law, PG&E had to

provide a 15-day notice before filing for bankruptcy protection. So

PG&E's announcement starts the clock on a period during which

politicians, regulators and the company can make a last-ditch

attempt to find a solution outside of bankruptcy court.

However, several state lawmakers said that there was little

appetite in Sacramento for a financial rescue. Public pressure has

been building over the past few weeks against any sort of bailout.

PG&E said Monday that it had concluded a bankruptcy filing was

its only real alternative because state rescue efforts would likely

take years, and it was running out of time due to deteriorating

finances.

State Sen. Bill Dodd, who sponsored legislation that allows

PG&E to pass along some of the costs of 2017 wildfires to

utility ratepayers, said there likely won't be any similar bills to

help the company deal with fallout from the 2018 fires, adding that

the costs were just too large.

"Moving forward, our eye is going to be focused on making sure

the victims aren't victimized yet again and that ratepayers aren't

crushed," he said.

California fire investigators have determined that PG&E

power lines sparked 18 wildfires in October 2017 that burned nearly

200,000 acres, destroyed 3,256 structures and killed 22 people. The

state is investigating whether a PG&E high-voltage transmission

line started last year's Camp Fire, which killed 86 people in

November, making it the deadliest fire in state history.

For plaintiffs suing PG&E, resolving the litigation through

bankruptcy rather than the traditional court process has pros and

cons, experts said. Wildfire victims should have equal priority to

subsidiary bondholders in a bankruptcy.

Money could be paid out faster than through a drawn-out

litigation process, but "the bargaining power they have by suing

will be greatly diminished," said Jared Ellias, a law professor at

University of California Hastings College of the Law in San

Francisco.

James Frantz, a California attorney representing around 2,000

wildfire victims, said he was unconcerned about resolving the

claims through a bankruptcy. Mike Danko, an attorney with about

2,000 other clients affected by wildfires, took a dimmer view.

"They want to avoid compensating the victims," Mr. Danko said of

PG&E.

--Katherine Blunt, Alejandro Lazo and Nicole Friedman

contributed to this article.

Write to Russell Gold at russell.gold@wsj.com, Sara Randazzo at

sara.randazzo@wsj.com and Rebecca Smith at

rebecca.smith@wsj.com

(END) Dow Jones Newswires

January 16, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

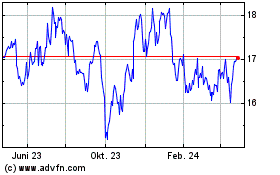

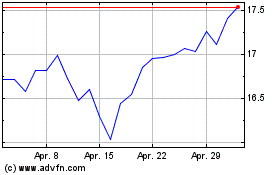

PG&E (NYSE:PCG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

PG&E (NYSE:PCG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024