European Car-Parts Suppliers Lower on Bad News and Gloomy Outlook

10 Januar 2019 - 5:04PM

Dow Jones News

By Max Bernhard

European car suppliers trade lower Thursday amid a flurry of

negative sector news and a gloomy outlook for the year ahead.

Suppliers have enjoyed "unparalleled revenue growth" for the

past two decades, but are now faced with a global production

slowdown and disruptive new technologies, said David Lesne at UBS.

On top of that comes slowing demand in China, the world's biggest

car market, as well increased trade tensions, uncertainty

surrounding Brexit and tightening emissions rules.

"Those issues have led to a series of profit warnings, which

have weighed on investor sentiment," Mr. Lesne said, adding that

the market slowdown also raises the risk that car makers will put

more pressure on suppliers to lower their prices.

UBS downgraded Continental AG (CON.XE) to neutral and Faurecia

SA (EO.FR) to sell.

At 1502 GMT, suppliers were largely lower. Faurecia is down

6.2%, while Valeo SA (FR.FR) trades 3.5% lower. Continental and

Schaeffler AG (SHA.XE) are down 3.0% and 2.9%, respectively.

In the meantime, Thursday brought negative news for the sector,

with Ford Motor Co (F) and Tata Motors Ltd's (500570.BY) Jaguar

Land Rover both announcing thousands of job cuts in Europe, citing

some of the same reasons mentioned by UBS.

The slump in suppliers' shares also followed an interview with

the chief executive of Osram Licht AG (OSR.AG), which traded 6.1%

lower at 1502 GMT.

Olaf Berlien said he sees "dark clouds looming on the horizon

for 2019," in an interview with German daily Augsburger

Allgemeine.

Mr. Berlien said a downturn in the German auto industry was his

biggest concern for 2019, adding that lower car sales in China in

the last quarter had been "painful" for the company.

Write to Max Bernhard at max.bernhard@dowjones.com;

@mxbernhard

(END) Dow Jones Newswires

January 10, 2019 10:49 ET (15:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

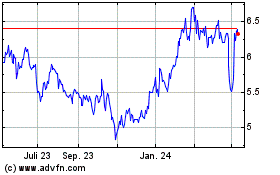

Schaeffler (TG:SHA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

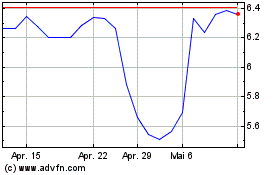

Schaeffler (TG:SHA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024