Dollar Lower After Soft U.S. Consumer Inflation Data

12 Dezember 2018 - 10:45AM

RTTF2

The U.S. dollar was lower against its major counterparts in the

European session on Wednesday, as a data showed that nation's

consumer prices came in flat for November, reducing market

expectations for further hikes next year.

Data from the Labor Department showed that U.S. consumer prices

came in flat for November as a sharp pullback in gasoline prices

offset increases in other prices.

The consumer price index was unchanged in November after rising

by 0.3 percent in October. The unchanged reading matched economist

estimates.

Excluding food and energy prices, core consumer prices edged up

by 0.2 percent in November, matching the uptick seen in October as

well as expectations.

Investors await the Fed decision due next week, when it is

widely expected to raise interest rates for the fourth time this

year.

The dollar has been falling over the past few weeks, amid rising

hopes that the Fed is likely to pause its rate-hike cycle next year

as economic growth slows in the U.S.

The currency showed mixed trading against its major counterparts

in the Asian session. While it dropped against the euro and the

pound, it held steady against the franc. Against the yen, it

trended higher.

The greenback dropped to 1.2622 against the pound, after rising

to a 1-1/2-year high of 1.2477 at 2:30 am ET. The greenback is seen

finding support around the 1.28 level.

Following an 8-day high of 113.52 against the yen seen at 2:15

am ET, the greenback pulled back to 113.30 after the data. If the

greenback falls further, 112.00 is possibly seen as its next

support level.

Data from the Bank of Japan showed that Japan producer prices

fell 0.3 percent on month in November.

That missed expectations for a decline of 0.1 percent following

the 0.4 percent increase in October.

The greenback retreated to 0.9937 against the franc, from a

6-day high of 0.9966 set at 7:30 am ET. The greenback is likely to

find support around the 0.98 level.

The greenback fell back to 1.1363 against the euro, after having

climbed to 1.1315 at 2:30 am ET. The greenback is poised to find

support around the 1.15 level.

Figures from Eurostat showed that Eurozone's industrial

production grew in October after a slump in the previous month.

Industrial production rose 0.2 percent from September, when it

declined 0.6 percent, which was revised from 0.3 percent. The

growth was in line with economists' expectations.

The greenback slipped to 1.3341 against the loonie, a 2-day low.

This follows a high of 1.3396 seen at 5:30 pm ET. On the downside,

1.32 is possibly seen as the next support level for the

greenback.

The greenback eased to 0.7224 against the aussie, heading to

pierce a 5-day low of 0.7230 hit at 8:30 pm ET. Next key support

for the greenback is seen around the 0.74 region.

On the flip side, the greenback held steady against the kiwi,

following a 2-week high of 0.6825 it touched at 8:25 am ET. The

next possible resistance for the greenback is seen around the 0.67

level.

The U.S. monthly budget statement for November is scheduled for

release at 2:00 pm ET.

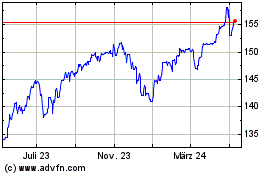

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

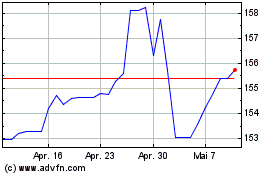

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024