By Mark DeCambre, MarketWatch , Chris Matthews

Macro concerns overwhelm relatively bullish jobs report

U.S. stocks deepened their losses in the final hour of trading

Friday as new jitters on trade relations overshadowed the November

employment report.

Benchmarks

The Dow Jones Industrial Average fell 655 points, or 2.1%, at

24,425, the S&P 500 index is down 72 points, or 2.7%, at 2,624,

while the Nasdaq Composite Index traded down 242 points, or 3.4%,

lower at 6,947.

Check out:A death cross for the S&P 500 highlights a stock

market in tatters

(http://www.marketwatch.com/story/a-looming-death-cross-for-the-sp-500-highlights-a-stock-market-in-tatters-2018-12-06)

For the week, the Dow, S&P 500 and Nasdaq are set to show

declines of more than 4.8%.

Late Friday morning, both the S&P 500 and the Dow fell into

negative territory for the year, while the Nasdaq is clinging to a

0.8% advance year-to-date.

Market drivers

Concerns over global trade continue to weigh on investor

sentiment, even after a Friday morning report from the Labor

Department that showed healthy November job gains for the U.S.

economy and the fastest pace of wage growth in nearly 10 years.

Despite efforts by the Trump administration and its Chinese

counterparts to paint an optimistic picture of ongoing negotiations

aimed at reducing trade tensions, investors are demanding more

evidence that the two sides will avoid the imposition of new and

expanded tariffs in 2019, market participants say. Once again, a

pair of administration officials gave opposing views about those

negotiations in separate television appearances Friday.

The effect of trade concerns on the markets can be observed in

sector-by-sector performance figures, as retail trade was the

sector taking the heaviest losses in the S&P 500 Friday

afternoon, down 5.9%, according to FactSet.

Read:Jobs report provides reason for Fed caution on interest

rates next year

(http://www.marketwatch.com/story/jobs-report-provides-reason-for-fed-caution-on-interest-rates-next-year-2018-12-07)

Retailers are particularly vulnerable to new tariffs, as

companies like Walmart Inc. (WMT) and Target Corp. (TGT) source

much of their merchandise from China. Walmart CEO Doug McMillon

told CNBC on Thursday

(http://www.marketwatch.com/story/walmart-ceo-warns-customers-might-pay-if-trade-tensions-escalate-2018-12-06)

that his company may soon have to raise prices if trade tensions

escalate.

Next week's vote on a deal covering Britain's exit from the

European Union as well as negotiations between Italy and the EU

over its budget deficit are also contributed to the risk-off

sentiment investors.

This is despite a relatively strong jobs report, which showed

that the U.S. economy adding 155,000 new jobs in November

(http://www.marketwatch.com/story/us-gains-155000-jobs-in-november-and-unemployment-rate-stays-at-37-2018-12-07),

the Labor Department estimated Friday morning, somewhat below

expectations of 190,000 new jobs, according to a MarketWatch poll

of economists.

The jobs report also showed the unemployment rate holding steady

at 3.7%, as expected. Average hourly earnings grew 6 cents per hour

from October, or 0.2%, just shy of expectations, and grew by 3.1%

year-over-year, their highest rate since 2009.

Read:Softer-than-expected jobs report called uninspiring by

economists

(http://www.marketwatch.com/story/softer-than-expected-jobs-report-called-uninspiring-by-economists-2018-12-07)

The jobs numbers are of particular importance to investors, as

these data will inform The Federal Reserve's interest-rate-setting

committee, as it prepares to decide whether to raise interest rates

at its coming meeting Dec. 18-19.

Signs that the Federal Open Market Committee may take a less

aggressive tack in normalizing rates have increased, with The Wall

Street Journal on Thursday reporting that Fed officials are

considering a new wait-and-see mentality

(https://www.wsj.com/articles/restrained-inflation-reduces-urgency-for-quarterly-rate-increase-pattern-1544127856?mod=searchresults&page=1&pos=1)

at that December meeting. And nonvoter, St. Louis Fed President

James Bullard, said he would advocate delaying a rate hike later

this month, during an interview.

Read:Huawei arrest creates concerns in Silicon Valley as well as

abroad

(http://www.marketwatch.com/story/huawei-arrest-creates-concerns-in-silicon-valley-as-well-as-abroad-2018-12-06)

What investors and analysts say

"Today's is an exaggerated selloff," Vincent Juvyns, global

market strategist at J.P. Morgan Asset Management, told

MarketWatch. "But in the short term, there is just so much

uncertainty surrounding trade talks, Brexit and Italy," he

said.

"There's too much for investors to swallow at the moment,"

making it "not a good time to take bold risks," he said, adding

that his firm has recently increased his cash holdings in many

funds, even as they remain long U.S. equities, to help reduce risk

and ride out this troubled patch in the markets.

"The jobs report threaded the needle really well," J.J. Kinahan,

chief market strategist with TD Ameritrade told MarketWatch,

arguing that new jobs in November were neither too high nor too low

for investors.

"Had the this come in really hot, the market would have

interpreted it as a number that would force the Fed to raise rates

not just in December, but in March too," he said. "You also didn't

want to miss in a huge way on the down side, as it would have

shaken faith in the economy," he said.

Steve Chiavarone, portfolio manager at Federated Investors, told

MarketWatch that while the jobs report was bullish, trade concerns

will continue to weigh on the market in the short term.

On this top of his list of concerns is a recent decline in capex

spending that he says "is absolutely related to trade."

"Companies can't plan their global supply chains, with so much

uncertainty over where policy is going, and if you can't plan, you

can't invest," Chiavarone said. This dynamic will hurt the U.S.

economy, productivity growth and equity values if China and the

U.S. cannot come to some agreement that provides certainty around

the new rules of trade.

Stocks in focus

Shares of Big Lots Inc.(BIG) are trading down more than 9%,

after wider-than-expected third-quarter loss.

Shares of Broadcom Inc. (AVGO) are in focus after the chip maker

announced fiscal fourth-quarter profits and sales Thursday evening

that topped Wall Street expectations. The stock is up 0.7%

Friday.

Ulta Beauty Inc. (ULTA) shares have slumped more than 10%

Friday, after a Thursday evening earnings release that predicted

weaker holiday sales that analysts hoped.

Shares of Altria Group (MO)are in focus after the company

announced it would take a 45% ownership stake in the cannabis-firm

Cronos Group Inc. (CRON.T), worth $1.8 billion. The stock is up

0.6%, while Cronos shares are surging more than 22% on the

news.

The transportation sector was hit hard Friday, as oil prices

rose again

(http://www.marketwatch.com/story/oil-futures-end-higher-up-more-than-3-for-the-week-2018-12-07)

to cap a week where they climbed 3.3%. American Airlines Group Inc.

(AAL) stock fell 8.8%, while FedEx Corp.(FDX) stock tumbled 6.4%

Friday.

Data and Fed speakers

Other markets

Asian markets traded mostly higher Friday

(http://www.marketwatch.com/story/asian-markets-inch-forward-amid-us-china-friction-2018-12-06),

with the Nikkei 225 rising 0.8% and markets in South Korea and

Australia advancing on the day. The Shanghai Composite Index was

virtually flat, with gains of less than 0.1%.

European markets ended mostly higher Friday, with both the Stoxx

Europe 600 and the FTSE 100 in the green.

Crude oil rallied after OPEC and its allies agreed to a

production cut

(http://www.marketwatch.com/story/oil-prices-are-up-modestly-as-saudis-still-skeptical-of-opec-coalition-cuts-2018-12-07),

while gold advanced and the U.S. dollar edged lower

(http://www.marketwatch.com/story/dollar-traders-take-a-breath-before-jobs-report-2018-12-07).

(END) Dow Jones Newswires

December 07, 2018 15:15 ET (20:15 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

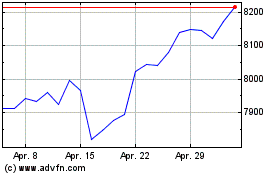

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024